GoldenCrest Metals Review

This in-depth review of GoldenCrest Metals covers company’s products, fees, customer service, and how it compares to other precious metals IRA companies.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

When prices are rising alongside growing government debt, people look for ways to protect their capital from currency devaluation.

That’s where gold IRAs come in. They let you hold physical gold and silver inside a tax-advantaged retirement account, giving your portfolio a layer of stability when the economy looks shaky.

One gold IRA company getting a lot of attention in this space is GoldenCrest Metals. Being a newer and lesser-known player in the market, GoldenCrest has quickly built a reputation as a gold IRA company for retirement savers who want a clear, no-nonsense path into precious metals.

In our GoldenCrest metals review, we’ll dig into what the company offers, how it compares to the competition, and whether it might be the right fit for your long-term goals. Let’s get started!

Pros and Cons

| GoldenCrest Metals Pros | GoldenCrest Metals Cons |

|---|---|

| Transparent and competitive pricing: No hidden markups or overpriced coins. | Relatively new to the market: Founded in 2023, GoldenCrest lacks the decades-long track record of some competitors. |

| Strong fee promotions: Up to ten years of IRA fees covered for qualifying accounts. | Smaller scale: Doesn’t yet have the same national brand recognition as larger, more established gold IRA companies. |

| Wide selection of recognized coins: All metals are widely traded and valued in the open market. | Limited product diversification: Focuses exclusively on gold and silver, with narrower selection of platinum and palladium options. |

| Reliable buyback program: Customers can liquidate holdings at competitive rates. | |

| Endorsed by high-profile celebrities: Michael Savage and Kevin Harrington’s endorsements add credibility. | |

| Backed by private equity: This financial backing helps ensure liquidity to honor the company’s buyback policy. | |

| Customer-first approach: Emphasis on education and straightforward service. | |

| No pressure sales: Potential customers can call, ask questions, and explore options without being pushed into making a decision. | |

| Boutique service: Despite being large enough to handle high volume, GoldenCrest takes a boutique approach. The CEO personally calls customers to confirm they’ve had a five-star experience. In many cases, he even shares his personal cell phone number. |

Download a free precious metals IRA guide from GoldenCrest Metals to learn how physical gold can protect your savings from inflation and economic uncertainties.

Company Background

GoldenCrest Metals was founded in 2023 by CEO Rich Jacoby and a leadership team with over 20 years of combined experience in the precious metals industry. The company is headquartered in Calabasas, California, at 23901 Calabasas Rd, Suite 2002, Calabasas, CA 91302.

GoldenCrest Metals was built around a simple mission: to give retirement savers a transparent, customer-first alternative in a market often criticized for high-pressure sales tactics and overpriced “exclusive” coins.

Jacoby and his team emphasize honesty, education, and accessibility. Rather than overwhelming customers with jargon or aggressive pitches, GoldenCrest focuses on making the process of setting up a gold IRA straightforward and approachable.

With its educational approach and clear pricing, GoldenCrest is positioning itself as a trusted partner for retirement savers who want to add stability to their portfolios through physical gold and silver. The company provides step-by-step guidance throughout the rollover or transfer process for all gold IRA customers.

Its commitment to customer education and service excellence has earned recognition from conservative financial media outlets, independent ranking sites, and even a few celebrity endorsements.

The only real drawback is that GoldenCrest is a newer player compared to companies that have been around for decades.

GoldenCrest Metals partners with Entrust Group as their preferred gold IRA custodian and utilizes Delaware Depository, one of the industry’s most reputable storage facilities.

If you choose to work with GoldenCrest, your gold IRA will be managed by Entrust Group, and your assets will be securely stored at Delaware Depository, fully insured and protected.

Products & Services Offered by GoldenCrest

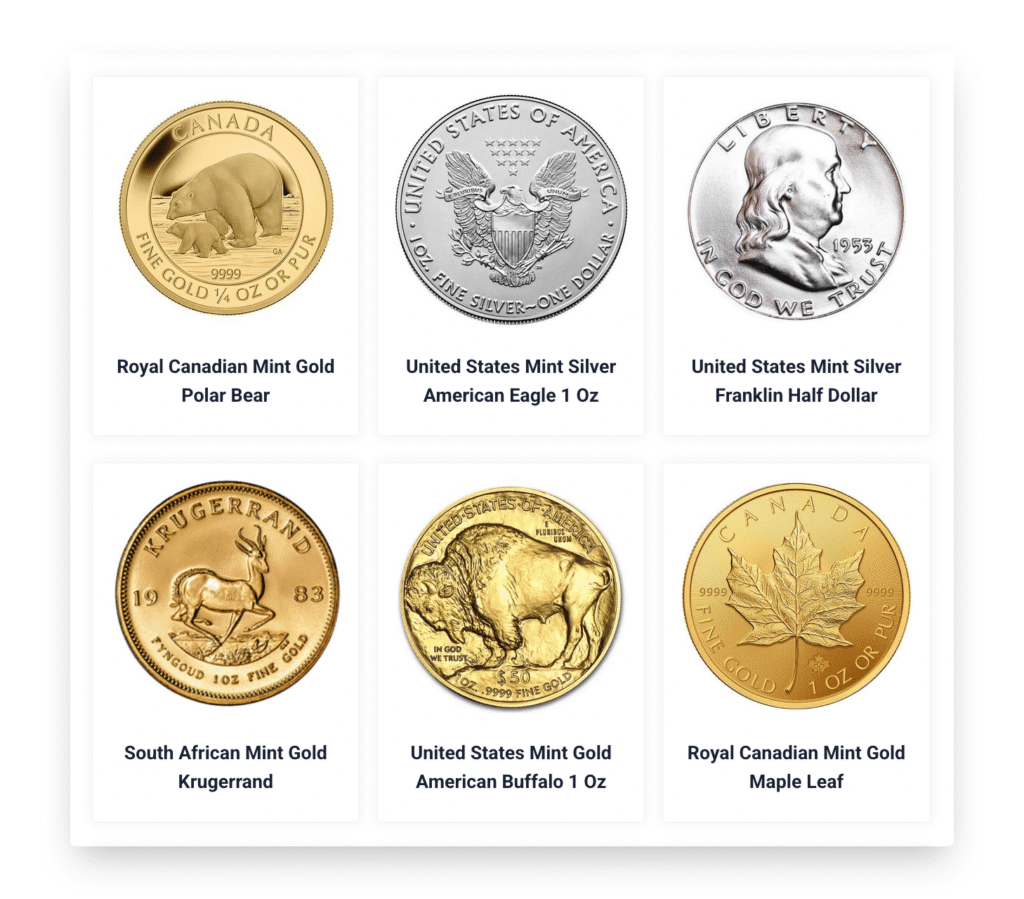

GoldenCrest Metals offers a broad selection of both bullion bars and coins, but with one important distinction: every coin they sell is widely recognized and traded in the open market.

Unlike many popular precious metals IRA companies, GoldenCrest Metals does not offer a wide variety of platinum or palladium products, focusing exclusively on gold and silver.

Even though the company’s primary focus is on gold and silver IRAs, customers can also choose to have metals delivered for direct ownership outside of retirement accounts.

The minimum investment for both direct purchases and gold IRAs is $10,000. However, to unlock added benefits (such as a 10% silver rebate, free insured shipping, and complimentary storage) a recommended investment amount is $25,000 or more.

- Free Silver: The 10% Silver Rebate is GoldenCrest Metals’ key promotion for IRA rollovers or purchases of $25,000+, giving 10% of your investment value back as physical silver (e.g., $2,500 on $25,000; up to $25,000 max on $250,000+). It doesn’t apply to $10,000 cash purchases.

- Complimentary Storage: Free secure storage in an approved vault, with the duration increasing by investment size:

- $25,000+: 1 year

- $50,000+: 2 years

- $100,000+: 3 years

- $250,000+: 5 years

- Free Insured Shipping: Covers the cost of securely delivering your metals to an IRS-approved depository or your chosen location. Included starting at $25,000 for IRAs.

GoldenCrest Metals upholds high ethical standards and doesn’t push “exclusive” or private-label coins with inflated markups.

The company sticks to metals that actually hold value beyond the company’s customer base. This makes it easier for retirement savers to buy with confidence, knowing they’re getting assets that can be sold or traded elsewhere without issue.

Gold Coins Available

| Coin Name | Mint/Country | Weight | Purity | Key Details |

|---|---|---|---|---|

| United States Mint Gold US BU Proof $5 | United States Mint | Same as $5 Liberty/Indian Gold (approx. 0.2419 oz pure gold) | 90% | Replica of historic $5 coins, produced since 1986 to celebrate U.S. history. |

| United States Mint Gold US BU Proof $10 | United States Mint | 0.48375 oz pure gold | 91.67% | American Gold Eagle, first U.S. gold coins minted since 1933, available in Proof and Uncirculated versions from 1984. |

| Proof Gold American Eagle 1/2 Oz | United States Mint | 0.5 oz | .9167 fine | Features Augustus Saint-Gaudens’ Liberty design; comes with certificate of authenticity. |

| Gold American Buffalo 1 Oz | United States Mint | 1 oz | .9999 fine | First .9999 fine gold bullion coin from U.S. Mint, issued in 2006. |

| Gold Philharmonic 1 Oz | Austrian Mint | 1 oz | .9999 fine | Popular European bullion coin; multiples of 10 in mint tubes. |

| Gold Krugerrand | South African Mint | 1 oz | .9167 fine | World’s first modern bullion gold coin; highly popular for investment. |

| Gold Gyrfalcon | Royal Canadian Mint | 0.25 oz | .9999 fine | Features design by Steve Hepburn depicting the gyrfalcon; bullion coin. |

| Gold Arctic Fox | Royal Canadian Mint | 0.25 oz | .9999 fine | Design by Maurice Gervais showing Arctic fox in habitat. |

| Gold Polar Bear | Royal Canadian Mint | 0.25 oz | .9999 fine | Obverse with Queen Elizabeth II; protective packaging. |

| 1933 St. Gaudens Gold Double Eagle | United States Mint | 0.9675 oz | .900 fine | Historic collectible coin that circulated over 80 years ago. |

Silver Coins Available

| Coin Name | Mint/Country | Weight | Purity | Key Details |

|---|---|---|---|---|

| Silver American Eagle 1 Oz | United States Mint | 1 oz | .999 fine | Most popular bullion coin worldwide; beautiful design for investment. |

| Proof Silver American Eagle 1 Oz | United States Mint | 1 oz | .999 fine | Proof version with heraldic eagle reverse; eligible for IRAs. |

| Morgan Silver Dollar | United States Mint | 0.7734 oz pure silver | 90% | Comes in protective packaging; multiples in tubes or bags. |

| Silver Franklin Half Dollar | United States Mint | 0.3617 oz pure silver | 90% | Circulated or BU; classic U.S. half dollar design. |

| Silver Kennedy Half Dollar BU 1964 | United States Mint | 0.3617 oz pure silver | 90% | One-year-only 90% silver composition; Brilliant Uncirculated. |

| Silver Maple Leaf | Royal Canadian Mint | 1 oz | .9999 fine | Features MintShield™ technology to reduce white spots; highly beautiful. |

| Silver Arctic Fox | Royal Canadian Mint | 1.5 oz | .9999 fine | Unique size; continues RCM’s tradition of high-quality silver products. |

| Silver Polar Bear | Royal Canadian Mint | 1.5 oz | .9999 fine | Multiples of 15 in tubes; protective packaging for others. |

| Silver Gyrfalcon | Royal Canadian Mint | 1.5 oz | .9999 fine | Design by Steve Hepburn capturing the gyrfalcon in flight. |

Unfortunately, GoldenCrest Metals doesn’t list gold and silver bars on its product page. However, I reached out to customer support, and they confirmed that these products are available upon request.

Gold Bars Available

GoldenCrest Metals offers a variety of gold bars, sourced from trusted refiners. These are IRA-eligible (99.99% purity minimum) and available in sizes from 1 gram to 1 kilogram, ideal for larger investments or cost efficiency.

| Gold Bar Name | Refiner | Weight | Purity | Key Details |

|---|---|---|---|---|

| Credit Suisse Gold Bar | Credit Suisse | 1 oz | .9999 fine | Swiss-refined with assay card for authenticity; highly liquid and stackable. |

| Perth Mint Gold Bar | Perth Mint (Australia) | 1 oz | .9999 fine | Government-guaranteed purity; secure packaging with serial number. |

| Valcambi Gold Bar | Valcambi Suisse | 1 oz, 10 oz | .9999 fine | Swiss quality; CombiBar option for easy division into smaller units. |

| Johnson Matthey Gold Bar | Johnson Matthey (UK) | 1 oz, 100 oz | .9999 fine | Renowned refiner; excellent for bulk storage with assay certification. |

Silver Bars Available

Silver bars are also available upon request, focusing on .999 or .9999 purity for IRA eligibility. Sizes range from 1 oz to 100 oz, offering affordability for stacking.

| Silver Bar Name | Refiner | Weight | Purity | Key Details |

|---|---|---|---|---|

| Highland Mint Silver Bar | Highland Mint | 5 oz, 10 oz | .999 fine | Stackable design for easy storage; cost-effective for mid-sized investments. |

| Royal Canadian Mint Silver Bar | Royal Canadian Mint | 10 oz, 100 oz | .9999 fine | Government-backed; tamper-evident packaging with security features. |

| Sunshine Minting Silver Bar | Sunshine Mint | 1 oz, 100 oz | .999 fine | Innovative MintGuard technology (hidden security assay); highly recognizable. |

In addition to their product lineup, GoldenCrest emphasizes education and transparency. Their team takes the time to explain the difference between spot price and premiums, how storage works, and what to expect over the long term. No high-pressure sales tactics that have given parts of the industry a bad reputation.

GoldenCrest Metals Reviews and Reputation

GoldenCrest Metals has quickly built a reputation for being approachable, transparent, and customer-focused. Online feedback and customer reviews highlight how easy it is to get questions answered without high-pressure tactics.

This is something that sets GoldenCrest Metals apart in an industry where aggressive sales calls are unfortunately too common.

Download a free precious metals IRA guide from GoldenCrest Metals to learn how physical gold can protect your savings from inflation and economic uncertainties.

At the time of this writing GoldenCrest Metals review, the company has a pristine 5-star average score on sites like Google and the Better Business Bureau.

- 5/5 based on 18 reviews in Google Reviews

- A+ rating from the Better Business Bureau (BBB) and 5/5 based on 5 reviews

- 4.3/5 from 8 reviews on Trustpilot

According to the majority of GoldenCrest Metals reviews, the company’s representatives are known for their extensive customer education efforts.

The GoldenCrest team takes care to guide retirement savers through every detail of setting up a gold IRA (explaining fees, storage options, and the differences between various coins in plain language).

This educational approach helps customers feel confident about their decisions rather than rushed into them. As a result, GoldenCrest Metals has no recorded complaints to date.

While GoldenCrest doesn’t yet have the decades of name recognition held by more established competitors, the consistency of early customer feedback suggests it’s well on its way to becoming one of the most trusted names in the gold IRA space.

GoldenCrest Metals Fees

One of GoldenCrest’s biggest advantages is its clear and competitive fee structure. Setting up a gold IRA with the company involves two trusted partners:

- Custodian: Entrust Group, which charges an annual $125 account maintenance fee.

- Depository: Delaware Depository, one of the most established names in the industry, charging an annual storage fee of just $125.

GoldenCrest itself does not charge any direct fees for gold IRAs and instead earns revenue from a small spread on the precious metals you purchase.

As mentioned earlier, GoldenCrest covers up to 10 years of free storage for qualifying accounts (tiered by investment: e.g., 1 year at $25K+, up to 10 years at higher tiers), plus free shipping and a free silver coin with rollovers. This can save $1,000+ annually vs. competitors.

How to Open a Gold IRA With GoldenCrest Metals

The setup process itself is designed to be straightforward. GoldenCrest’s team walks customers through the transfer or rollover of retirement funds into a self-directed IRA, ensures all paperwork is compliant.

1. Request Initial Consultation

Request a free gold IRA guide to learn about GoldenCrest’s way of doing business, as well as pros and cons of investing in gold to see if it’s right for you.

A company representative will contact you to help with any questions you may have, discuss your financial goals, and assist in selecting the right custodian if needed.

2. Open Your Self-Directed IRA

GoldenCrest will provide you with a few forms to fill to open a gold IRA with their partner (Entrust Group) to set up an IRS-compliant account. Provide necessary identification, designate beneficiaries, and await approval before funding can begin.

3. Fund Your Account

Transfer the money from your current 401(k) or IRA tax-free with GoldenCrest’s professional guidance. Your dedicated precious metals specialist will coordinate all steps to make it quick and compliant.

For 401(k)s from former employers, request a direct rollover. For existing IRAs, opt for a trustee-to-trustee transfer.

4. Choose Your Metals

Select IRA-eligible coins and bars that you’d like to include in your portfolio. Focus on highly liquid options that meet IRS purity standards (e.g., .995+ for gold), such as American Gold Eagles or Canadian Maple Leafs. Confirm selections with your custodian to ensure approval.

5. Secure Storage

Ship your precious metals to Delaware Depository (segregated, fully insured storage facility by Lloyd’s of London). Your custodian will arrange shipping, insurance, audits, and regular reporting for secure, compliant storage.

Ongoing

Access account monitoring and buyback support. Review your account annually, rebalance as markets or goals change, and utilize GoldenCrest’s lifetime support for adjustments or liquidations.

GoldenCrest’s Buyback Program

Liquidity is one of the biggest concerns retirement savers have when it comes to precious metals. GoldenCrest Metals addresses this with a straightforward buyback program that allows customers to sell their gold or silver back to the company at competitive market rates.

There are no additional fees to sell your precious metals back to GoldenCrest. Repurchases are made at the spot price, with only a small spread. For the exact spread percentage, be sure to request written details during your consultation.

Customers don’t have to worry about being locked into overpriced coins with no real resale market. Every bullion and premium coin they sell is highly liquid and valued with investors worldwide. This helps ensure fair pricing on both the purchase and resale side.

This clear and reliable buyback policy gives retirement savers peace of mind, knowing that if they need to liquidate part of their holdings in the future, GoldenCrest has a system in place to make it simple.

Alternatives to GoldenCrest Metals

The gold IRA industry has several well-established players, each with its own strengths and weaknesses. Here’s how GoldenCrest Metals stacks up against some of the best-known names.

Augusta Precious Metals is a widely acclaimed gold IRA company for its educational approach and premium customer service. However, it has drawn criticism for its high $50,000 account minimum, which can place it out of reach for many gold investors.

GoldenCrest offers a much lower entry point, allowing customers to open a new gold IRA with as little as $10,000.

Birch Gold Group is one of the most reputable gold IRA companies with a strong presence in the industry since 2003 and strong brand recognition. The company offers a wide range of products and competitive fees.

However, GoldenCrest often stands out when it comes to promotions and fee coverage, offering up to ten years of fees covered for qualifying accounts.

Goldco is one of the most recognized names in the industry, known for its strong brand presence and extensive advertising across television and online media.

It has earned endorsements from well-known figures such as Sean Hannity, Tom Selleck, Dennis Quaid, and others. Goldco requires a higher investment minimum of $25,000 and is geared towards wealthy investors.

GoldenCrest sets itself apart by prioritizing customer service, transparent pricing, and a more generous fee coverage program. It places less emphasis on marketing and more on long-term value for clients.

While GoldenCrest may not have decades of history behind it, its combination of fair pricing, strong liquidity, and customer-first service places it on par with more established competitors.

If you want to discover more gold IRA companies, you can check out our gold IRA company ratings and comparisons.

Who Should Choose GoldenCrest Metals?

According to my evaluation, GoldenCrest Metals is a strong fit for retirement savers who want simplicity, transparency, and peace of mind when diversifying with precious metals. However, I think it’s particularly well-suited for:

- Retirement savers wary of high-pressure sales: GoldenCrest’s no-pressure approach makes it easy to ask questions and learn before committing.

- Buyers who value transparency: With no gimmicky “exclusive” coins or hidden fees, customers know exactly what they’re paying for.

- Those seeking cost savings: Up to ten years of IRA fees covered is a standout promotion that can save thousands over time.

- Conservative planners who value liquidity: The company’s private equity backing and straightforward buyback program ensure that metals can be sold when needed.

- Newcomers to gold IRAs: GoldenCrest’s educational focus and hands-on guidance make it a comfortable entry point for first-time buyers.

If you’re looking for a clear, customer-first alternative in a crowded gold IRA market, GoldenCrest Metals offers a compelling option.

Next Steps

GoldenCrest Metals has quickly positioned itself as one of the most retirement-friendly gold companies in the market. The company offers transparent pricing, widely recognized coins, and a no-pressure sales environment. This combination of qualities is surprisingly rare in an industry known for high markups and outright gold IRA scams.

GoldenCrest offers strong promotions, including up to ten years of IRA fees covered, along with a reliable buyback program backed by private equity. It’s easy to see why the company is gaining momentum with retirement savers.

Claim your free gold IRA guide from GoldenCrest today to get started. No obligation, just expert insights to help you protect your retirement savings.

While the company doesn’t yet have the decades-long track record of some larger competitors, its focus on education, customer service, and liquidity makes it a safe choice for anyone considering a gold IRA in 2025.