Birch Gold Group Review

In our in-depth Birch Gold Group review, we cover fees, customer experiences, reputation, and more. Use our comprehensive insights to make an informed decision about your gold investment.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

During times of economic uncertainty, savvy investors turn to precious metals like gold, which have a safe-haven status and tend to retain their value or even appreciate when traditional markets falter.

In recent years, diversifying your portfolio with precious metals has become an increasingly popular strategy for securing financial stability.

However, navigating the investment process to gain exposure to gold through a gold IRA requires careful consideration. One of the most important steps in this process is selecting a reliable gold IRA company to work with.

Birch Gold Group has over two decades of experience in the industry and positions itself as one of the leaders in this space.

Birch Gold ranks #5 on our list of the best gold companies in the U.S. and has earned a reputation for providing exceptional customer service, transparent pricing, and a wide range of investment options.

This review explores Birch Gold Group’s offerings, processes, strengths, and potential drawbacks, drawing from extensive research and user experiences to help you decide if it’s the right fit for your investment goals.

Pros and Cons

| Birch Gold Group Pros | Birch Gold Group Cons |

|---|---|

| Established Track Record: Over 22 years with trusted industry partnerships. | Not Transparent Pricing: Investors must call for updated price quotes. |

| Diverse Products: Gold, silver, platinum, and palladium bullion coins and bars, as well as premium exclusives like the Britannia series. | Higher Premium Markups: Some reviews allege markups on premium coins are excessive. |

| Clear Fees and Promotions: Flat fees and offers like $10,000 free silver, with waivers on larger investments. | Sales and Service Complaints: Occasional issues reported with sales tactics and responsiveness. |

| Great Reputation Online: High ratings and positive endorsements support company’s reliability. | No Online Purchases: All transactions require specialist interaction, which may feel outdated. |

| Extensive Educational Resources: Expert interviews, market reports and educational videos. | No Storage for Non-IRA Metals: Investors must arrange storage independently for precious metals outside a gold IRA. |

| Reliable Buyback Program: Ongoing support and fair buyback options. | |

| Low Minimum Investment: Starts at $10,000, lower than many competitors. |

Interested in gold investments? Download a free gold IRA guide from Birch Gold Group and learn how a gold IRA can help protect your assets from inflation and market volatility.

Overview of Birch Gold Group

Founded in 2003 by Canadian-born entrepreneur Laith Alsarraf, Birch Gold Group is one of the longest-standing precious metals dealers in the United States.

Initially headquartered in Burbank, California, the company now operates from Des Moines, Iowa, with a focus on helping individuals protect their retirement savings through physical precious metals.

Over the years, Birch Gold has assisted over thirty thousand customers in opening gold IRAs, emphasizing transparency, education, and personalized service. With approximately 58 employees and annual revenues around $18.9 million, Birch Gold demonstrates stability and scale in a highly competitive industry.

Birch Gold’s legitimacy is bolstered by its high-profile endorsements from conservative influencers and political figures, including Ben Shapiro, former Senator Ron Paul, Donald Trump Jr., Ben Shapiro, Steve Bannon, and many others.

As of 2025, Birch Gold Gold Group also maintains strong accreditations, including an A+ rating from the Better Business Bureau (BBB), AAA from the Business Consumer Alliance, and excellent scores on platforms like Trustpilot and Google.

The company partners with trusted gold IRA custodians (Equity Trust, Goldstar Trust, STRATA Trust Company) and depositories (Delaware Depository, Brink’s Global Services), ensuring compliance with IRS regulations for precious metals IRAs.

Despite occasional criticisms, Birch Gold’s longevity and positive track record affirm its status as a legitimate gold IRA company in the metals market.

Precious Metals Products Offered by Birch Gold

Birch Gold Group caters to a broad audience of investors by offering a wide range of precious metals and comprehensive services designed to simplify diversification.

The company’s product inventory includes IRS-approved gold, silver, platinum, and palladium in various forms to suit different investment strategies. Key offerings include:

- Gold: American Buffalo coins (1 oz, ½ oz, ¼ oz), bars and rounds (1/10 oz, ¼ oz, ½ oz), and the new 1/3 oz Gold Britannia Coin.

- Silver: American Eagle (bullion and proof), Canadian Maple Leaf, bars and rounds (1 oz, 5 oz, 10 oz, 100 oz).

- Platinum: American Eagle coins, bars, and rounds.

- Palladium: Canadian Maple Leaf coins, bars, and rounds.

Birch Gold’s website doesn’t list specific prices, so you need to contact a specialist for the latest quotes — a practice they’ve continued from previous years.

Investors can choose between standard bullion coins and premium or semi-numismatic coins. Bullion coins are high-purity (99.99%) and priced close to spot, while premium coins carry higher markups due to limited mintage and collectible value.

For instance, the new Britannia and Liberty series falls into the premium category, potentially appealing to those seeking scarcity-driven appreciation. These metals are available for direct physical purchase or inclusion in a self-directed IRA, allowing tax-advantaged growth.

As of 2025, Birch Gold Group continues to innovate and adapt to market demands. The company has introduced exclusive new products, such as the world’s first 1/3 oz Gold Britannia Coin, available solely through Birch Gold for gold IRAs.

This coin represents a historic collaboration between the U.S. Mint and The Royal Mint, celebrating transatlantic ties. Additionally, the Britannia and Liberty series features new gold and silver coins designed jointly by the sovereign mints of the U.S. and U.K., offering investors unique collectible options with potential for appreciation.

Retirement Account Rollover Assistance

One of Birch Gold’s standout services is its seamless rollover support for converting traditional retirement accounts into precious metals IRAs. Eligible accounts include Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, 401(k)s, 403(b)s, 457s, and TSPs.

A dedicated precious metals specialist handles the paperwork, ensuring no tax penalties or complications. This hands-on approach is particularly beneficial for first-time investors unfamiliar with IRS rules, distinguishing Birch from competitors that may offer less guidance.

Bonus Offer: When you make a new purchase of eligible precious metals (whether for an IRA or physical delivery) Birch Gold Group may add up to $10,000 in free metals to your order. The exact bonus depends on how much you buy, and not all purchases will qualify (minimum purchase required).

For IRA accounts, any bonus metals will be added directly to your IRA. For full details, including terms, limitations, and exclusions, click here.

Buyback Program

Birch Gold’s buyback service allows clients to liquidate holdings at competitive market rates, with specialists providing real-time quotes. This feature enhances liquidity, giving investors flexibility to sell back metals without hassle.

Storage Facilities

Secure storage is critical for IRA compliance, and Birch Gold partners with reputable, IRS-approved depositories:

Delaware Depository is a storage facility that provides secure, insured storage solutions for precious metals in individual retirement accounts. It has locations in Wilmington, DE, and Seal Beach, CA, and offers up to $1 billion in all-risk insurance coverage.

International Depository Services (IDS) is a storage facility that caters to both individual and institutional investors, including IRA custodians. IDS offers segregated metals storage, quick processing, and cost-effective rates, with locations in Wilmington, DE, and Seal Beach, CA.

Brink’s Global Services is renowned for its worldwide security expertise and operates depositories in New York City, NY, Los Angeles, CA, and Salt Lake City, UT. It offers both segregated and commingled storage for gold IRA assets.

Texas Precious Metals Depository is one of the state’s largest precious metals storage sites by capacity and asset value. Established in 2018, the Texas depository now serves personal investors, IRA accounts, and institutions, offering the most advanced security measures.

Customers can select a facility based on proximity or preference, with all options providing insured, segregated storage.

For non-IRA purchases, investors must arrange their own storage, such as home safes or bank deposit boxes, though Birch advises against home storage for security reasons.

Birch Gold Group Reviews

Birch Gold enjoys predominantly positive feedback, with thousands of reviews across platforms as of mid-2025. Updated ratings reflect continued satisfaction, though isolated complaints persist.

Birch Gold Group’s Better Business Bureau (BBB) profile boasts an A+ rating, with customers awarding 4.5 out of 5 stars across 197 reviews. On Google Reviews satisfaction customer satisfaction score is even stronger, earning a 4.8 out of 5 rating from over 370 verified customers.

Interested in gold investments? Download a free gold IRA guide from Birch Gold Group and learn how a gold IRA can help protect your assets from inflation and market volatility.

Positive testimonials often highlight seamless rollovers and educational support, as seen in BBB reviews and testimonials on Trustpilot sharing 5-star experiences.

Here’s a brief overview of Birch Gold Group reviews and ratings across the web:

- 4.7 based on 383 review in Google Reviews

- A+ and 4.53/5 on BBB (Better Business Bureau), with 197 customer reviews

- 5.0/5 rating on ConsumerAffairs, based on over 172 reviews

- 4.5/5 on Trustpilot, supported by 217 verified reviews

- 5-star rating on TrustLink according to 135 reviews

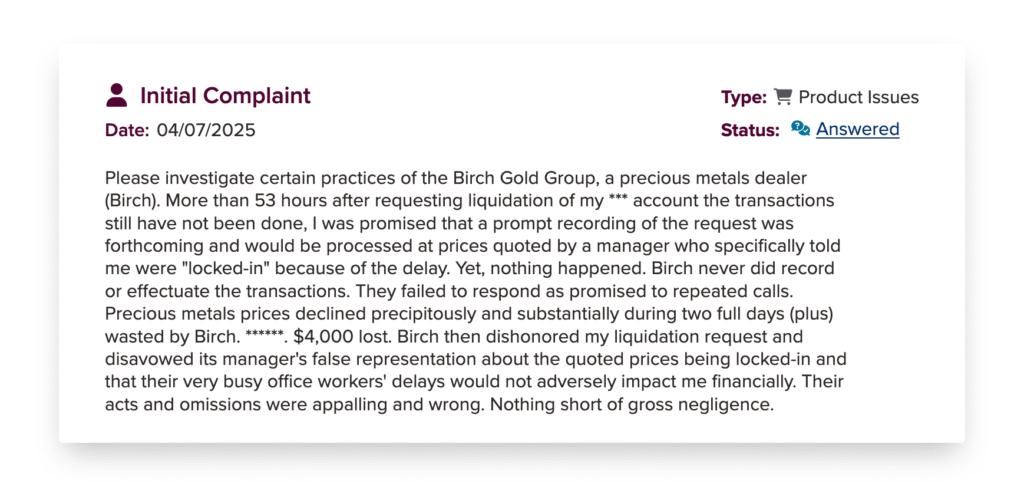

Birch Gold Group complaints, though rare, center on high-pressure sales, premiums on “rare” coins that underperform expectations, or slow customer support. Company resolves most issues promptly, maintaining its A+ BBB status.

There have been only two registered complaints on the Better Business Bureau in the past year, which attests to Birch Gold Group’s dedication to customer support. From my own experience dealing with the company, Birch Gold’s team strives to resolve all issues personally to avoid public negative reviews.

Birch Gold Group Fees and Costs

Birch Gold prides itself on a transparent, flat-fee structure, avoiding asset-based percentages for most clients using preferred custodians. The minimum investment remains $10,000, accessible for many investors.’

| First-Time Fees | Annual Fees |

|---|---|

| Account setup fee: $50 | Storage and insurance fees: $100 |

| Wire transfer fee: $30 | Account management fee: $100 |

| Total: $70 | Total: $200 per year, flat rate. |

First-year fees are waived for investments over $50,000, and 2025 promotions include up to $10,000 in free silver. However, product pricing involves markups over spot prices, especially for premium coins, which some reviews criticize as high.

Delivery charges for non-IRA purchases are not disclosed online. You will have to consult a Birch Gold Group’s specialist for full details. Always factor fees into your overall strategy, as they impact net returns.

How to Open a Birch Gold IRA

The process is specialist-driven, ensuring personalization and compliance. Here’s a detailed step-by-step breakdown:

1. Contact a Specialist and Request Information: Begin by requesting a free gold IRA kit online to receive detailed guidance on how to roll over your existing retirement account into a gold-backed IRA, along with information about the benefits, risks, and approved precious metals options.

2. Select Funding Source: Decide on cash funding (minimum $10,000) or rolling over from an existing retirement account. Your specialist ensures tax-free transfers, explaining any implications.

3. Choose Your Precious Metals: Review Birch Gold’s products and pick the ones that suit your investment appetite. The specialist offers tailored advice based on market conditions, your risk profile, and diversification objectives.

4. Review and Purchase: Finalize selections, confirm pricing (which includes premiums), and complete payment via wire transfer or check. Note that online purchases are not supported; all transactions are specialist-assisted.

5. Select Storage: Choose from partnered depositories for secure delivery and storage.

6. Ongoing Monitoring and Support: Post-setup, your specialist provides regular updates on asset values, market insights, and buyback options, fostering long-term relationships.

This structured approach minimizes errors and builds confidence, though the lack of online autonomy may frustrate tech-savvy users.

Customer Education at Birch Gold Group

Education remains a core pillar of Birch Gold’s philosophy. The website acts as a robust learning platform with resources like:

- Articles on the benefits of physical gold and precious metals IRAs, why advisors might overlook them, and spotlights on items like Proof American Eagles.

- Guides to purchasing metals, IRA overviews, and home storage considerations.

- Interactive historical price charts, weekly market updates, and a newsletter.

- Interviews with experts like Steve Forbes and Peter Schiff.

This wealth of information empowers clients to align investments with personal goals and risk tolerances, a rarity in an industry often criticized for opacity.

Alternatives to Birch Gold Group

While Birch Gold excels in customer education and product variety, some alternative companies may better suit specific needs. Preserve Gold, mentioned in related reviews, focuses on silver-heavy portfolios.

If you’re willing to invest $50,000 or more, Augusta Precious Metals offers lifetime support, lower fees, and expert rollover guidance.

The company charges zero management fees and has earned thousands of 5-star reviews, along with endorsements from respected media like Investopedia, Morningstar, Forbes, and others.

Goldco is another highly rated option if you’re looking to open a gold IRA. The company holds an A+ rating from the Better Business Bureau and has partnerships with Sean Hannity, Chuck Norris, Dennis Quaid, and other well-known conservative figures.

Goldco doesn’t have a minimum investment requirement, making it a flexible choice no matter how much you plan to invest. It also offers a simple three-step process to set up a gold IRA, with personalized support provided throughout.

American Hartford Gold has a lot in common with Birch Gold Group. The company offers strong educational materials and has the same $10,000 investment minimum.

However, if you want to get the most from your investment, American Hartford Gold is currently running a promotion that lets you receive up to $15,000 in free silver on qualifying purchases.

Conclusion

Birch Gold Group is a legitimate gold IRA company and reliable education-focused partner for precious metals investing. Its transparent fees, specialist guidance, and commitment to customer growth make it an excellent choice for diversifying retirement portfolios with precious metals.

Ready to take the first step? Request a free gold IRA guide from Birch Gold Group to connect with their support team and explore how their gold IRA works.

Remember that past price action of gold doesn’t guarantee future returns. Invest cautiously and avoid overexposing yourself to a single asset class. Good luck!