Goldco Review

This in-depth Goldco review explores company’s reputation, pros and cons, fees, storage options, and customer experience. Find out if it’s the right choice for your retirement strategy.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

Goldco is one of the industry leaders and most established gold IRA companies in the space. It was incorporated in 2006 and is headquartered in Woodland Hills, California. The company focuses on educating and assisting investors in the United States with adding physical gold and silver to their retirement portfolios.

The company has earned thousands of five-star reviews across multiple review platforms, and ranked #2 on our list of the best precious metals IRA companies for 2025.

Goldco has also appeared on the Inc. 5000 list of the fastest-growing private companies in America eight times, adding to its proven track record.

Goldco offers some of the most attractive incentives in the industry, including silver bonuses that match customer contributions. Unlike many competitors, Goldco has a moderate IRA minimum investment requirement of $25,000 and provides expert guidance on incorporating IRA-approved precious metals into retirement plans.

But is Goldco the right choice for you? Let’s take a closer look.

Pros and Cons

| Goldco Pros | Goldco Cons |

|---|---|

| Established Reputation: Over 19 years in business, showing long-term reliability. | No Real-Time Pricing: You must call for up-to-date metal values. |

| Top Ratings: Holds an A+ BBB rating and a Triple-A rating from the Business Consumer Alliance. | Occasional Communication Delays: A few users experienced slow responses during account closures or sales. |

| Trusted by Investors: Over $3 billion in transactions underscores strong market credibility. | Limited Metal Selection: Only offers gold and silver, no platinum or palladium. |

| Personalized Support: Dedicated account reps offer tailored assistance. | No Free Storage: Storage fees aren’t waived, even if your deposit is substantial. |

| Educational Resources: Extensive materials help investors make informed decisions. | Limited Online Listings: Website focuses on coins; other products require speaking with a rep. |

| Simple IRA Setup: Experts guide you step-by-step through the process. | U.S.-Only Shipping: International investors can’t use their delivery service. |

| Transparent Fees: Clear explanation of costs and rules, no hidden fees. | |

| Buyback Guarantee: Goldco promises to repurchase your metals if needed. | |

| Easy Rollovers: Streamlined rollover process with minimal paperwork. | |

| Free Silver Bonus: Eligible new clients receive free silver. | |

| Responsive Service: Fast, helpful customer support. |

Request Goldco’s free gold IRA kit to learn how precious metals can help you protect your savings tax & penalty free.

Company Overview

Goldco’s team assists customers with opening precious metals IRAs and transferring funds from existing retirement accounts in an easy-to-understand and IRS-compliant way.

The company builds trust through strong support and high-quality assistance, and it prioritizes teaching investors about precious metals markets, so you will always stay informed about what’s going on in the industry if you decide to invest.

Goldco’s Products

Goldco’s product line doesn’t include platinum and palladium, but its gold and silver product selection is vast. It covers coins like American Eagles, American Buffaloes, Canadian Maple Leafs, gold and silver bars, and other officially minted and recognized products that qualify for IRAs.

All gold and silver products that Goldco sells to customers meet IRS rules and regulations for purity and quality.

Goldco’s Rollover Assistance

Goldco differs from other gold IRA companies by making IRA rollovers from other retirement plans easy and straightforward.

Each customer gets a dedicated precious metals specialist to guide them step by step through the investment process and beyond. Goldco’s specialists manage most of the paperwork for you while following IRS standards and ensuring compliance.

While Goldco focuses on helping you add gold to your IRA, you can also purchase precious metals directly if you want to store them at home outside of your gold IRA.

According to multiple reviews, beginners appreciate the focus on learning and the easy-to-use system. This makes it a solid choice for those new to investing in gold.

One of Goldco’s key strengths and competitive advantages is its moderate investment minimum and strong customer support. This makes Goldco a good choice for beginners or those with smaller budgets who may struggle with the high minimums set by other precious metals dealers.

Here’s a brief comparison of other established gold IRA companies and their investment minimums:

| Company | Investment Minimum | BBB Rating |

|---|---|---|

| Goldco | $25,000 | A+ |

| Augusta Precious Metals | $50,000 | A+ |

| Birch Gold Group | $10,000 | A+ |

| Noble Gold Investments | $20,000 | A+ |

| American Hartford Gold | $10,000 | A+ |

If you have any questions, you can use the live chat feature to talk to a support agent if you’re not comfortable talking by phone. However, you’ll need to provide your name, email, and phone number to connect with a representative.

Another standout feature of Goldco is its buyback guarantee. It ensures customers can sell their gold and silver at the best available price back to Goldco without the headache of finding a buyer for their precious metals.

Goldco works with one of the most trusted gold IRA custodians in the industry, Equity Trust. For secure storage, Goldco partners with the Delaware Depository and Brink’s Global Services, both of which are IRS-approved and backed by full insurance from Lloyd’s of London.

That’s the gist of what Goldco offers. Now, let’s take a closer look at its reputation, fees, and how it compares to competitors.

Goldco Reviews, Reputation and Trustworthiness

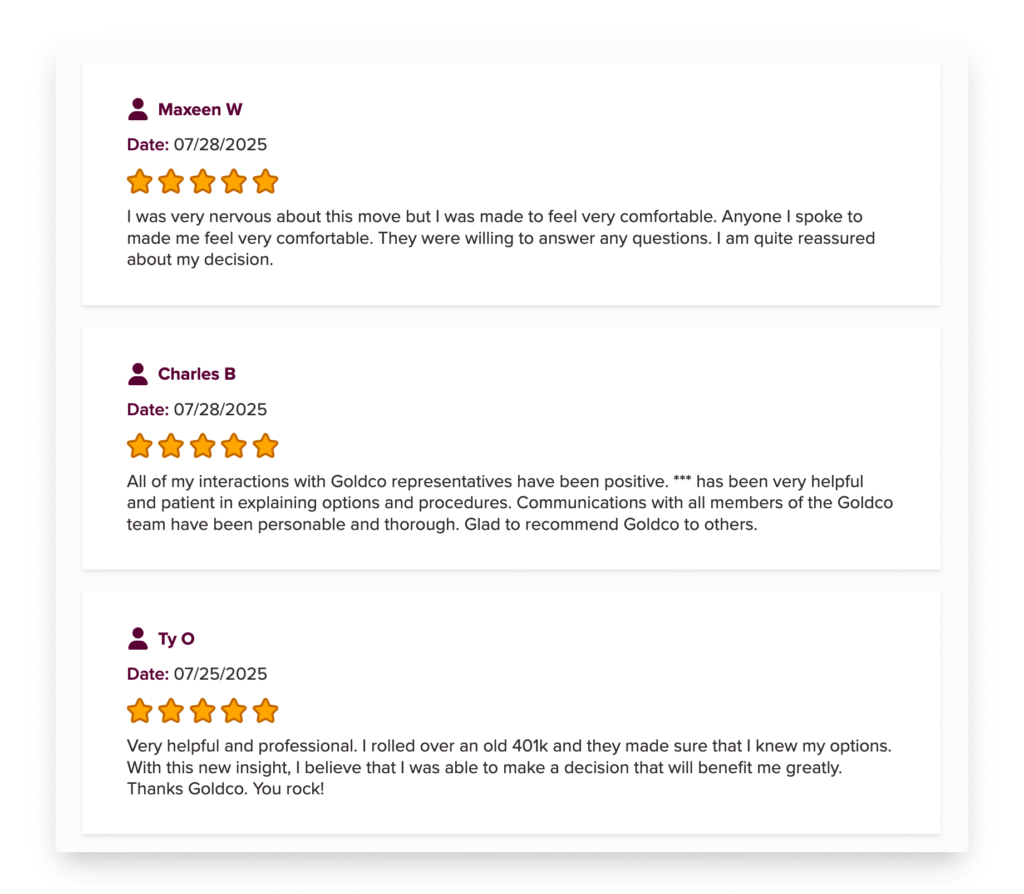

With nearly two decades in the industry, Goldco has earned strong credentials, including a 4.8 rating on Trustpilot and an A+ from the Better Business Bureau.

Here’s how Goldco rated accross the web:

- 4.9/5 based on 3,007 ratings in Google Reviews

- A+ rating and 4.83/5 from 1,215 reviews on Better Business Bureau (BBB)

- AAA rating from the Business Consumer Alliance (BCA)

- 254 five-star reviews on TrustLink

- 4.8/5 according to 1,612 reviews on Trustpilot

Goldco has maintained its A+ rating with the BBB for over a decade. Its accreditation and high rating reflect a commitment to the Better Business Bureau’s principles of trust, such as clear communication, honesty, and quick responses to customer needs.

Request Goldco’s free gold IRA kit to learn how precious metals can help you protect your savings tax & penalty free.

In recent years, Goldco has maintained a clean record, free of any legal disputes or controversies. Throughout 19 years of operation, thousands of Goldco reviews highlight positive experiences.

Goldco distinguishes itself from newer competitors through several third-party accolades:

- Since its founding, Goldco has facilitated over $3 billion in gold and silver transactions.

- It has consistently held an A+ rating from the Better Business Bureau since gaining accreditation.

- For eight years in a row, it has been featured on Inc. 5000’s list of the fastest-growing private companies.

- The Business Consumer Alliance awarded it a Triple-A rating for its reliability.

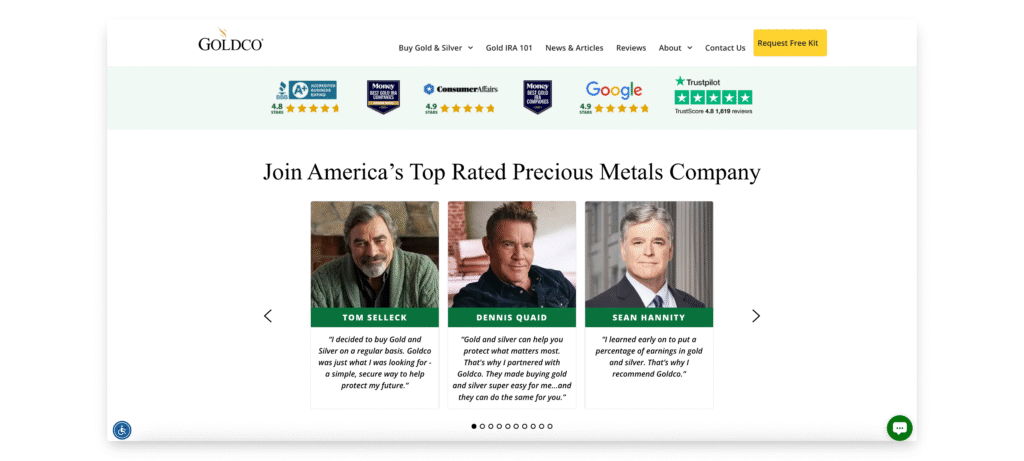

While endorsements do not ensure investment success, Goldco has also gained attention through affiliations with conservative celebrities and well-known figures such as:

- Sean Hannity, a prominent conservative commentator;

- Chuck Norris, an actor and martial artist;

- Ben Stein, an economist, conservative commentator, and lawyer;

- Dennis Quaid, a recognized actor;

- Tom Selleck, a renowned actor;

- Shawn Ryan, a podcaster and former Navy SEAL;

- And other prominent figures, such as Candace Owens, Dana Loesch, Jesse Kelly, as well as Ty & Charlene Bollinger.

These connections have boosted Goldco’s media visibility, particularly among investors seeking alternatives to conventional retirement strategies.

Goldco’s Fee Structure

Many companies in the precious metals industry add various charges for account opening and handling deals. Goldco keeps these details off its website, so a quick call to one of its reps is the best way to learn about expenses and any special deals.

We called Goldco and spoke to a representative to get a clear overview of the fees. They apply a $275 fee in the first year, covering custodian services, unlimited storage, purchase processing, and wire transfers.

From year two onward, Goldco charges a $225 annual fee for storage and maintenance. Add another $50 annually if you choose the Texas Depository for your IRA-qualified metals.

If you’re thinking about Goldco for opening a precious metals IRA, knowing all the charges upfront matters a lot. From what I’ve gathered, here’s a full overview of the typical costs.

| Fee Type | Amount | Frequency | Paid To |

|---|---|---|---|

| Account Maintenance | $80 | Annual | Custodian |

| Segregated / Non-Segregated Storage | $100 / $150 | Annual | Depository |

| Account Opening | $50 | Once | Custodian |

| Wire Transfer | $30 | Once or Twice | Custodian |

Storage and Security Solutions

Ensuring that precious metals eligible for IRAs are stored safely and in line with IRS rules is a top priority. Goldco meets this need by partnering with top-tier storage facilities designed to protect valuable assets.

Goldco works with the Delaware Depository and Brink’s Global Services, two IRS-approved storage facilities fully insured by Lloyd’s of London. These depositories offer significantly more protection than typical bank safe deposit boxes, featuring high-level security measures such as:

- Class III vaults: These top-tier vaults are built with reinforced walls, internal barriers, and advanced locking mechanisms that require multiple levels of verified access.

- Redundant security systems: Each facility is equipped with UL-rated alarms and layered surveillance, including motion, heat, sound, and vibration detectors, all monitored around the clock by remote security teams.

- Armed security on-site: Both locations maintain a constant armed presence, with the Texas site staffed by law enforcement officers.

- Strict access protocols: Entry requires biometric verification, multi-person access procedures, and role separation during transactions to safeguard against both external breaches and internal risks.

Segregated and Non-Segregated Storage

Goldco offers two storage options, each with the same security and insurance standards but differing in setup and cost: segregated storage and non-segregated storage.

In a segregated storage (yearly cost around $150) your metals stay in an individual, labeled compartment, away from others’ assets. This way, your investment is tracked with unique identifiers for each deposit.

In a non-segregated storage (roughly $100 per year), your metals are stored alongside others’ and identified by serial numbers and precise weights.

Your choice depends on whether you prefer added separation or a lower price point. There is no difference in terms of safety, as both options ensure top-level protection.

Insurance of Precious Metals

With Goldco, you receive full asset protection, regular audits, and access to performance reports. You also get periodic statements detailing your holdings through Goldco’s gold IRA custodian Equity Trust Company.

Your investment is fully insured, regardless which storage you choose: Delaware Depository or Brink’s Global Services. Both facilities cover the entire replacement value of your metals. This is included in the annual storage fees at no extra charge.

Routine audits are conducted annually (both internal and independent), including thorough verifications of records, physical presence of assets, and management practices. Regulatory requirements ensure regular audits to maintain certifications.

Customer Support and Education

Goldco’s commitment to service stands out, earning praise from Money.com as the top gold IRA provider for outstanding customer care two years in a row.

Unlike some competitors with generic call centers, Goldco assigns a dedicated representative to each customer, ensuring a personalized experience. What this means for you:

- One point of contact from your first call through account setup.

- A representative who knows your unique needs.

- Quick answers to follow-up questions from someone familiar with your account.

- Tailored advice based on your investment plans.

Goldco’s support team responds promptly, offering clear and thorough answers to customer questions.

How to Reach Goldco

Goldco offers multiple ways to get in touch, with reliable response times:

| Contact Method | Typical Response Time | Availability |

|---|---|---|

| Live Chat | Within 5 minutes | Mon-Fri, 8AM-6PM PT |

| Phone Support | Within 15 minutes | Mon-Fri, 8AM-6PM PT |

| Call-Back Requests | Same business day | Mon-Fri, 8AM-6PM PT |

| Email Inquiries | Within one business day | 24/7 submission |

During major market swings or after big economic news, response times may stretch slightly due to higher contact volumes.

Goldco prioritizes informing clients over pushing sales, which is especially helpful for those new to precious metals. They provide:

- Complimentary guides on investing in metals.

- Frequent updates on market trends.

- Videos breaking down retirement account choices.

- Clear breakdowns of IRS rules.

This approach empowers retirement-focused investors with the straightforward information needed to make confident, well-informed decisions.

The educational tools include a range of downloadable books and clips covering topics like common retirement account pitfalls, reasons to consider precious metals accounts, and strategies for acquiring these assets. Investors can also request a no-cost guide that explains self-managed retirement options and outlines available coins and bars.

Goldco’s Precious Metals IRA Option

With a precious metals IRA from Goldco, you can invest in gold and similar assets while enjoying the tax perks tied to either a Roth IRA or a Traditional IRA, based on your choice.

These accounts let you postpone taxes on growth and potentially claim credits for contributions, plus they can transfer to heirs without estate taxes in certain cases.

After setting up the account, you can deposit cash to acquire the metals or transfer funds from another source like a 401(k), 403(b), Thrift Savings Plan, or existing IRA. All purchases go into storage at a protected third-party vault for safekeeping.

By holding some assets in metals, you reduce risks from market drops, as these often rise in value when stocks fall, providing a reliable balance in your holdings.

Metals like these maintain worth over the years due to their scarcity and diverse applications, from adornments to tech components, and they can be sold quickly when needed thanks to steady demand.

Goldco’s Free Silver Promotion

Like many players in this field, Goldco offers incentives for new clients who are ready to invest substantial amounts of money into a gold IRA. Goldco rewards investors who make qualifying purchases with free silver.

Deposits starting at $50,000 qualify for a return of 5% to 10% in silver. For instance, on a qualifying purchase of $100,000, you could receive up to $10,000 worth of free silver as part of its ongoing offer.

How to Invest in a Gold IRA With Goldco

Opening a precious metals IRA through Goldco follows a series of clear steps to ensure everything aligns with IRS rules and keeps things simple for those planning their retirement.

Here’s an outline of the main stages.

Step 1: Opening an Account

To start a gold IRA with Goldco, begin by requesting a free gold IRA kit to see if a gold IRA is right for you. You will have to provide your name, phone number and email to request the kit.

This kit is packed with useful information about how Goldco works, as well as detailed information about gold IRAs, requirements, eligibility, tax information, IRA-approved gold, and more.

Before proceeding, decide on the type of gold IRA that suits your needs, such as a Traditional version funded with pre-tax dollars or a Roth option using post-tax contributions, which can affect how you handle taxes during funding and withdrawals.

If you decide to move on, Goldco’s representative will send you an account opening form to fill. From there, follow these steps:

- Enter your details on the designated form page.

- Fill out the required paperwork, which you can do digitally or via postal service.

- Submit proof of identity.

- Share information about any existing retirement plans if you’re transferring funds.

Once your application is submitted, sign an agreement with Goldco to confirm you understand its business terms and the overall setup process.

Goldco collaborates with reliable custodians for self-directed IRAs, such as Equity Trust and STRATA Trust. These partners manage the day-to-day operations of your IRA. Expect approval in about one to three business days.

Step 2: Adding Funds to Your Account

Now, fund your account through a check or bank wire transfer. It is generally recommended to roll over (transfer) assets from an existing retirement plan, which often avoids any tax implications.

You can add funds by three different ways: direct transfer, rollover, and cash contribution. Direct transfer is the most preferred option, because it allows you to move money between accounts without any penalties. Compare the different ways to deposit money below.

| Method | Timeline | Best For | Notes |

|---|---|---|---|

| Direct Transfer | 1-2 weeks | Current IRAs | Money moves straight from one custodian to another |

| 401(k) Rollover | 2-3 weeks | Old job retirement plans | Might involve a check from your previous employer |

| Cash contribution | 3-5 days | Fresh deposits | Follows yearly IRA limits on contributions |

For 2025, standard contribution limits are set at $7,000 annually, or $8,000 if you’re 50 or older, so plan accordingly if using new cash deposits.

Some things to keep in mind:

- Some transfers must happen within 60 days to avoid penalties.

- You cannot roll over required minimum distributions.

- New deposits stick to standard annual caps.

Keep in mind that Traditional gold IRAs may require minimum distributions starting at age 73, while Roth versions offer tax-free withdrawals after age 59½ if the account has been open for at least five years.

Step 3: Picking Your Precious Metals

Examine Goldco’s range of precious metals that meet IRS guidelines and decide how much you want to allocate into gold or silver. Choose gold or silver coins and bars that match your investment goals.

Many Goldco clients favor conventional options like American Eagle, American Buffalo, or Canadian Maple Leaf coins. The staff will assist you in picking items that satisfy IRS purity rules.

Goldco’s product variety is pretty vast and offers unique dragon-themed coins, and lunar series from the Royal Mint, along with bars from trusted makers in various weights.

Keep in mind that eligible gold needs at least 99.5% purity, and silver requires 99.9%, which limits choices but ensures compliance. Coins sometimes hold extra appeal due to rarity or demand, potentially boosting their worth beyond just the metal content.

Certain U.S. Mint coins, like the American Gold Eagle, are allowed even if they don’t meet the standard fineness threshold due to specific legal exceptions.

Gold bars come in sizes ranging from small one-gram pieces to larger ones weighing hundreds of ounces, giving flexibility based on your budget and strategy.

Step 4: Arranging Storage and Monitoring Your Portfolio

After selecting your metals, review and approve the necessary agreements with your chosen custodian to confirm all details are accurate. Double-check your precious metal selections to ensure they align with your goals and comply with regulations.

Arrange the secure storage, specifying preferences like segregated storage where your items are kept separately from others for added personalization.

Once everything is confirmed, your selected precious metals will be purchased using the funds in your account and transported to an IRS-approved depository for safekeeping.

Verify that comprehensive insurance coverage is in place to protect against loss, theft, or damage while in storage. Access your account through online portals provided by Goldco or the custodian to monitor holdings, view statements, and make adjustments as needed.

The entire setup usually spans two to four weeks, from your first submission to having metals safely stored.

You retain control over buying or selling decisions within IRS rules, and after age 59½, you can take penalty-free distributions, including physical delivery of the metals if desired.

Goldco’s Buyback Program

Goldco provides a repurchase program where they agree to buy back the precious metals they’ve sold, using fair market prices at the time.

For customers, this brings several advantages:

- It offers peace of mind about turning assets into cash quickly.

- You avoid the hassle of searching for other buyers.

- Selling becomes a smoother experience overall.

- Both IRA holders and those who buy directly can use this service.

To liquidate your precious metals to Goldco, you will have to contact your dedicated precious metals specialist and get a quote based on the latest market values.

Payment comes once your precious metals are releases from storage, and the whole process typically takes no longer than 5 business days.

Alternatives to Goldco

While Goldco earns praise, if it does not fit your needs, consider these alternatives for gold IRAs in 2025. Each option varies in costs, services, and ratings, so compare based on your goals.

Augusta Precious Metals ranks high for its white-glove service and transparent fees, making it ideal for larger portfolios.

With a $50,000 investment minimum, Augusta is clearly geared toward serious investors. For those who can meet this threshold, the company offers unmatched lifetime customer support, webinars with a Harvard-trained specialist, and a fee waiver.

American Hartford Gold offers strong customer support and no minimums, much like Goldco, but with broader metal choices. American Hartford Gold mirrors Goldco in many ways, particularly in its marketing approach.

Both companies highlight celebrity endorsements, offer free guides in exchange for contact details, and showcase customer testimonials. Each also takes pride in its inclusion on the Inc. 5000 list of fast-growing businesses.

Birch Gold Group suits those seeking low entry points and educational tools. Based in California, Birch Gold Group is another competitor offering retirement accounts and direct delivery of precious metals, including gold, silver, platinum, and palladium.

Compared to Goldco, Birch provides a wider variety of products, such as bars, coins, and rounds, directly on their website. Goldco’s site focuses mainly on coins, though a broader selection becomes available when you speak with their representatives.

Who Should Choose Goldco?

If you have $5,000 or more to invest in precious metals and your investment strategy align with the long-term nature of physical precious metals, Goldco is for you. However, if rare or collectible coins are your focus, a specialized numismatic dealer might better suit your needs.

Having reviewed numerous precious metals companies over the years, I can say that Goldco is a legit company that stands out for its reliability. It has helped customers put over $3 billion in precious metals over the course of 19 years, and continues to be a reputable option for gold IRAs.

Goldco’s commitment to customer education, clear fee structure, and secure storage options address the main concerns of retirement investors exploring this asset class.

Their low-pressure, educational approach resonates particularly with conservative investors making significant financial choices.

Ready to invest? Start by requesting a free gold IRA guide from Goldco to get in touch with customer support and learn about Goldco’s gold IRA.

From my evaluation, Goldco is particularly well-suited for:

- Investors who want to open a gold IRA, but cannot afford to invest tens thousands of dollars to satisfy the high minimum investment requirements of other companies.

- Those who prefer hands-on guidance over self-service online platforms.

- Individuals seeking a streamlined process for rolling over retirement accounts.

- Conservative savers prioritizing wealth protection.

- People who value a company’s long track record and strong reputation.

Keep in mind that physical precious metals are just one part of a balanced retirement strategy. Always consider how they fit into your broader financial goals and long-term plans before deciding.