How to Open a Gold IRA and Invest in Precious Metals

Learn how to start a gold IRA to protect your retirement with precious metals. This guide simplifies choosing a reliable gold IRA company, selecting a trusted custodian, funding your account, and picking IRS-approved metals for tax-advantaged growth.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

As the chance of a recession keeps rising, more Americans are seeking ways to safeguard their finances and assets from potential declines. This concern hits especially hard for those with retirement savings in tax-advantaged accounts like IRAs and 401(k)s.

With tens of thousands, or hundreds of thousands of dollars invested, keeping these funds secure is a big priority. Many investors turn to gold and precious metals as a way to keep their money safe amidst uncertain times, and investing in a gold IRA may help.

What is a Gold IRA?

A gold IRA is a retirement account that holds physical gold coins or bars. Sometimes, you might hear it called a precious metals IRA, a gold-backed IRA, or another similar term.

Traditional IRAs focus on assets like stocks, bonds, and mutual funds. A gold IRA, on the other hand, contains physical gold you can claim when you withdraw it.

This type of account is a self-directed IRA, giving you control as the investor. You decide which gold coins or bars to purchase, where to store them, and which custodian will oversee the process. You also set the timing and method for taking distributions.

How to Invest in a Gold IRA: Step-by-Step Guide

To open a gold IRA, you’ll have to:

- Select a reputable gold IRA company and a trusted custodian. The gold IRA company assists in setting up a self-directed IRA, while the custodian takes care of storing and managing your precious metals.

- Next, you’ll need to fund the account. You can do so by transferring or rolling over funds from another retirement account or by making a cash deposit.

- After that, choose IRS-approved gold or other precious metals, which will be securely stored in an IRS-compliant depository.

Now, let’s break down each step of this process.

Step 1: Choose a Gold IRA Company

The first step in opening a gold individual retirement account is selecting the best company for a gold IRA. First, you sign an agreement with them stating you understand their business terms.

These companies guide you through opening your account, transferring funds, buying precious metals, and arranging secure storage at an approved depository.

In some cases, the gold investment company may also serve as your account’s custodian. It means that it will take responsibility for managing paperwork and ensuring IRS compliance.

With gold being a sought-after investment, you’ll find many gold IRA companies offering different fees, services, and levels of customer support. Take time to compare your options and choose a company that delivers top-notch service without charging exorbitant fees.

Once you’ve decided on a company, you’ll complete the necessary forms to set up your IRA and fund the account. Be ready to provide a driver’s license or other state-issued ID. You’ll also have to provide information on your current retirement accounts (like a 401(k) or another IRA) if you plan to transfer funds.

Step 2: Select a Custodian

A gold IRA company will either match you with a custodian they work with, or offer a few to choose from. A custodian is a financial entity that oversees your IRA’s paperwork, ensures compliance with IRS rules, and manages tasks related to buying and storing your precious metals.

Choose a gold IRA custodian with expertise in precious metals IRAs and a strong industry standing. Here are key points to evaluate:

- Costs: custodians charge for account setup, storage, and yearly maintenance. Compare their fee structures to find one that suits your budget.

- Expertise: Check how long the custodian has operated and whether they have a proven history with gold and silver IRAs.

- Support: Look for a custodian who offers responsive customer service, guiding you clearly through the process.

Reputable custodians, such as Equity Trust or STRATA Trust, are known for handling precious metals IRAs. Review your options carefully to pick the best fit.

Step 3: Add Funds to Your IRA

Once you open an account, you’ll need to figure out how to fund it. For most people, this involves a 401(k) to gold IRA rollover. Your gold IRA company’s team can assist you with this process.

The most common way to fund it is through a rollover or transfer from an existing tax-advantaged retirement account. However, you can do this in three ways:

- Direct Contribution: If you’re opening a new IRA, you can deposit money directly, similar to a standard IRA. Be aware of IRS annual contribution caps.

- Transfer: If you have an existing IRA, you can move existing retirement funds into a gold IRA without worrying about taxes or penalties, especially if you’re 59½ or older. The process is straightforward and can help strengthen your investment portfolio with gold.

- Rollover: Rollovers can come from old workplace 401(k) plans that have been sitting untouched and forgotten for years. They can also come from individuals actively managing their retirement accounts who want to safeguard their hard-earned savings.

Step 4: Pick Your Precious Metals

Finally, once your gold IRA is funded, you choose which gold coins or bars you want to buy. Contact a gold IRA company or a trusted precious metals dealer to place your order. You’ll complete an investment direction form, which your custodian will process.

Decide whether to focus on gold, silver, or both. Gold tends to hold steady, while silver may offer higher growth but with more risk. Diversify by including gold bars, silver coins, or other eligible metals to balance risk.

Once your custodian approves the purchase, the dealer will ship your metals to the chosen depository. The depository verifies authenticity, stores the metals, and updates your account records, which will reflect in your statements.

Step 5: Set Up Storage

IRS regulations mandate that precious metals in a gold IRA must be stored at an approved depository. Most gold IRA companies work with vetted depositories, so you don’t need to worry about this step.

The most popular and trusted ones are: Delaware Depository, International Depository Services (IDS), and Brink’s Global Services.

Approved depositories typically insure stored assets, but verify coverage details and consider additional insurance if needed. Storage costs depend on the depository and storage type, but are usually low (around $100-$150). Now, the only thing you’ll need to consider after that is when to take a distribution.

Benefits of Investing in Gold

Investing in gold offers many benefits, and using a gold IRA can add even more value. Here are some key points to consider.

Protection Against Economic Instability

Gold is widely recognized as a stable asset during periods of inflation, and historical evidence supports this view.

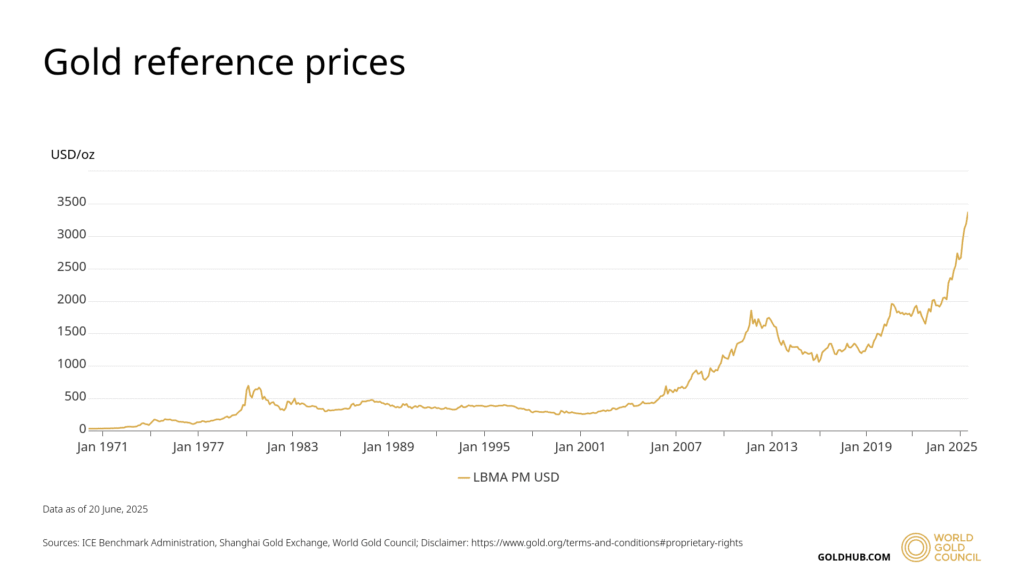

In the 1970s, amid significant inflation, gold prices rose from $35 per ounce in 1971 to $850 by 1980, achieving a gain well beyond 30% over the decade. Since the end of the gold standard in 1971, the U.S. dollar has lost over 85% of its purchasing power, reducing the value of $1 from that time to approximately $0.15 today.

In contrast, gold’s price has increased from $35 to around $3,380 between 1971 and 2025, reflecting a rise of approximately 9,531%. This demonstrates that gold has preserved its value more effectively than the dollar.

Portfolio Diversification

One of the best ways to balance your investments is through diversification. During the 2008 financial crisis, both stock and bond markets struggled. With another recession looming, rising interest rates and falling bond prices make diversification even more critical now.

Traditional IRAs and 401(k) plans limit your options to just a handful of funds focused on traditional assets. This can feel restrictive when trying to protect your money. With a self-directed IRA, you take full control.

You can invest in a range of assets like real estate, private equity, or precious metals. Adding a gold IRA to your mix can lower your risk and shield you from market downturns during tough economic times.

Physical, Safe-Haven Asset

Gold has long been a reliable safe haven and continues to serve that purpose. Central banks are buying gold at record levels, and individual investors are turning to it to guard their wealth against future challenges.

Holding physical gold offers a unique sense of security. Unlike stocks or bonds, which exist as digital or paper records, precious metals have real, inherent worth. The ability to physically see and touch your investment brings a comforting sense of confidence. Gold stands out for maintaining value during tough times.

Tax-Free Growth

Investing in gold through an IRA lets you enjoy tax-free growth. With a Traditional gold IRA, you use pre-tax dollars to buy gold and only pay taxes when you take distributions. A Traditional gold IRA is usually the best option for those people who expect to have a lower tax rate in retirement, as this delays taxes until you withdraw the money.

If you opt for a Roth gold IRA, your gains are completely tax-free at distribution. Contributions come from after-tax dollars, so you don’t get a tax break upfront. You need to meet income requirements, such as a modified adjusted gross income under $161,000 for singles or $240,000 for married couples filing jointly in 2025.

If you wait until age 59½ and hold the account for at least five years, withdrawals are completely tax-free, including any profits from your gold. A Roth gold IRA is for those who think taxes or gold values will rise in the future, as tax-free withdrawals can boost your overall gains.

IRS Rules and Requirements

Generally, a gold IRA follows the same IRS guidelines as other IRA accounts. However, there are certain rules and limitations that the IRS imposes on gold IRAs.

Eligible Precious Metals

Not every type of gold or silver can be included in an IRA. The IRS specifies strict standards for approved metals. Gold must have a minimum purity of 99.5%, and silver requires at least 99.9% purity.

Common choices include gold and silver bars or coins that meet these criteria, such as American Gold Eagles, American Gold Buffalos, Canadian Gold Maple Leafs, and American Silver Eagles.

Investing in collectibles is not allowed in a gold IRA, which can get confusing. Certain coins and items might seem eligible, but there are strict rules. Only specific coins meet the criteria for IRA investments.

This includes some U.S. Mint coins and others that meet minimum fineness standards. Popular choices like South African Krugerrands or older American double eagle $20 gold coins don’t qualify because they fall short of these standards.

Thankfully, most modern mints produce coins designed to be IRA-eligible. Partnering with a trusted gold IRA company can help you avoid issues by offering compliant options.

Storage Requirements

A distinctive feature of a gold IRA is the need for proper storage. Gold is a physical asset, and the IRS requires that your precious metals be held in an approved depository, not at home or in a personal safe.

These depositories are secure facilities built to safeguard your investments. You can keep your gold in either a segregated storage, or in non-segregated storage. In segregated one, your metals are stored separately. In a non-segregated storage, your metals are kept alongside others’ assets.

Taxes and Penalties

Withdrawing money from a Traditional gold IRA means you’ll owe taxes on the amount. If you take money out before age 59½, you may also face a 10% penalty.

Roth gold IRAs work differently. Distributions are typically tax-free if you’re at least 59½ and the account has been open for five years. Otherwise, you might owe taxes or penalties on early withdrawals, depending on your earnings.

Maximum Contributions

For 2025, the contribution limits for gold IRAs stay the same as in 2024. The annual limit is $7,000 for those under 50 and $8,000 for individuals 50 and older, which includes a $1,000 catch-up contribution. This cap covers the total amount you can contribute across all your IRAs, including traditional, Roth, or gold IRAs.

Required Minimum Distributions

Traditional gold IRAs require minimum distributions (RMDs), which begin at age 72. There’s talk in Congress about possibly raising this age or even eliminating RMDs, but nothing is set yet. Roth gold IRAs, on the other hand, are not subject to RMDs.

Maintaining and Evaluating Your Gold IRA

Setting up your gold IRA and storing your metals is just the beginning. To ensure your investment supports your retirement plans, you must actively oversee it

Regularly review the market value of your precious metals. Pay attention to economic trends that could influence their price. Your custodian will provide access to online portals or periodic statements to help you track your IRA’s performance easily.

Plan routine assessments of your IRA to confirm it’s meeting your expectations. Adjust your strategy as needed. Meeting with a financial planner or tax advisor can help you ensure your precious metals investments align with your broader retirement objectives.

Who Is Eligible to Start Gold IRA?

Most people who qualify for a traditional IRA or Roth IRA can also open a gold IRA. This applies to individuals with earned income, as long as they follow the annual contribution limits and age-related guidelines.

If you have funds in a 401(k), 403(b), or another traditional IRA, you may be able to transfer them into a gold and silver IRA. This can be a smart way to diversify your savings with physical assets. To avoid taxes or penalties, it’s essential to follow the correct rollover process.

Conclusion

A gold IRA offers a practical way to protect your retirement savings from economic uncertainty by investing in physical precious metals. By carefully selecting a reputable gold IRA company, a trusted custodian, and IRS-approved metals, you can diversify your portfolio, hedge against inflation, and enjoy tax-advantaged growth.

Don’t forget to regularly monitor your gold IRAs performance and consult with professionals to align it with your retirement goals. Good luck!