Augusta Precious Metals Review

This in-depth review of Augusta Precious Metals explores the company’s products and services, fees, customer support, reputation, and pros and cons. It will help you decide if it’s the right choice for your retirement savings strategy.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

Established in 2012 and headquartered in Casper, Wyoming, Augusta Precious Metals is a popular gold IRA company and precious metals dealer that specializes solely in gold and silver products.

Augusta Precious Metals is ranked #1 as a top gold IRA company for 2026 in our rankings, standing out alongside other highly rated companies in the industry.

The company is known for its top-notch customer support, strong focus on education, and expert rollover guidance that helps mitigate IRS penalty risks.

Augusta Precious Metals distinguishes itself from the competition through endorsements from reputable media, such as Forbes, Investopedia, and USA Today, strong customer reviews, and a focus on honest practices and transparency.

Could it be the best choice for your needs? This detailed analysis explores what the company provides, its pricing structure, customer insights, and additional details to guide your decision.

Pros and Cons

| Augusta Precious Metals Pros | Augusta Precious Metals Cons |

|---|---|

| Endorsed by Top Publications: Praised by Forbes, Investopedia, CNBC, Entrepreneur, and USA Today. | High Minimum Investment: Demands a $50,000 minimum to invest. |

| Strong Customer Trust: Holds thousands of 5-star reviews, an A+ rating from BBB, and AAA rating from BCA. | No Online Purchases: Self-service online purchases are not available, all quotes and deals require a phone call. |

| Top-Tier Buyback Guarantee: You can sell your precious metals back to Augusta at the best possible price. | Limited Metal Options: Focuses solely on gold and silver, without options for platinum or palladium. |

| Seamless Experience: Delivers customer satisfaction through no-pressure sales tactics and IRS-compliant investments. | US-Only Availability: Available only to customers in the United States. |

| No Management Fees: Charges zero management fees or hidden commissions. | Mandatory Phone Consultations: Involves a phone consultation for account opening, lacking a fully online process. |

| Investor Education: Prioritizes investor education with complimentary guides, online webinars, market insights, and fraud prevention advice. | |

| 7-Day Money-Back Guarantee: You have freedom to change your mind and get your money back in full within a 7-day timeframe. | |

| Free Shipping and Insurance: Includes complimentary shipping and insurance on eligible investments. | |

| Lifetime Customer Support: Offers ongoing lifetime assistance and an easy-to-follow setup. |

Download a free gold IRA guide from Augusta Precious Metals to learn how a gold IRA can protect your savings from inflation and economic uncertainties.

Overview of Augusta Precious Metals

Although Augusta Precious Metals sells gold and silver directly, its main focus is helping retirees invest in precious metals through gold IRAs. These accounts allow individuals to store physical gold, silver, platinum, and palladium in a retirement plan that offers tax benefits.

Unlike some competitors that spread their services across cryptocurrencies and standard IRAs, Augusta sticks strictly to precious metals. This narrow focus brings greater industry knowledge and a more tailored approach for customers who are looking to invest in gold and silver for retirement.

As a result, the company holds the highest A+ rating from the Better Business Bureau (the industry’s most trusted review platform) with zero complaints and steady acclaim for its commitment to safety and customer satisfaction.

Despite its high rankings, Augusta Precious Metals might not be for everyone, as it mainly serves wealthier investors. The company has a substantial $50,000 minimum investment requirement to open a gold IRA, which is higher than the industry’s average. However, such a requirement allows for top-tier service, with each customer receiving personal guidance on any questions.

Augusta’s competitive edge lies in its industry recognition, as well as its customer education efforts and top-tier support. Customers can access free gold investment guides, regular market trend updates, video reports, and exclusive one-on-one online sessions with Harvard economist Devlyn Steele.

For those who meet the investment requirement, Augusta handles the entire process — from starting a self-directed IRA to selecting qualifying products and arranging secure storage.

If someone wants to transfer funds from an old 401(k), 403(b), traditional IRA, or Roth IRA, the company simplifies the process by guiding you through each step and keeping you informed along the way.

Storage Options

All metals in a precious metals IRA must meet IRS purity standards (at least .995 for gold and .999 for silver). Augusta’s Precious Metals specialists will help you select the right metals based on your investment goals, without using any aggressive sales tactics. When working with Augusta, you’re always in control and never pressured into purchasing something you don’t want.

Augusta Precious Metals closely works with America’s top-tier vaults that specialize in storage of precious metals: Delaware Depository in Wilmington, DE and International Depository Services (IDS) in Dallas, TX.

Precious metals delivery comes at no charge, and they usually reach the facility in about 10 days. After arrival, your holdings gain protection under a $1 billion comprehensive insurance plan backed by underwriters in London. These assets sit separate from the depository’s own books, shielding them from any outside claims.

For purchases outside an IRA, you have the option to receive items directly at your address. Still, the company suggests storing your metals at a specialized facility for improved safety. These facilities operate independently, undergo regular checks, and spread out across different areas to reduce risks.

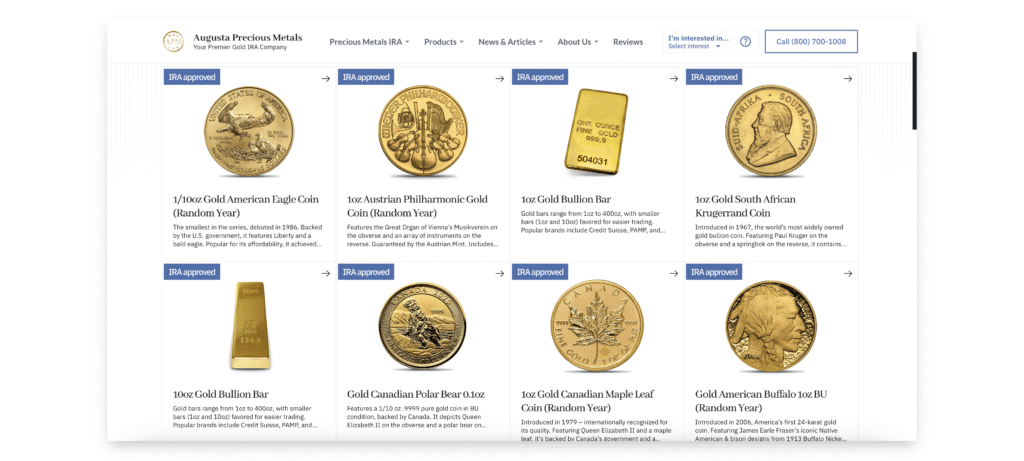

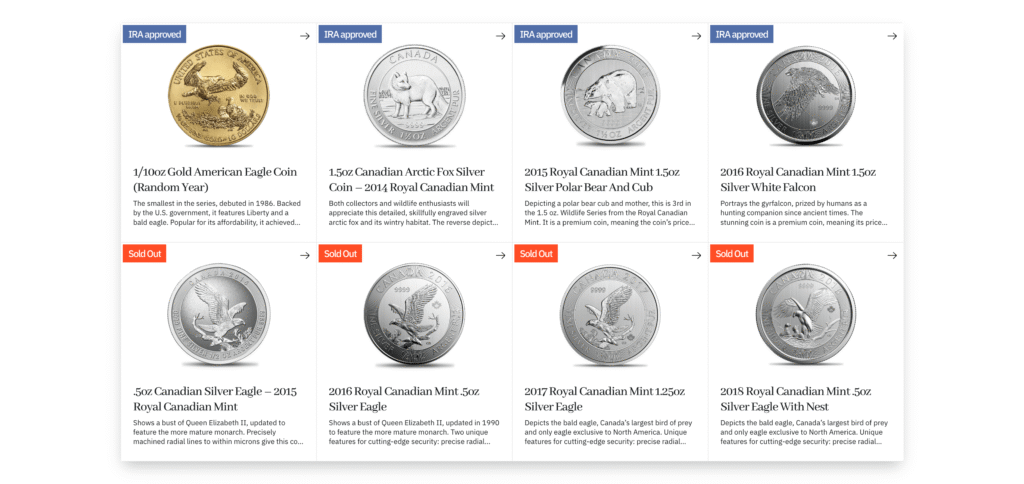

Which Precious Metals Are Available at Augusta?

Investors often choose Augusta Precious Metals over competitors for its targeted range of high-quality gold and silver products. All of these are of highest purity and meet IRS guidelines for inclusion in retirement accounts.

While some other gold IRA companies offer platinum and palladium products, Augusta maintains a simple and specialized product lineup that is focused on popular gold and silver coins and bullion.

Here is a non-exhaustive overview of most popular products:

| Gold | Silver |

|---|---|

| American Eagles in sizes like 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. | American Eagles at 1 oz, Canadian Maple Leafs at 1 oz, Austrian Philharmonics at 1 oz, silver rounds at 1 oz, Canadian 5 Blessings at 1 oz. |

| American Buffalos at 1 oz, Canadian Maple Leafs at 1 oz, Austrian Philharmonics at 1 oz. | America the Beautiful series like 5 oz Cumberland Gap, Fort Moultrie, or Effigy Mounds. |

| South African Krugerrands at 1 oz. | Silver bars in 10 oz or 100 oz sizes. |

| Canadian Polar Bears at 0.1 oz, British Britannias at 0.1 oz. | |

| Gold bars in 1 oz or 10 oz weights. |

Not every collectible coin works for an IRA, so the team at Augusta suggests verifying details first. Such choices can strengthen your savings mix and come with potential tax perks. Always talk to a tax expert for personalized advice.

Collectors or anyone after something distinctive might enjoy some Augusta’s premium coins as well. Some of the available premium coins that blend history, design, and value are:

- Gold Sovereign from St. Helena (2022 edition).

- Canadian Gold Arctic Fox at 0.25 oz (2014 edition).

- Royal Canadian Mint Silver Soaring Eagle at 1.25 oz (2021 edition).

- Certified 5-piece sets of Indian or Liberty gold coins.

- Ben Franklin silver half-dollar.

- Mercury silver dime.

No matter if you’re setting up an IRA or buying precious metals from Augusta directly, the company upholds high quality and reliability standards in its products. This approach simplifies adding variety to your portfolio and ensures that you’re making informed decisions with secure, trustworthy investments.

Augusta Precious Metals Reviews and Customer Ratings

Augusta Precious Metals maintains an A+ rating from the Better Business Bureau (BBB) and a 4.8 out of 5 rating on Trustpilot, supported by numerous verified customer reviews. These accolades highlight the company’s commitment to ethical business practices, transparency, and outstanding customer service.

Looking to invest in gold? Download a free gold IRA guide from Augusta Precious Metals to learn how a gold IRA can protect your savings from inflation and economic uncertainties.

Here’s a brief overview of Auguta’s reviews accross popular review websites:

- 4.9/5 based on 647 reviews in Google Reviews

- A+ rating from the Better Business Bureau (BBB) and 4.93/5 based on 122 reviews

- AAA rating from the Business Consumer Alliance (BCA) and 126 reviews

- 5-star feedback on TrustLink (305 reviews), and other review sites

- 4.8/5 from 231 reviews on Trustpilot

- 5.0/5 from 172 reviews on Consumer Affairs

After reading hundreds of Augusta Precious Metals reviews, I can say that customers often praise how easy the entire investment process with Augusta is, particularly for newcomers.

At least a dozen reviewers on BBB mentioned that the team felt knowledgeable, provided helpful information, and was easy to communicate with.

Augusta Precious Metals Fees and Costs

Augusta Precious Metals is committed to ethical practices and clear fee disclosures. notice with its straightforward and fair pricing approach. It skips charges for managing accounts or tacking on commissions to the quoted rates. Even so, setting up an IRA brings some standard expenses tied to oversight and secure storage.

- Initial setup charge: $50 (paid once).

- Yearly custodian fee: $125.

- Annual storage cost for non-segregated options: $100.

The total fee for opening a gold IRA with Augusta Precious Metals is $275, with a $225 annual charge starting from the following year.

These are the main costs. You won’t face unexpected administrative charges, high shipping fees, or extra insurance costs. Augusta handles shipping and provides liability insurance for all eligible orders, ensuring your precious metals reach the selected storage facility safely and without added expense.

Apart from the fees, all gold IRA companies charge a markup on the metals themselves, which depends on the specific product. In my experience, Augusta’s premiums align closely with standard rates in the industry.

Based on my evaluation of the top gold IRA companies, the gap for Augusta’s most affordable one-ounce gold bar stood at about 0.05% above the Comex gold price. Across similar companies, the typical spread for gold bars reached nearly 0.08%.

How to Invest in a Gold IRA With Augusta Precious Metals

Opening an account at Augusta Precious Metals is fairly easy and efficient, because it’s backed by expert help every step of the way.

Augusta’s team guides you through the details, ensuring you feel confident and well-informed throughout your investment. Let’s break the whole process down into clear stages.

1. Request a Free Gold IRA Guide

First, request a free gold IRA kit to determine if both a gold IRA and Augusta Precious Metals are right for you. The kit covers key topics like individual retirement accounts, associated costs, market influences, and common pitfalls to avoid.

When requesting the free kit, you’ll provide your phone number and email, allowing Augusta to contact you and pair you with a dedicated precious metals specialist.

2. Set Up an Account With Augusta

Next, set up your IRA. The specialists in account setup take care of nearly all the paperwork. They open a self-directed IRA tailored to your needs, making the process quick and hassle-free.

3. Fund Your Account

Then, add funds to your new account. You can transfer money from existing plans such as a 401(k), another IRA, TSP, 403(b), or any other qualified plan. This is the fastest and most straightforward way to fund your gold IRA account, as in 2026 cash contributions are capped at $7,500 per year if you’re younger than 50, or $8,600 if you’re 50 or older.

On the other hand, there is no cap in how much money you can transfer from one retirement account to another.

4. Select Precious Metals to Include in Your IRA

After you funded the account, you can proceed to purchasing precious metals. Work with the purchasing team to pick from approved items that fit IRA rules. They’ll walk you through options and finalize everything during a recorded conversation for clarity and records.

5. Approve Shipment to a Storage Facility

Finally, arrange secure storage. The metals get shipped with full insurance to a protected facility, where they stay safe until you need them.

Once everything is in place, Augusta provides ongoing customer support to answer all questions you may have about maintaining your gold IRA. You’ll have a dedicated precious metals specialist to answer your questions, plus all the resources for learning more about the market and managing your IRA effectively.

Augusta’s Buyback Program

If you want to withdraw your precious metals from a gold IRA, you can access your investment by either receiving the physical metals yourself or converting them into cash through a sale.

Augusta has a buyback program that allows you to sell the precious metals back to the company and have the funds sent directly to your account custodian.

However, keep in mind that it’s important to adhere to IRS guidelines to avoid unnecessary penalties. If you withdraw funds before reaching age 59½, you might face an additional 10% penalty. Read our guide on gold IRA tax rules and regulations to learn more.

To navigate your gold IRA withdrawals effectively, it’s wise to speak with a qualified tax professional.

Alternatives to Augusta Precious Metals

Augusta Precious Metals is one of the highest-rated gold IRA companies on the market. However, if you can’t meet the $50,000 investment requirement and are considering other options, there are several strong alternatives worth your attention.

Goldco offers excellent customer support, competitive fees, and has no minimum investment requirement. These factors make it a strong alternative for investors who may not meet Augusta’s $50,000 investment threshold.

Like Augusta, Goldco holds an A+ rating from the Better Business Bureau and boasts thousands of positive reviews. The company is also endorsed by high-profile celebrities, including Tom Selleck, Sean Hannity, Dennis Quaid, Chuck Norris, and others.

American Hartford Gold is known for its competitive fees and a low $10,000 minimum investment requirement. This makes it an attractive option for investors who prioritize cost-effectiveness along with reliable customer support.

Eligible customers also enjoy promotional benefits, such as waived storage fees, a fee-free buyback policy, and free silver on qualifying purchases.

Birch Gold Group is another reputable gold IRA company, known for its wide range of products, including platinum and palladium alongside traditional gold and silver.

It’s a solid choice for investors who want to diversify into more precious metals, with moderate fees and a low $10,000 minimum investment. This low minimum is well-suited for mid-tier investors, in contrast to Augusta’s focus on higher-value customers.

Who Should Choose Augusta Precious Metals?

I’d say Augusta Precious Metals is the best gold IRA company for investors with portfolios ranging from $100,000 to $1 million or more. Those who want to allocate serious money to precious metals and are either close to retirement or already retired often find Augusta to be a great fit.

It’s not advised to allocate your entire savings to a single asset, so this setup makes sense for meeting the $50,000 entry requirement while dedicating a relatively small percentage of your total assets to precious metals.

For those who meet the investment requirement and are ready to invest, Augusta offers a level of service unmatched by other companies. The company provides exceptional customer support, professional market guidance, and top-tier asset security through partner vaults.

Conclusion

Augusta Precious Metals is a completely legitimate company that is widely recognized as a top-tier provider of gold IRAs. It earns praise for its commitment to clear communication, helpful educational resources, and unmatched customer support. Augusta maintains an impressive A+ rating with the Better Business Bureau and a perfect AAA rating from the Business Consumer Alliance.

The company stands out with its expertise, valuable educational resources, and unwavering commitment to customer needs. This dedication fosters confidence, supported by a flawless track record and glowing customer feedback.

While the high starting investment may deter some investors, those who are serious about protecting their wealth over the long term will find the level of service hard to beat. If these factors align with your goals, Augusta could be a trusted partner.

Ready to invest? Start by requesting a free gold IRA guide from Augusta Precious Metals to get in touch with customer support and learn about Augusta’s gold IRA.

Just be sure to consult with a financial expert to ensure it fits your overall strategy. To explore more options, consider reviewing top companies in precious metals or diving into detailed resources on gold IRAs.