Advantage Gold Review

This Advantage Gold review offers a well-rounded perspective on the company’s operations and reputation. It covers the range of services and products available, highlights Advantage Gold’s strengths and drawbacks, and examines customer feedback and complaints.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

Advantage Gold is a gold IRA company founded in 2014 and based in Los Angeles, California. It operates as a precious metals dealer and focuses on helping customers set up IRAs backed by gold and other precious metals.

The company was founded by Adam Baratta, Larry Levin, and Kirill Zagalsky, who each bring years of experience from key roles at major precious metals dealers affiliated with the U.S. Mint, as well as commodity trading.

Advantage Gold is known for providing customers with clear guidance, personalized support, and a straightforward process for transferring funds from existing retirement accounts into gold-backed IRAs without incurring unnecessary taxes or IRS penalties.

A quick note before we dive deeper into our Advantage Gold review!

Choosing a gold IRA company is a major financial decision, and we’re committed to providing you with trustworthy, detailed information on your options. After extensive research, we’ve compiled our top five gold IRA companies for this year.

Curious if Advantage Gold made the cut?

You can also request a free gold IRA kit from our top-recommended gold IRA company for 2025 below, or keep reading this review for the full scoop on Advantage Gold.

This overview combines insights from customer reviews, official company statements, and our own evaluations of the company’s products and services.

It covers the strengths and drawbacks of Advantage Gold, costs and fees, how the company handles operations, as well as overall reputation in the gold IRA industry.

Pros and Cons

| Advantage Gold Pros | Advantage Gold Cons |

|---|---|

| Top Ratings: Holds an A+ BBB rating and a 4.9 Trustpilot score, with over 1,800 five-star reviews reflecting high customer satisfaction. | No Pricing Transparency: Current metal values and full costs are not displayed online, requiring a phone call for details. |

| Personalized Support: Excellent customer service featuring dedicated representatives who provide tailored, educational guidance throughout the investment process. | Limited Non-IRA Availability: Primarily geared toward IRA investments, with restricted options for direct, non-retirement purchases. |

| Diverse Metal Selection: Offers a wide range including gold, silver, platinum, and palladium, allowing for greater portfolio diversification beyond just gold and silver. | Shipping and Insurance Charges: Additional fees apply for delivery and insurance on purchases, except for qualifying large orders. |

| Buyback Guarantee: Reliable program offering repurchases at fair market prices with 24-hour processing for quick liquidity. | No Live Chat Support: Absent instant messaging feature, limiting quick online assistance to phone or email only. |

| Educational Resources: Comprehensive materials such as the Learning Center, First Time Investor Program, free Gold Investment Kit, and the book The New Case for Gold to empower informed decisions. | Occasional Complaints: Some customers report issues with markups, perceived value losses, persistent follow-up calls, and rare delays in delivery or communication. |

| Fast Delivery: Insured shipping completed in 2-3 days, with free shipping available on large orders exceeding $25,000. | Phone-Only Purchases: Lacks online buying capabilities, necessitating interaction with a representative for all transactions. |

| Product Authenticity: Listed as an authorized U.S. Mint dealer, ensuring all products are genuine and high-quality. | |

| Transparent Rollovers: Supports tax-free rollovers with flat fees, providing cost predictability and minimal paperwork. | |

| Price Match Guarantee: Commits to matching competitor prices on bullion purchases for competitive value. | |

| Simple IRA Setup: Streamlined process with two custodian options and online account opening for added convenience and ease. |

Company Background and Evolution

Advantage Gold’s main office is located at 12100 Wilshire Boulevard, Suite 1450, Los Angeles, California, with an additional location in Austin, Texas.

The company is managed by industry professionals who are deeply involved in the precious metals market.

- Adam Baratta, Advantage Gold’s co-CEO is a published author of popular books that include: “The Great Devaluation” and “The End of Money,” which explore using gold to counter inflation risks.

- Kirill Zagalsky, meanwhile, often gives precious metals industry commentary and appears on national networks like NBC and Fox Business News.

- Larry Levin is an experienced stock market trader and expert in commodities.

Together, this combination of skills enabled them to develop practical strategies for helping investors effectively diversify their retirement portfolios during uncertain times.

Many people overlook the fact that precious metals can play a key role in retirement planning, so Advantage Gold capitalized on this gap by making customer education and support a central part of their business model.

From its inception, the company focused on converting standard retirement funds into IRAs that hold physical precious metals, dedicating a team specifically to that process. Over time, it grew to around 35 employees, many of whom specialize in gold IRAs and related services.

Advantage Gold sources its products from industry’s leading NYMEX, COMEX, NYSE/Liffe, LPPM, LBMA, TOCOM, and ISO 9000. As a dealer affiliated with the U.S. Mint, Advantage Gold deals in authentic coins and bars.

The company is a member of the Industry Council for Tangible Assets and the American Numismatic Association, which underlines its credibility.

Despite being a relatively new player in a market dominated by long-established names, Advantage Gold has quickly earned a strong reputation, in part through paid ambassador endorsements from conservative media personalities such as Mark Levin, Benny Johnson, Jason Hanson, Ed Mylett, and others.

The company grew rapidly, attracting a large customer base and gaining support from prominent figures in conservative circles.

Its rise can be attributed to a customer-first approach, quick shipping, industry-leading insurance and regular updates on market trends. To meet investor needs, the company also offers ways for customers to sell back their precious metals, as well as offers secure storage.

Advantage Gold’s Products and Services

Advantage Gold primarily specializes in IRAs backed by precious metals, but it also offers customers the option to purchase gold, silver, platinum, and palladium products outside of an IRA.

To open a gold IRA with Advantage Gold, you’ll need at least $5,000 as a base amount. This is unusually low, as most gold IRA companies require $20,000 to $50,000 and typically do not accommodate investors who cannot commit larger sums.

All products sold by Advantage Gold meet IRS standards for purity and IRA eligibility, enabling investors to include high-quality precious metals in their retirement accounts without incurring tax penalties.

Gold, Silver, Platinum and Palladium Options

Advantage Gold is among the few precious metals investment companies offering palladium coins that meet IRA standards, although availability can be limited at times. One of the company’s strongest advantages is its product variety, which appeals to investors looking for a more diverse portfolio.

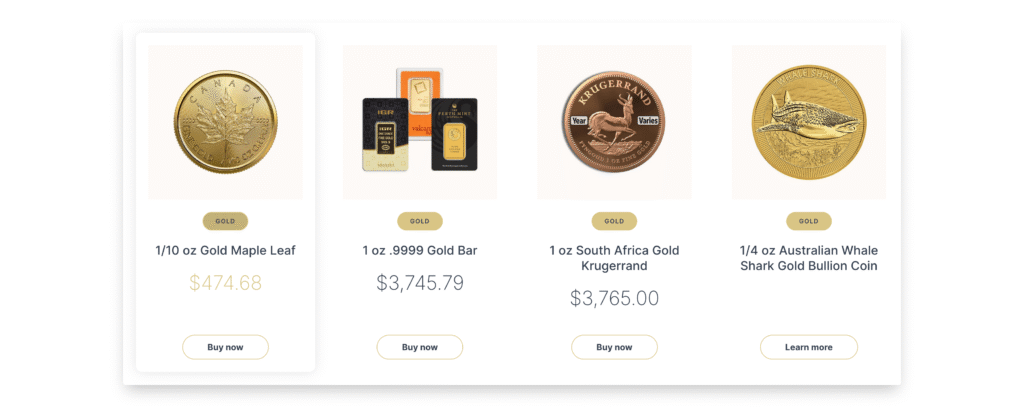

Gold options include:

- 1 oz .9999 Gold Bars

- 1/10 oz Gold Maple Leafs

- 1 oz South African Gold Krugerrands

- 1 oz American Gold Eagles

- And more.

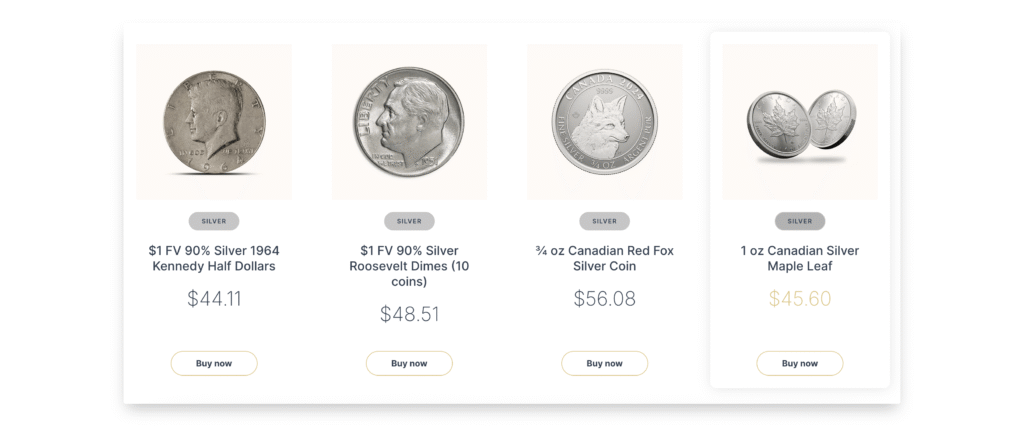

Silver products feature:

- 1 oz Canadian Maple Leafs

- 1 oz American Silver Eagles

- Mexican Libertads

- Australian Emperor Penguins

- And more.

Platinum items include:

- 1/3 oz Australian Whale Coins

- 1/3 oz Australian Leopard Seal Coins

- 1/3 oz Australian Sea Lion Coins

- And others.

Palladium offerings consist of:

- 1 oz Palladium Bars

- Canadian Palladium Maple Leafs

- And additional options.

Looking for the best gold IRA company? Download a free gold IRA comparison checklist to learn how to avoid common scams and find out whether the company of your choice passes the ethics test.

IRS Standards for IRA-Eligible Coins and Bars

To meet IRS standards, gold must have a minimum purity of 99.5%, silver 99.9%, and both platinum and palladium 99.95%. All products offered by Advantage Gold are IRA-eligible and IRS-compliant, including coins and bars sourced from trusted mints such as the U.S. Mint and the Royal Canadian Mint.

Investors usually aim for a balanced portfolio of coins and bars. Coins tend to have higher markups but can appreciate in value beyond gold’s spot price, while bars generally have lower markups and are priced closer to the spot price.

Here’s a quick breakdown of coin categories and how they stack up:

| Coin Type | IRA Eligibility | Purity Requirement | Liquidity/Resale | Examples |

|---|---|---|---|---|

| Bullion | High | 99.5%+ for gold | High, near spot price | American Eagle, Canadian Maple Leaf |

| Premium/semi-numismatic | Variable | Varies | Medium, based on rarity | Proof coins, collectibles |

| Numismatic/collectible | Low | Varies | Low, collector-dependent | Rare historical coins |

Beyond IRAs, you can purchase metals directly, though the selection may be more limited, and you’ll be responsible for delivery and protection costs. The company also avoids dealing with digital currencies or combining them with gold in retirement accounts, focusing solely on physical precious metals.

Advantage Gold’s Buyback Program

Advantage Gold offers a buyback program that allows customers sell their metals back to the company at market-linked rates, with a floor set at the current spot price.

To initiate the process of selling your metals, you simply request a quote based on live market values and send the metals through insured channels. You can expect to receive the funds fairly quickly, usually within a day or so.

The buyback program provides sheer flexibility to liquidate your assets and makes it easier for customers to access their money when needed. Additionally, Advantage Gold is committed to matching or exceeding the rates offered by competitors for similar bullion products.

Storage and Security

To comply with IRS regulations on retirement accounts, precious metals must be stored in approved facilities.

The company partners with reputable storage companies like the Delaware Depository in Wilmington, Delaware, and which offers competitive rates, coverage of up to a billion dollars for all risks, and Brink’s Global Services, with locations in Los Angeles, California, and Salt Lake City, Utah.

These companies ensure safe and secure storage of your precious metals under comprehensive insurance. Your assets are fully protected against any potential risks, such as theft, natural disasters, fire, or damage during transit.

For those interested in private vaults, segregated storage options are offered for $100 to $150 per year, with pricing varying depending on the managing firm.

Both depositories adhere to strict industry standards and undergo regular audits to ensure the integrity and security of your holdings. Additionally, they offer real-time inventory tracking, providing you with peace of mind that your assets are being closely monitored and maintained under optimal conditions.

How to Open and Manage an Advantage Gold IRA

Opening a gold IRA with the company is generally easy and involves creating a self-directed IRA that allows you to store physical gold, silver, platinum, or palladium as part of your retirement account.

Self-directed IRAs backed by precious metals come with the same tax perks as regular IRAs, yet they bring the reliability of a physical asset, making them a draw for anyone wanting to step away from just paper investments.

1. Contact an Advantage Gold Representative

This initial conversation helps guide you through the overall process of opening a gold IRA. No specific prerequisites are required for this step, it’s essentially the entry point to get personalized advice on eligibility, your investment options, and next actions.

2. Fill Out the Application for a Self-Directed IRA

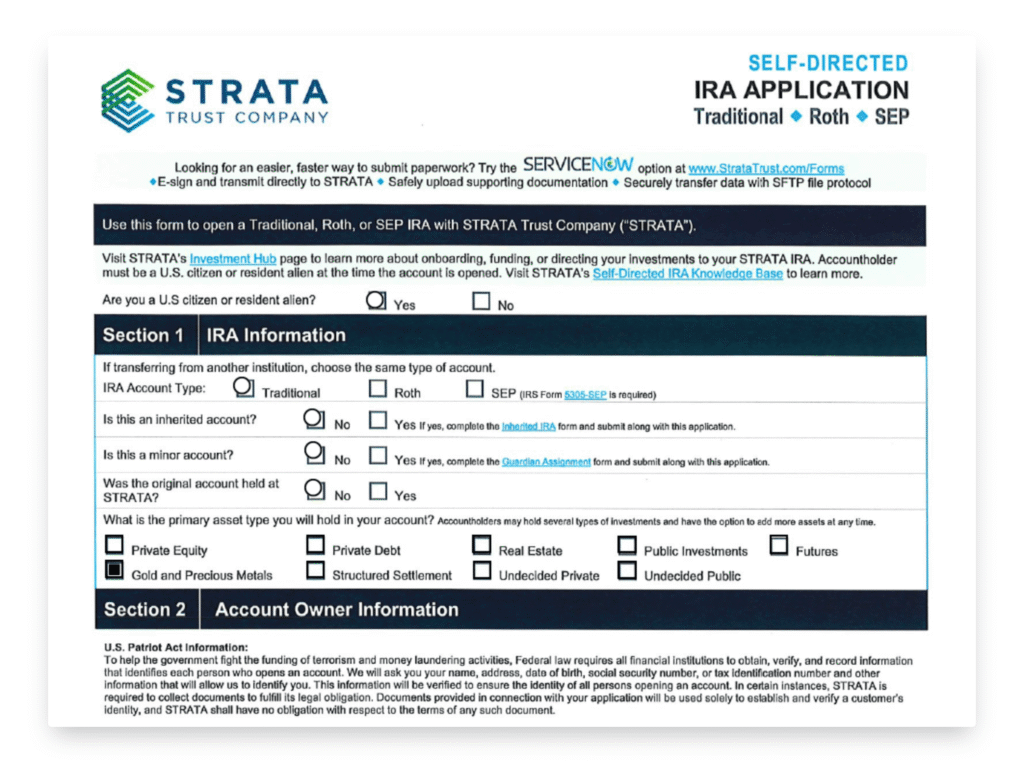

To get started, complete the application for a self-directed IRA and select a custodian, such as STRATA Trust or Equity Trust Company. Using STRATA Trust as an example.

In the STRATA Trust self-directed IRA application, you’ll need to provide some personal details. These details include: your name, address, Social Security number, phone number, and government-issued ID information.

You’ll be asked how you want to fund the account (direct transfer/rollover from another IRA/plan, annual contribution). You can submit the application online.

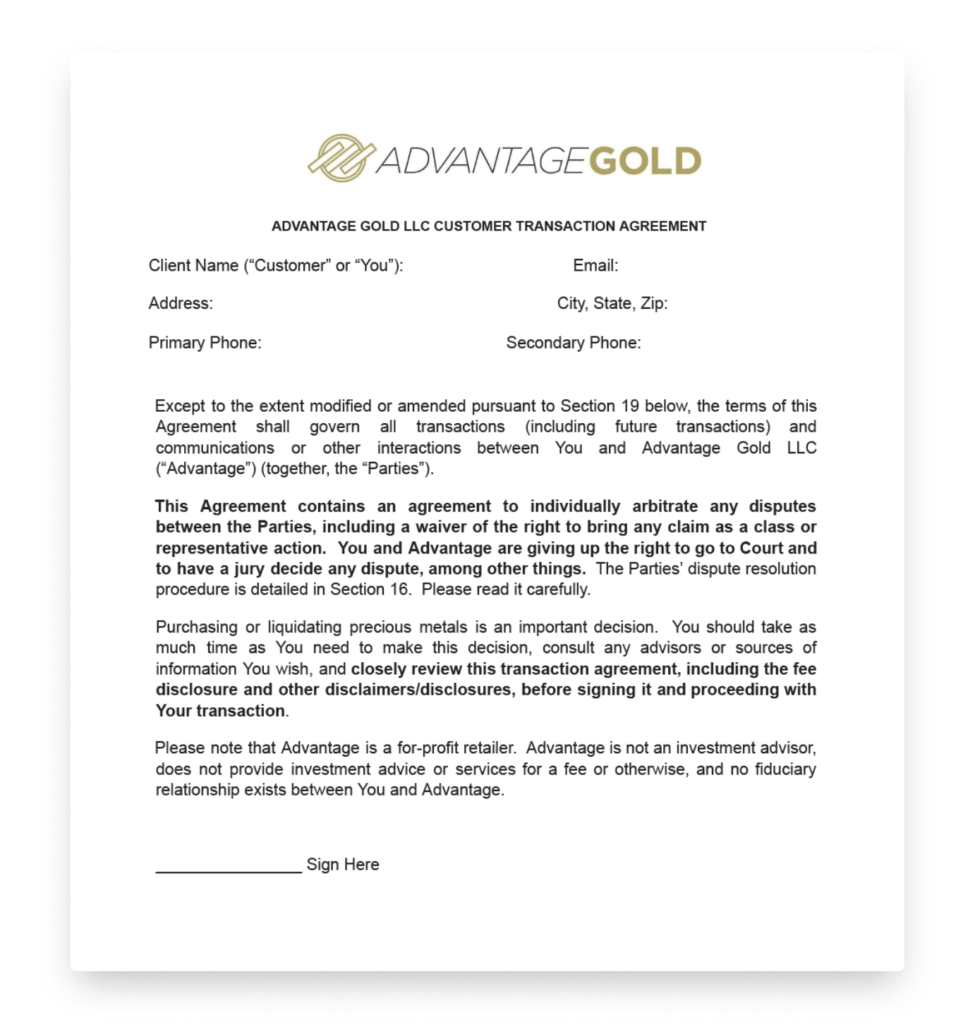

3. Review Advantage Gold’s Client Terms

Next, review and agree to the client and shipping terms.

This document includes details about refunds, delivery, and buyback process. It also outlines disputes, specific disclosures regarding IRA investments, risks, precious metals spread, as well as general terms & conditions.

Advantage Gold makes transferring funds from other retirement accounts straightforward and seamless. Accounts eligible for a transfer include: Roth IRAs, SEP and SIMPLE IRAs, 401(k)s, 403(b)s, 457(b)s, federal Thrift Savings Plans, and certain annuities.

Thanks to their professionalism and industry expertise, these transfers are completed without triggering taxes or other fees.

4. Provide a Recent Retirement Account Statement

This step requires you to upload a digital copy (e.g., PDF or scan) of your most recent retirement account statement directly through an online form on their application page.

By reviewing the statement, Advantage Gold can assess your current savings balance and tailor recommendations for how gold or precious metals might fit into your overall retirement strategy.

It also ensures that the account you’re looking to roll over or fund is eligible. Gold IRAs have specific IRS rules, and this check confirms your account qualifies for adding physical precious metals without triggering penalties or tax issues.

5. Submit the Investment Direction Form

Complete the form to direct your precious metals investment, choose a storage facility, and acknowledge the terms and conditions.

This document is used by the IRA account holder to authorize and provide instructions for purchasing, selling, or exchanging precious metals within a self-directed IRA.

This form ensures compliance with IRS regulations by routing funds through the IRA custodian (STRATA), designating Advantage Gold as the precious metals dealer, and specifying the chosen depository (Delaware Depository or Brink’s Global Services).

6. Select Your Precious Metals and Send Them for Storage

After funding your account, choose the metals you’d like to invest in and arrange for secure storage. Advantage Gold can help you pick the right metals based on your investment goals.

When it’s time to liquidate your assets and access your funds, you can either take the physical precious metals home or sell them back through the program.

Remember to keep IRS guidelines in mind: there’s a 10% penalty for early withdrawals before age 59½. For traditional IRAs, required minimum distributions begin at age 73. Failure to take them could result in a 20% penalty. It’s a good idea to consult with a tax expert to navigate these rules based on your personal situation.

Advantage Gold Fees and Costs

The company is generally transparent about its pricing. However, some specifics (like the prices of certain coins, for instance) aren’t listed on the website. You’ll need to speak with a precious metals representative to get the most up-to-date pricing, which can fluctuate over time.

As for the fees, you can expect:

- A one-time account setup charge of $50.

- Annual administration fees ranging from $95 at STRATA Trust to $225 at Equity Trust Company (depending on the chosen custodian and account size).

- Annual storage costs between $100 and $150, depending on whether it’s shared or segregated storage.

Advantage Gold’s markups on bars and coins typically range from 2% to 7%. Additional fees may apply for shipping, insurance, and handling based on your specific needs (e.g., direct purchases or IRA distributions).

The first-year fees may be waived for accounts over $50,000, and new customers often qualify for discounted rates. Orders exceeding $25,000 ship free. Overall, Advantage Gold’s fees are highly competitive compared with other gold IRA companies. The company offers fixed rates that remain the same regardless of account size.

Advantage Gold Reviews, Complaints, and Ratings

As of mid-2025, Advantage Gold continues to earn strong feedback across major review platforms.

Overall, Advantage Gold reviews are overwhelmingly positive. Advantage Gold holds an A+ from the Better Business Bureau and a AAA from the Business Consumer Alliance. It also scores close to perfect (around 4.9/5 stars on Trustpilot from over 1,800 users).

TrustLink lists Advantage Gold at a full 5 stars from nearly 493 reviews, where it has held the top spot among gold IRA companies for eight consecutive years. Consumer Affairs gives it 5 stars based on 449 reviews.

Most of the praise highlights the company’s exceptional customer service, educational resources, and smooth account setup. One BBB reviewer described receiving educational videos, multiple follow-up calls to walk through options, and detailed explanations at every step.

Looking for the best gold IRA company? Download a free gold IRA comparison checklist to learn how to avoid common scams and find out whether the company of your choice passes the ethics test.

Customers frequently mention representatives such as Adam, Jose, Paul, and Richard for their personalized assistance. Repeat customers also point to consistent reliability, even during periods of high demand.

Advantage Gold Complaints

Advantage Gold complaints are uncommon, but we did find a few concerning reviews on the Better Business Bureau and Trustpilot.

One BBB reviewer reported that their stepmother was charged a 30% premium on the precious metals she purchased, and that her entire account balance was transferred into a gold IRA instead of just the portion she had originally requested.

Advantage Gold hasn’t replied to this review despite it being a serious accusation.

Unsatisfied customers report concerns about unclear fees or high markups that reduce returns. One BBB reviewer felt overcharged, while a Trustpilot reviewer noted steep deductions when selling precious metals back to Advantage Gold due to fees.

Delivery delays are occasionally mentioned as well, though most of those issued were quickly resolved. Other minor complaints include frequent follow-up calls and the lack of an option to purchase directly online.

Final Verdict

Advantage Gold is a legit gold IRA company supported by strong ratings, industry affiliations, and largely positive customer reviews. However, a few unresolved complaints point to occasional issues with account transfers, communication delays, and misunderstandings regarding fees or the buyback process.

Advantage Gold will work for those who value guidance and ongoing support, but be sure to ask about fees directly and compare them against competitors. To broaden your perspective, review detailed comparisons of top-rated gold IRA companies to see how Advantage Gold stacks up against competition.

Looking for the best gold IRA company? Download a free gold IRA comparison checklist to learn how to avoid common scams and find out whether the company of your choice passes the ethics test.

The company’s focus on investor education and its streamlined rollover process make opening a gold IRA simple and straightforward. Overall, Advantage Gold is well-suited for investors of all portfolio sizes who want to add precious metals to their retirement savings.