Best Gold IRA Companies 2026

The article reviews the top-rated gold IRA companies for 2026 and details each company’s fees, storage, customer service, and unique features.

Clute Journals independently evaluates all recommendations.

We may earn a commission from links you click, but this does not influence our rankings or reviews.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

Preparing for retirement is more than just a wise choice, it’s a necessary step for every American.

For over a decade, I’ve helped people strengthen their retirement savings through precious metals. One of the most effective ways to do this is by opening a gold IRA.

You might wonder why precious metals like gold are so popular among investors, or what makes a gold IRA special.

The answer is that physical gold offers unmatched stability compared to traditional investments. It’s seen as a reliable asset that serves as a hedge against inflation, a safeguard during economic downturns, and a proven way to preserve wealth.

With a gold IRA, you can own physical gold coins and bars within a retirement account that grows without immediate tax burdens (depending on the account type).

However, not every gold IRA company offers reasonable fees or delivers the same level of service.

Having worked with leading companies in the precious metals industry, I’ve used my expertise, in-depth research, and customer feedback to identify the top five gold investment companies that stand out in 2026 for reliability, service, and low fees.

Top Gold IRA Companies in 2026

| Company | Best For | Minimum Investment | Annual Fees | Customer Ratings |

|---|---|---|---|---|

| Augusta Precious Metals | Best Gold IRA Company Overall | $50,000 | $200-$250 | 4.98 (1,410 reviews) |

| Goldco | Best for Beginners | $25,000 | $200-$280 | 4.95 (6,721 reviews) |

| American Hartford Gold | Best for Low Fees | $10,000 | $175-$225 | 4.88 (4,924 reviews) |

| Noble Gold Investments | Best for Educational Resources | $20,000 | $250 | 4.87 (2,684 reviews) |

| Birch Gold Group | Best for Fee Transparency | $10,000 | $180-$230 | 4.79 (1,191 reviews) |

This table provides a concise comparison to help you choose the gold IRA company that better aligns with your financial goals.

All companies have strong reputations with A+ ratings from the Better Business Bureau (BBB) and high scores on platforms like Trustpilot and ConsumerAffairs.

Best Gold IRA Overall

Augusta Precious Metals

Augusta Precious Metals is the best overall pick. It offers professional, completely stress-free gold IRA rollover guidance, low fees, and exceptional lifetime customer support. However, the company requires a high minimum investment of $50,000.

Augusta Precious Metals is the top-rated gold IRA company that has been recognized by Investopedia, Forbes, Money Magazine, Entrepreneur, Morningstar, and other leading financial publications.

What sets them apart isn’t only their fair pricing or diverse selection of IRA-approved precious metals. It’s their commitment to ongoing support and clear communication. I opened my own gold IRA with this company five years ago, and I can confirm their customer service remains consistently responsive and helpful, just as it was at the start.

If you’re new to investing in precious metals, Augusta’s team will take the time to clearly explain every aspect of your investment, and guide you through every step. Augusta’s representatives are always happy to help you understand how gold strengthens your retirement strategy and assist with all necessary documentation.

This customer-oriented approach underpins Auguta’s consistently high ratings, including an A+ rating from the Better Business Bureau.

Augusta Precious Metals works with the industry’s best gold IRA custodian, Equity Trust, and the reputable storage facility, Delaware Depository.

For anyone looking a company that blends reliability with tailored guidance, Augusta is a choice I can confidently recommend. They ensure you’re supported at every stage, never left to navigate the process alone.

Pros

- Named as the “Best Gold IRA Company” by Money Magazine and as having the “Most Transparent Pricing” by Investopedia for four consecutive years.

- Offers a free educational web conference led by a Harvard-trained economic analyst.

- Simplifies the investment process by handling paperwork, IRA account setup, and rollovers.

- Offers a risk-free, 7-day money back guarantee.

- Focuses on educating clients about precious metals investments and gold IRA scams.

- Shares current market news and a video library with expert insights on the global gold industry.

Cons

- Requires a minimum investment of $50,000.

Reliable Credentials & Transparent Pricing

What I value about Augusta Precious Metals is their commitment to quality. Augusta is an authorized gold dealer with the Professional Coin Grading Service (PCGS) that adheres to the rigorous standards of the Numismatic Guaranty Corporation (NGC).

The company ensures you receive accurately graded, fairly priced metals backed by trusted expertise, not empty claims.

What Sets Augusta Apart

From my perspective, Augusta’s greatest strength lies in its customized service and ongoing support. Here’s why this company stands out:

- Highest-quality precious metals – All gold and silver bullion sold by Augusta comply with IRS regulations and are designed to complement a diversified investment portfolio.

- Exclusive educational sessions – Led by Harvard-trained economist Devlyn Steele, these webinars clarify economic trends and risks.

- Customer-centric approach – They listen to you and focus on your unique goals rather than pushing generic solutions.

- Lifelong customer support – They remain available long after your initial purchase.

- Consistent account managers – You deal with familiar specialists who understand your account.

- Ethical retirement planning – No pushy sales tactics or marketing gimmicks. They help align your IRA with your overall financial strategy, rather than solely focusing on selling you metals.

- Secure storage options – Augusta partners with trusted custodians and IRS-compliant depositories.

- Transparent costs and fees – Clear fees that protect your investment returns.

- Fast account setup – Starting a gold IRA with Augusta takes around 30 minutes.

Customer Experience & Reputation

Augusta consistently delivers exceptional service. Their strong reputation is evident across independent platforms, mirroring my own experience:

- 4.9/5 based on 634 reviews in Google Reviews

- A+ rating from the Better Business Bureau (BBB) and 4.93/5 based on 118 reviews

- AAA rating from the Business Consumer Alliance (BCA) and 125 reviews

- 5-star feedback on TrustLink (304 reviews), and other review sites

- 4.9/5 from 229 reviews on Trustpilot

Client reviews frequently highlight the team’s honesty, patience, and clarity, making a complex process feel straightforward and well-guided.

Fees

Augusta’s fee structure is straightforward and includes:

- One-time custodian application fee: $50

- Annual sample non-government depository storage fee: $100

- Yearly custodian fee: $125

Storage

After your purchase, your metals are insured and securely shipped to a trusted, non-government storage facility. Augusta partners with a top-tier depository in the United States, Delaware Depository. Storage of your precious metals in this facility is protected by a $1 billion all-risk insurance via London underwriters.

This privately managed facility is fully IRS-compliant (IRC-408n) for IRA assets, and strategically located away from major financial and political centers. This ensures that your metals are stored in a secure environment.

The depository is designed to protect your assets both physically and legally. It keeps them legally documented and shielded from any claims by the facility’s creditors.

Read our Augusta Precious Metals Review to learn more.

Best For bEGINNERS

Goldco

Goldco is a highly rated gold IRA company endorsed by Sean Hannity, Dennis Quaid, Chuck Norris, and Ben Stein. It is known for its professionalism and knowledgeable customer support. Goldco has a moderate $25,000 minimum investment requirement, making it an attractive option for a wide audience of investors, especially beginners.

In an industry packed with flashy promises and marketing gimmicks, Goldco stands out as a gold investment company you can trust for honest and reliable service.

When I began researching the industry and setting up my gold IRA, I had little knowledge of precious metals investing. Fortunately, Goldco’s team did their best to educate me, and made the whole investing process smooth and approachable. They offered clear explanations to complex terms, provided tax information, and guided me toward choices that supported my financial objectives for the future.

Located in Los Angeles, Goldco holds an A+ rating from the Better Business Bureau, and a strong track record backed by thousands of positive reviews. Goldco’s custodian of choice is Equity Trust, industry’s biggest precious metals IRA custodian with $70B assets under administration.

Goldco’s website is user-friendly, and managing a gold IRA feels simple, even for beginners. What stood out most was Goldco’s professionalism and consistent support. Each interaction felt personalized and sincere, never rushed or purely business-driven.

For anyone seeking a trustworthy company that prioritizes clarity, dependability, and individualized care, Goldco is a choice I’d recommend with confidence.

Pros

- Goldco is a beginner-friendly gold IRA company thanks to its customer education initiatives.

- Thousands of five-star reviews reflect Goldco’s strong commitment to customer happiness.

- Their wide range of IRA-eligible gold bars and coins caters to diverse investor goals and preferences.

- Qualifying accounts receive a percentage of their initial investment as free silver.

- Goldco offers one of the most competitive buyback guarantees, ensuring flexibility for investors.

- The site provides up-to-date industry news and articles to keep clients well-informed.

- All coins and bars are fully certified, ensuring quality and authenticity.

- Their customer service team is responsive, professional, and focused on addressing client needs.

Cons

- The company does not provide clear details on pricing and fees, which may require additional research.

What Sets Goldco Apart

From my perspective, Goldco distinguishes itself through several key features:

- Metal Buyback Option – Goldco allows you to sell your precious metals back to them at fair market prices, offering flexibility and convenience.

- Real-Time Chat Support – Their responsive team is available to answer questions promptly, ensuring you get the help you need when you need it.

- Complimentary Shipping and Bonus Metals – For eligible purchases, Goldco includes free, insured shipping and occasionally offers additional metals at no extra cost.

- Expert Rollover Assistance for 401(k) and IRA Accounts – The Goldco team provides clear, step-by-step guidance to ensure seamless, compliant, and penalty-free account transfers.

- Physical Gold IRA Kit – They provide an informative gold guide that explains the essentials of precious metals investing.

- Gold and Silver Products of the Highest Purity – Investors can choose from a variety of IRA-eligible coins and bullion, suitable for retirement accounts or personal ownership.

These points highlight Goldco’s commitment to prioritizing customer’s needs over simply pushing sales.

Customer Experience and Reputation

A reliable investment company is defined not just by its offerings but by the quality of its people. Goldco’s support staff has consistently been professional, friendly, and attentive in all my interactions. They’re easily accessible through a toll-free phone line, email, or live chat, and they deliver on their promises every time.

Goldco’s reputation is further reinforced by its strong track record:

- 4.9/5 based on 3,318 ratings in Google Reviews

- A+ rating and 4.83/5 from 1,445 reviews on Better Business Bureau (BBB)

- AAA rating from the Business Consumer Alliance (BCA)

- 254 five-star reviews on TrustLink

- 4.8/5 according to 1,703 reviews on Trustpilot

The wealth of positive feedback aligns with my own experience: Goldco is dedicated to its clients and has built a solid reputation for trustworthiness and care.

Fees

Goldco provides exceptional services, but one area for improvement is their transparency regarding costs. While their fees are generally reasonable and not prohibitive, it can be difficult to obtain clear, upfront information about charges and additional service costs.

Storage

Goldco ensures your precious metals are securely stored, offering two distinct options with varying costs:

- Non-Segregated Storage: Your metals are stored alongside those of other clients, costing $100 per year. This budget-friendly option suits investors seeking affordability.

- Segregated Storage: Your coins or bars are kept separate from others’ assets, priced at $150 annually. This premium option provides added assurance for those who prefer individually tracked holdings.

Goldco partners with reputable depositories: Brink’s Global Services and Delaware Depository. These companies employ advanced security measures, comprehensive insurance coverage, and ensure your investments remain well-protected and secure.

Read our Goldco Review to learn more.

Best for Low Fees

American Hartford Gold

American Hartford Gold is a popular gold IRA company with some of the lowest fees in the industry. It offers a wide variety of IRA-eligible precious metals at competitive prices and is endorsed by respected public figures like Bill O’Reilly, Piers Morgan, and Trish Regan.

American Hartford Gold (AHG) is a gold IRA company I’ve personally worked with and confidently recommend. While many companies boast positive reviews, AHG’s stellar reputation is genuinely earned.

With an A+ rating from the Better Business Bureau and consistently high scores on Google Reviews and Trustpilot, AHG’s credibility is well-established. My own experience with them has been equally impressive, reinforcing their strong standing.

AHG partners with two leading custodians, Equity Trust Company and STRATA Trust, allowing clients to choose between these trusted firms to hold their IRA assets. Both custodians are well-respected for their expertise and customer-centered approach, ranking them among the industry’s finest.

With over ten years of expertise in the precious metals IRA industry, AHG delivers exceptional service. When I transferred funds from a traditional IRA to a gold IRA, their team guided me with precision and professionalism. Their partnership with Equity Trust, a highly reputable IRA custodian, further instilled confidence in the security and quality of my investment.

American Hartford Gold provides a wide range of IRA-approved and direct-purchase precious metals, allowing you to align your investments with your financial objectives:

- Gold and silver coins and bars

- American Gold Eagles and Buffalo coins

- American Silver Eagles and Canadian Maple Leaf coins

- 1-ounce gold bars

Their product offerings cater to a variety of needs. If you aim to diversify your retirement portfolio with high-quality gold bars or invest in other physical precious metals, AHG’s order desk provides expert guidance and a seamless process to help you select the right products.

AHG also offers investment versatility through its buyback program, allowing you to sell your gold at current market rates.

For anyone seeking a reliable gold IRA company with a blend of experience, trustworthiness, and attentive service, American Hartford Gold is an excellent option to explore.

Pros

- American Hartford Gold has been ranked among America’s fastest-growing private companies according to Inc. 5000 for five consecutive years.

- The company is endorsed by Bill O’Reilly, Rick Harrison, and Mike Huckabee.

- Strong reputation for exceptional customer support.

- Offers up to $15,000 in free silver for investors for qualified accounts.

- No account maintenance fees for up to three years.

- 24/7 customer service availability

- Low minimum IRA investment of $10,000 compared to competitors

- Simple buyback process with no liquidation fees.

- Price match guarantee for competitive precious metals pricing.

Cons

- Precious metals prices not listed on their website.

Why American Hartford Gold Stands Out

What I value most about AHG is their focus on putting investors first. Here are some key features that make them unique:

- Buyback Commitment – You can sell your metals back at competitive market prices whenever you choose, giving you flexibility and peace of mind.

- Free Silver for Qualifying Accounts – American Hartford Gold offers up to $15,000 in free silver and additional bonuses like account setup and storage fee-waiver for up to five years when investing $100,000 or more.

- Secure Shipping – All metals are shipped with full insurance and professional care, ensuring safety from start to finish.

- Tailored Advice – Their team takes the time to understand your goals and recommends metals that suit your strategy.

- Discreet Transactions – Every purchase is handled with strict privacy and security, protecting your personal information.

- Charitable Support – American Hartford Gold actively supports veteran charitable organizations such as Wounded Warrior Project.

Customer Experience and Reputation

From my own interactions and research, American Hartford Gold excels in customer care. They offer:

- Live chat for quick, knowledgeable responses

- Tools to track market prices in real time

- Free educational materials delivered to your email

- Responsive support through phone and email

AHG’s reputation speaks for itself:

- An average score of 4.8 based on 1,596 reviews in Google

- 600 customer reviews, 4.75/5 and A+ rating from the Better Business Bureau

- 4.8/5 stars on ConsumerAffairs, based on over 1,129 reviews

- 4.6 based on 1,599 reviews on Trustpilot

AHG has built trust through reliability, prompt service, and a genuine commitment to clients. Very few companies match their consistent record of addressing customer concerns with speed and respect.

Fees

When I opened a gold IRA with American Hartford Gold, I paid a straightforward annual storage fee of $180. There were no additional charges for setting up the account, which made the process simple and cost-effective.

Storage

American Hartford Gold provides secure storage for gold IRA investors through trusted depositories, including International Depository Services (IDS), Delaware Depository, and Brink’s.

You can choose from various storage locations based on your preference:

- Wilmington, Delaware

- Las Vegas, Nevada

- Dallas, Texas

- Salt Lake City, Utah

- New York City, New York

- Los Angeles, California

Unlike most competitors that offer only one storage solution, AHG allows you to choose from multiple storage facilities and locations, providing greater flexibility and customization to meet your needs.

Read our American Hartford Gold Review to learn more.

Best for Fee Transparency

Birch Gold Group

Birch Gold Group is one of the oldest players in the gold IRA market, established in 2003. The company continues to grow while maintaining a strong reputation for service. Birch Gold is the best pick for fee transparency, as it is one of the most open companies when it comes to clear and straightforward fee disclosures.

I’ve had the opportunity to invest with Birch Gold Group and talk to their customer support representatives at multiple occasions, and my experience was truly exceptional. Notably, my sentiment is shared by countless other happy clients, including celebrities and prominent figures like Ron Paul, Donald Trump Jr., and Stephen Bannon.

What truly sets Birch apart is their commitment to treating every investor with care, regardless of portfolio size. Birch Gold Group works with custodians like Equity Trust and GoldStar Trust Company, who specialize in self-directed IRAs and precious metals, ensuring a seamless and secure process for your investments.

Birch Gold offers a wide range of metals for a gold IRA and expert rollover guidance, making it an excellent fit for both new investors and those looking to expand their retirement plans.

Their professionalism and dedicated support made a lasting impression. From the outset of my gold IRA rollover, their team ensured every detail was clear, streamlined, and tailored to my financial goals.

Beyond their services, Birch provides a wealth of educational resources that I found invaluable when exploring investment options. This combination of expertise, patience, and personalized attention distinguishes them in the industry. With an A+ rating from the Better Business Bureau and consistently positive reviews, their reputation is well-earned.

Birch Gold Group provides the broadest selection of high-quality precious metals for investment, with a particular emphasis on platinum and palladium compared to competitors. Their offerings include:

- Gold bars and coins

- Silver bars and coins

- Platinum bars and coins

- Palladium bars and coins

Whether you’re setting up a gold IRA or purchasing metals for personal ownership, their wide range of products helps you align your portfolio with your financial objectives.

For anyone seeking a trusted company with strong fundamentals and reliable, individualized guidance, I’d confidently recommend Birch Gold Group.

Pros

- Birch Gold Group is a trusted brand that served over 36,000 customers since 2003.

- Birch Gold Group offers the widest range of precious metals, including platinum and palladium coins and bullion.

- Their $10,000 gold IRA minimum investment is lower than many competitors.

- Their website offers a variety of educational materials suitable for both beginners and experienced investors.

- They maintain a clear and transparent fee structure, easily accessible on their website.

- Real-time gold price updates are available on their site, helping investors stay informed.

- They offer a buyback program, allowing investors to sell their gold from an IRA account whenever they choose.

Cons

- Investments cannot be made directly through their website, you must contact their customer support team to proceed.

- Initial setup and storage costs may exceed those of some competitors.

Why Birch Gold Group Stands Out

After talking to various companies in the precious metals industry, I found Birch Gold Group to offer several unique benefits that make them a top choice:

- Offers platinum and palladium – Birch Gold Group is one of the very few gold IRA companies to offer high-quality platinum and palladium bars and coins.

- Clear investor guidance – Their step-by-step approach is especially valuable for those new to precious metals, ensuring the process feels straightforward and approachable.

- First-year fee waiver for accounts exceeding $50,000 – They often waive custodial and storage fees for the first year, reducing your initial expenses significantly.

- Live pricing resources – Their website features real-time and historical price charts, empowering you to make well-timed, informed investment decisions.

- Detailed complimentary investment guide – Their detailed, educational kit is perfect for anyone researching precious metals before making an investment.

- Easy-to-use website – With intuitive navigation and well-structured information, their site is accessible even for those unfamiliar with the industry.

Customer Experience and Reputation

When I reached out to Birch Gold Group, their team impressed me with their expertise, responsiveness, and patience. They took time to clarify market trends and explain how various metals could fit into my long-term financial plan. There was no high-pressure sales tactic. Just clear, honest advice.

Their strong reputation is reflected in client feedback:

- 4.7 based on 428 review in Google Reviews

- A+ and 4.6/5 on BBB (Better Business Bureau), with 194 customer reviews

- 5.0/5 rating on ConsumerAffairs, based on over 186 reviews

- 4.6/5 on Trustpilot, supported by 248 verified reviews

- 5-star rating on TrustLink according to 135 reviews

These scores highlight their dedication to consistent, high-quality service, effective communication, and building lasting relationships with clients.

Fees

To open a gold IRA with Birch Gold Group, the minimum investment is $10,000. Their fee structure includes:

- One-time account setup fee: $50

- One-time wire transfer fee: $30

- Annual storage and insurance fee: $100

- Annual management fee: $100

The first year’s fees are typically waived for those investing more than $50,000 in a gold IRA. This provides significant savings upfront.

Storage

Birch Gold Group collaborates with trusted depositories to securely store self-directed IRA assets. Their partnered facilities include:

- Delaware Depository

- Brink’s Global Services

- Texas Precious Metals Depository

- International Depository Services

Read our Birch Gold Group Review to learn more.

Best for Educational Resources

Noble Gold Investments

Noble Gold Investments offers in-depth educational materials and a wide range of investment products. It provides gold, silver, platinum, and palladium coins and bars. This company is especially appealing to new investors seeking guidance in the precious metals market.

Noble Gold is a reliable company and a trusted choice for gold IRA investments, backed by years of industry expertise. What sets them apart (and what I found particularly impressive) is their steadfast dedication to transparency and clarity.

Throughout the process of establishing my IRA and selecting the precious metals, their team provided clear, honest, and detailed explanations of costs, risks, and product specifics. This level of openness is rare and offers significant reassurance for retirement planning.

Their reputation reinforces this dedication. Noble Gold holds an A+ rating from the Better Business Bureau, with numerous reviews echoing the professionalism and transparency I experienced.

They partner with Equity Trust (a prominent gold and silver IRA custodian), and STRATA Trust Company, to ensure the quality and security of their gold products. Additionally, their buyback program offers a straightforward way to liquidate assets when you’re ready to take possession.

Noble Gold offers a wide array of investment-grade precious metals and collectible coins, tailored to various investment objectives. Their offerings include:

- Gold and silver bullion

- Platinum and palladium coins

- American Gold Eagle coins (bullion and proof)

- Uncirculated Gold Buffalo coins

- Australian Kangaroo coins

- Canadian Maple Leaf coins

- Austrian Gold Philharmonic coins

- Rare and collectible coins

Whether your goal is long-term wealth protection or building a diverse, physical asset portfolio, Noble Gold provides options to suit a broad range of financial strategies.

I highly recommend Noble Gold Investments as a company that prioritizes trust, lasting client relationships, and a simplified approach to gold IRA investing.

Pros

- Gold held in your IRA is securely stored at their Texas-based facility, which adheres to top-tier security standards for precious metals IRAs.

- Noble Gold regularly offers incentives and special deals for new customers.

- Their website is packed with educational resources, catering to both new and experienced investors.

- Their buyback program provides flexibility, allowing clients to sell their precious metals when needed.

- The website offers multiple ways for investors to access expert advice and professional support.

Cons

- Does not offer a money back guarantee in case you change your mind shortly after investment.

Why Noble Gold Stands Out

Though relatively new to the industry, Noble Gold distinguishes itself with several standout features that appeal to practical investors:

- Texas-based storage – They are the only company offering IRS-approved storage in Dallas through International Depository Services (IDS).

- Guaranteed Buyback Program – Provides flexibility to sell your metals if your financial needs change.

- “Royal Survival Packs” – Curated bundles of precious metals designed for emergency liquidity or preparedness.

- Robust educational resources – Their materials cater to both newcomers and seasoned investors, empowering confident decision-making.

- Professional coin grading – Partnering with the Numismatic Guaranty Corporation (NGC) to ensure credibility and value.

These offerings make Noble Gold an excellent choice for investors prioritizing accessibility, preparedness, and clear communication.

Customer Experience and Reputation

In my experience, Noble Gold’s customer support is prompt, clear, and genuinely supportive. Their website features accessible tools like live chat, a detailed FAQ section, and a one-click “Call” button that connects you directly to a representative. There is no automated menus or long wait times.

Their online reputation reflects this high standard:

- 4.9/5 from 756 reviews in Google Reviews

- A+ and 4.98/5 rating with the Better Business Bureau (BBB) based on 253 reviews

- 4.9/5 stars on Trustpilot, based on over 744 verified reviews

- 4.9/5 on ConsumerAffairs from 931 reviews

There’s only one complaint on BBB in the past year, which is remarkably low for the industry. These metrics highlight Noble Gold’s dedication to trust, reliability, and exceptional client care.

Fees

Noble Gold isn’t as upfront about their fee structure as Birch Gold Group, but working with them directly gave me a clear picture of the costs involved in opening a gold IRA.

- Annual storage fee: $80 or $150, depending on the chosen storage facility (Texas or Delaware).

Storage

Noble Gold provides secure storage options for IRA-approved gold through International Depository Services (IDS). Investors can choose from trusted locations in Texas, Delaware, or Mississauga, ensuring safe and reliable storage for their assets.

Read our Noble Gold Investments review to learn more.

How Does a Gold IRA Work?

A gold IRA is a self-directed retirement account that lets you invest in physical gold (such as coins or bullion) instead of only traditional assets like stocks, bonds, or mutual funds.

It operates similarly to a Traditional or Roth IRA and has similar rules for contributions and withdrawals. However, it allows you to include physical precious metals (gold, silver, platinum, palladium) in your retirement portfolio.

There are two primary types of gold IRAs:

- Traditional Gold IRA: Contributions might be tax-deductible, but you’ll pay taxes on withdrawals during retirement.

- Roth Gold IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

In addition to physical gold, a gold IRA may hold gold-related investments as well. These include: mining company stocks, exchange-traded funds (ETFs), and mutual funds tied to precious metals. This provides a balance of diversification and the security associated with gold ownership.

What Makes a Gold IRA an Attractive Investment?

I have worked with multiple gold IRA companies and incorporated physical gold into my own retirement portfolio. What I can confidently say is that gold deserves a place in nearly every diversified portfolio.

Here’s why:

- Independent Price Action: Gold moves independently of the stock market, unlike many other investments. When stocks decline, gold often remains stable or even increases in value.

- Protection Against Inflation: As inflation erodes the value of paper money, gold consistently preserves its purchasing power.

- Reliability: Gold doesn’t typically experience dramatic surges, but it also avoids sharp declines. Such price action makes it a steady and trustworthy asset.

- Physical Ownership: In a world of digital investments you can’t hold, owning a physical asset with a centuries-long track record offers a rare sense of security.

From my experience, gold has proven to be resilient during turbulent markets. Even when its value doesn’t climb rapidly, it delivers reassurance as a dependable, long-term anchor for your wealth.

Are gold IRAs a good idea? Well, gold IRAs attract investors seeking a diversified retirement portfolio. As gold prices typically move inversely to paper assets, incorporating a gold IRA offers a hedge against inflation.

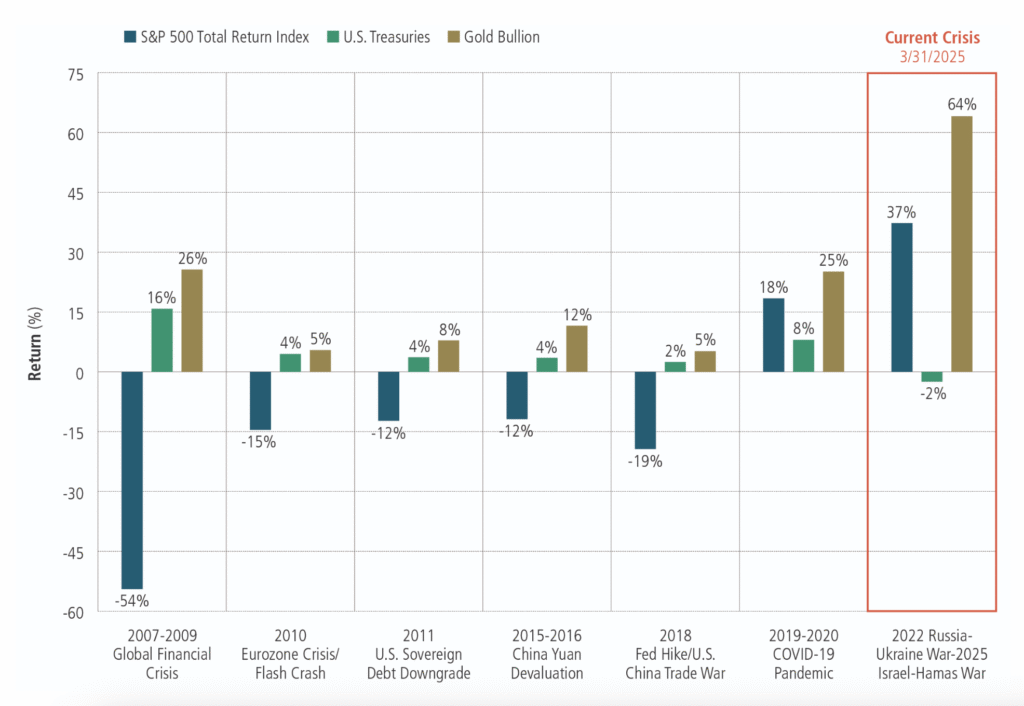

This bar chart compares the performance of S&P 500 Total Return Index (stocks), U.S. Treasuries (bonds), and Gold Bullion (gold) during different financial crises from 2007 to 2025.

The y-axis shows the percentage return (how much the investment gained or lost), and the x-axis lists the crises.

Amid recession risks from U.S. trade policies, the Russia-Ukraine war, and the Israel-Hamas conflict, stocks have fallen 2%, bonds have risen 25%, and gold has surged 64%. Gold typically outperforms during crises, while stocks and bonds often decline or see modest gains.

Read our full guide on pros and cons of a gold IRA if you want to learn about potential challenges and benefits of investing in precious metals for retirement.

Step-by-Step Guide to Opening a Gold IRA

Setting up a gold IRA is straightforward, especially with a trusted provider. To open a gold IRA, you’ll typically need a completed gold IRA application form, a self-directed IRA agreement, and a funding request or rollover/transfer paperwork.

Drawing from my experience assisting others, here’s a clear guide to the process:

1. Complete the Application

Provide personal information, including proof of identity and your Social Security number. You may also need to designate a beneficiary for your account. The initial setup usually takes 10–15 minutes.

2. Fund Your Account

Your custodian will guide you through the process to ensure compliance with IRS rules, helping you avoid any penalties. You can fund your Gold IRA through:

- A direct cash contribution;

- A rollover from a 401(k) or other employer-sponsored plan;

- A transfer from an existing IRA.

3. Choose Your Gold

Once your account is funded, select IRS-approved gold (typically 99.5% purity or higher). Your custodian or advisor can assist in picking options that align with your financial goals and risk tolerance.

Full processing (including funding and gold acquisition) depends on the custodian and funding method but generally completes within a few business days.

4. Arrange Secure Storage

Your custodian will coordinate the shipment and insured storage of your gold at an IRS-approved depository. Some providers offer flexibility in choosing a storage location, which can be appealing if you prefer a facility closer to home.

Read our in-depth guide on how to convert your IRA to a gold IRA if you want to learn more about the whole process.

Things to Consider When Choosing a Gold IRA Company

Selecting the right Gold IRA provider is critical for a smooth and secure investment experience. Having guided friends, clients, and colleagues through this process, I’ve identified the essential elements to prioritize when evaluating your options:

Reputation and Accreditations

Always read Google Reviews and verify a company’s standing with trusted organizations like the Better Business Bureau (BBB), Business Consumer Alliance (BCA), and Trustpilot.

High ratings and reviews on websites like BBB and Trustpilot are especially hard to fabricate. Therefore, positive reviews on these platforms reflect reliability and client satisfaction. Steer clear of companies with unresolved complaints or low scores.

Storage Facilities

Storage quality matters. Opt for companies that partner with IRS-approved depositories offering fully segregated custodial storage, rather than commingled or bank-style setups.

These facilities should feature top-tier security, comprehensive insurance, and regular third-party audits to ensure your assets are protected.

Clear Fee Structure

To avoid unexpected costs, select a gold IRA rollover company with a straightforward, flat annual fee. The average annual gold IRA fee is around $250.

It’s better to avoid companies that scale fees with your account size. Some top companies sweeten the deal by waiving fees for the first year or two, which can ease the initial investment burden.

Customer Support

Look for a company that takes the time to explain your precious metals investment options clearly, answers questions patiently, and avoids high-pressure sales tactics. You want a team that feels like a trusted partner, committed to your long-term success rather than just closing a deal.

Top-Rated Gold IRA Companies: Summary

- Best Gold IRA Company Overall: Augusta Precious Metals

- Best for Beginners: Goldco

- Best for Lowest Fees: American Hartford Gold

- Best for Educational Resources: Noble Gold Investments

- Best for Fee Transparency: Birch Gold Group

Conclusion

If you’ve made it this far, you’re already taking proactive steps toward securing your financial future. That’s something to be proud of! Selecting the right gold IRA company is a critical decision that can significantly impact your long-term wealth.

From my personal experience, Augusta Precious Metals stands out as the best company for a gold IRA. It offers exceptional service, clear pricing, and dependable support that’s hard to find in the industry. However, the best company for you will depend on your specific financial goals and portfolio size.

I encourage you to carefully evaluate fees, storage solutions, product offerings, and the quality of personalized guidance each company provides. These factors can greatly influence both your experience and your investment outcomes.

I hope this guide has given you a clearer understanding of your options and the confidence to take the next step. If you need help navigating your choices or deciding what’s next, I’m here to offer guidance and point you toward the right path.