Common Gold IRA Scams and How to Avoid Them

This concise guide exposes gold IRA scams and deceptive marketing tactics, helping you identify red flags to avoid fraud when investing in precious metals through a gold IRA.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

The precious metals market has attracted dishonest individuals for years, long before the digital age. Today, their schemes and lies are simply more noticeable.

As gold IRA accounts gain popularity amid economic uncertainty, scammers increasingly target individuals with IRAs and 401(k) plans. Fortunately, you can take practical steps to protect your retirement savings from fraudulent operators.

When it comes to financial transactions, encountering untrustworthy people is almost inevitable.

The silver lining? These bad actors are often easy to spot. By staying vigilant and cautious, you can steer clear of scams and protect your hard-earned money during a precious metal rollover.

Gold IRA Scams and Deceptive Tactics

This guide outlines common deceptive tactics and gold IRA fraud practices to watch for, while sharing helpful strategies to ensure a secure IRA rollover process.

1. High Markups on Coins

Certain gold IRA companies and precious metals dealers offer collectible or rare coins at drastically inflated costs, often charging premiums of 40% to 200% while promoting them as exceptional investment opportunities.

Many of these coins, despite being labeled “exclusive” or “limited,” are not approved by the IRS for IRA inclusion. When resold, dealers typically offer only the spot price, meaning investors rarely recover the steep premiums paid.

Some of the highly liquid and safe coin options are: American Gold and Silver Eagles, American Gold and Silver Buffaloes, Canadian Gold and Silver Maple Leafs, South African Krugerrands, Austrian Philharmonics.

Standard bullion coins and bars usually carry a modest 5-10% markup above the spot price. However, some companies take advantage of buyers, applying markups as high as 130%.

Customers are often urged to buy numismatic coins, which carry high premiums over the spot price. Sellers may claim these coins will increase in value due to their rarity or collectible appeal. However, valuing numismatic coins objectively is challenging, and the market for rare or proof coins tends to lack liquidity.

For instance, in 2023 SEC lawsuit exposed Red Rock Secured for misleading investors with false 1-5% markup claims, resulting in $50 million in losses to a gold IRA scam. Always verify the current spot price before purchasing precious metals to evaluate markups.

To protect yourself, opt for standard bullion with minimal premiums. Alternatively, shop around to compare dealer prices on highly liquid coins for the best value. Insist on clear fee disclosures and inquire about any notable price variations among custodians.

2. Hidden Charges and Confusing Pricing

Some dishonest gold IRA companies lure investors with promises of low initial costs, only to charge hidden fees for account setup, storage, maintenance, or transactions.

These companies often fail to disclose commissions or other charges upfront, leaving investors shocked by unexpected expenses down the line.

Some companies advertise budget-friendly products to draw attention, only to steer clients toward pricier metals by claiming the advertised items are sold out or unavailable.

Before investing, always request a clear, comprehensive list of all associated costs to ensure full transparency. If a specific gold or silver product is unavailable, approach offered alternatives with extreme caution.

3. High-Pressure, Aggressive Sales Practices

Some pushy salespeople exploit fear, warning of an impending economic disaster to pressure you into hasty or oversized investments. They often target unsuspecting seniors, particularly those aged 60 to 90, leaving them vulnerable to financial exploitation.

Suggestions that allocating all your retirement savings into precious metals is a secure move are false. High gold IRA fees and markups, wide spreads (40% to 200% or more), and ongoing costs like storage, insurance, and administration make profiting difficult.

Dealers sell metals above the spot price but offer less when buying them back, creating a financial disadvantage. Like other commodities, gold and silver prices fluctuate significantly. Spreading your investments across different asset types is generally wiser than focusing on a single category.

Watch out for salespeople who use:

- Overstated historical gains: Past performance doesn’t predict future results.

- Emotional manipulation: Appeals involving loved ones tug at heartstrings.

- Guaranteed profit promises: No investment is risk-free, all carry uncertainty.

- Evasive responses: Avoid those who dodge questions or lack transparency.

- Urgency tactics: Trustworthy deals allow time for careful consideration.

Approach overly pushy precious metals salespeople with the same skepticism you’d apply to a door-to-door salesperson. Their high-pressure tactics may violate state or federal laws enforced by the Federal Trade Commission (FTC) and could constitute fraudulent practices. Report any suspicious behavior to the appropriate authorities.

4. Fake or Low-Quality Gold

Certain companies and gold dealers may offer fake gold or products that don’t meet the IRS’s 99.5% purity requirement for retirement investments.

Dishonest companies might falsely claim their gold meets purity standards or, in some cases, supply entirely counterfeit items.

Partner only with trustworthy gold IRA companies and always request official documentation prior to purchase.

Confirm that the gold originates from a recognized government mint or an accredited refiner, such as those included on the LBMA Good Delivery List.

5. Guaranteed Returns

No investment can guarantee returns, as financial markets are inherently unpredictable. Gold IRAs are no exception.

There is a timeless saying that applies to all investments, not just gold: “Past performance does not guarantee future results.” Always keep this in mind when promised unbelievable returns on your investment.

Although gold is often viewed as a stable asset and a safeguard against inflation, its price can vary significantly. Unscrupulous companies exploit investors by offering assurances of substantial, risk-free profits.

These gold IRA schemes typically rely on misleading sales tactics, aggressive pressure, and convoluted financing deals. Claims of extraordinary gains with no risk are almost certainly fraudulent.

Reputable gold IRA companies warn about the risks of precious metals investing. Trusted companies always focus on long-term wealth building and portfolio diversification, not instant or guaranteed profits.

6. New, Suspicious Websites

Steer clear of recently established companies that lack reviews, as these could be fronts for fraudulent schemes.

Always conduct in-depth research on gold IRA companies, ensuring they have positive customer feedback, and valid accreditations from entities like the Better Business Bureau (BBB).

An “A+” rating from BBB indicates that a company has achieved the highest level of reliability and ethical standards.

Purchase from gold dealers or brokers with strong ratings on trusted platforms like Google Reviews, Trustpilot, and Consumer Affairs.

In the competitive precious metals industry, leading companies typically have strong reputations supported by excellent reviews. Exercise extreme caution when dealing with non-accredited BBB businesses and newer companies with little to no reviews.

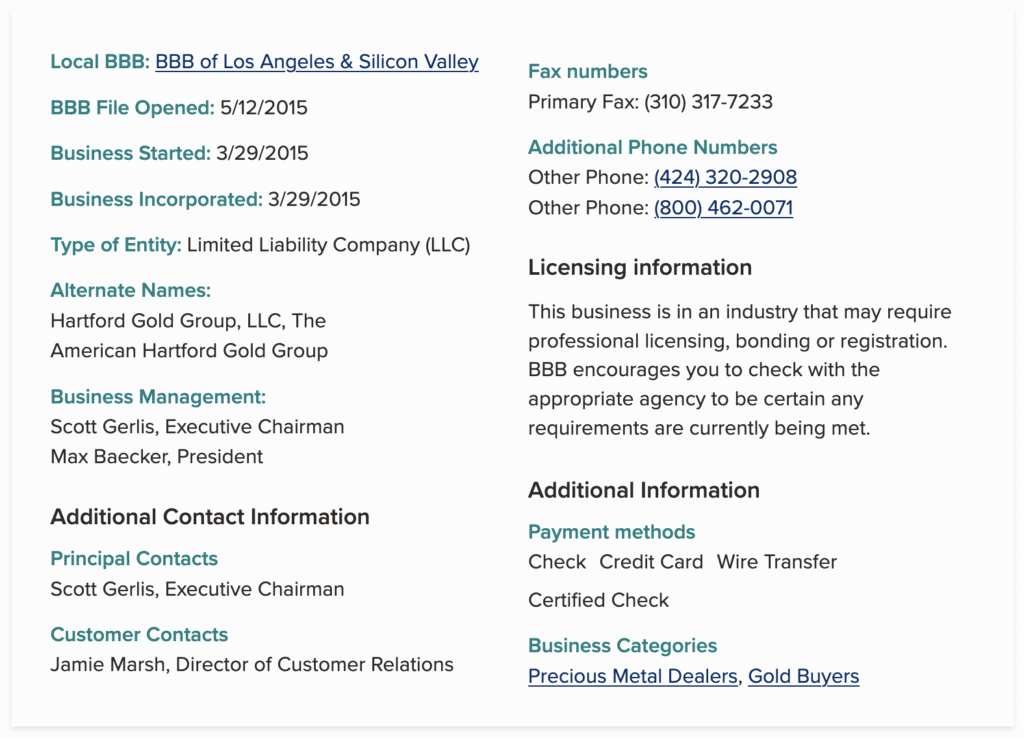

To determine how long a company has been in business, check the “BBB File Opened” and “Business Started” dates on the Better Business Bureau (BBB) website.

The “BBB File Opened” date shows when the company applied for a BBB listing, which gold investment companies typically do shortly after registering their business, often within a few months.

The “Business Started/Incorporated” date reflects the official incorporation of the business. The longer the company has been in business and on BBB — the better.

Before rolling over your IRA or 401(k) to a gold IRA, confirm the company’s credibility. Avoid companies with predominantly negative feedback or those that are newly launched with no public track record.

7. Fake Home Storage Promises

Scammers might mislead you into believing you can legally keep IRA gold at home, but this violates IRS regulations and can lead to severe penalties. The IRS strictly forbids storing precious metals (such as gold, silver, platinum, or palladium) in a self-directed IRA at your home or in a personal safe-deposit box.

Keeping IRA precious metals at home could be classified as a taxable distribution, potentially incurring a 10% penalty for individuals under 59½.

Storing metals at home may also fall under “self-dealing,” which is an illegal transaction where the IRA owner participates in restricted activities with the IRA, like borrowing funds or transferring property to it.

Any prohibited transaction, including but not limited to home storage, could trigger IRS penalties.

To remain compliant and avoid tax penalties, ensure your IRA precious metals are stored in an IRS-approved depository. Be wary of gold IRA companies claiming you can legally store precious metals at home, as this is prohibited.

Some Tips to Protect Yourself From Gold Investment Scams

Over the years, numerous gold investment companies have shut down and vanished, leaving investors with nothing. No metals, no refunds.

Notable cases include Regal Assets, American Coin Co (Formerly Red Rock Secured), and Oxford Gold Group, where gold IRA investors collectively lost tens of millions of dollars to a similar fraud scheme.

To avoid ending up in the same situation, check the company’s status with local regulatory bodies and the Better Business Bureau (BBB). Approach any company not accredited by the BBB with caution, and dedicate extra effort to reviewing authentic customer feedback and digging into the company’s background.

It’s also wise to avoid businesses that are relatively new. If a company has only been operating for a year or two, consider exploring other options, as their legitimacy may be uncertain due to their short track record.

Apart from the aforementioned red flags, below are some practical steps you can take to protect your investment from gold IRA scams.

Work With Trusted Companies

Select established companies for your gold IRA, including a gold IRA company, custodian, and depository.

Read our guide to top IRS-compliant gold IRA investment companies offering high-quality products and competitive fees.

Ensure they have a visible online presence, including customer reviews, a clear founding date, and a verifiable physical address.

You can often use tools like Google Maps to check the address, though keep in mind that some office buildings may not display tenant names externally.

Look Up Articles of Incorporation

Each state maintains a database of registered businesses, typically accessible through the Secretary of State’s website.

Fraudulent companies may claim years of operation, but verifying their claims is straightforward. Check a company’s registration status and review its articles of incorporation to confirm its operational history.

If a company claims long-term operations but the articles of incorporation contradict this or are missing, consider it a red flag and avoid doing business with them.

Avoid Unsolicited Offers

Be cautious of unexpected calls or emails pitching gold or gold IRA investments, especially if you don’t know how they got your contact information. It’s difficult to verify the identity of the person contacting you.

Instead, take the initiative to research and select a reputable company on your own terms.

Unfortunately, unsolicited phone calls, SMS, emails, and in-person visits are all too common. Avoid making any precious metal rollover decisions without first seeking advice from a licensed financial advisor.

Trustworthy gold and precious metals IRA companies do not rely on cold-calling or targeting unsuspecting individuals to generate business.

Demand Written Agreements

Before finalizing any purchase or opening a gold IRA, request a detailed contract. Carefully review it for fees, commissions, limitations, or any terms that seem unclear.

If the contract contradicts what the salesperson promised or raises concerns, hold off on signing until you’re fully comfortable.

Begin with a Modest Investment

For added security, start with a smaller investment when working with a company for the first time. Most gold IRA companies set minimum deposit amounts, and sticking to this minimum can be a prudent initial step.

After a successful transaction, you can gradually increase your investment as you gain confidence in the company.

Conclusion

The gold IRA industry is rife with scams and deceptive schemes. However, you can avoid them by equipping yourself with the right knowledge. By staying vigilant and informed, you can confidently navigate the precious metals market and secure your financial future.

If you ever feel uncertain about an investment or a counterparty’s legitimacy, consult a qualified financial advisor for guidance.