What is IRA-Eligible Gold?

This guide breaks down IRA-eligible gold, IRS rules, approved coins and bars, buying steps, and tax benefits. Compare gold bars vs. coins and learn key tips to diversify your retirement portfolio naturally.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

To invest in a gold IRA, you need to follow strict IRS rules. First, you must buy gold that qualifies for an IRA and select a custodian approved by the IRS to ensure the gold complies with regulations. Additionally, all gold in the IRA must be kept in a storage facility approved by the IRS.

IRA-eligible gold must meet strict standards set by the Internal Revenue Service (IRS). This includes gold coins and bars with a minimum purity of 99.5%, crafted by a recognized government mint or a certified refiner, assayer, or manufacturer.

- Gold bars and rounds must come from an approved mint, maintain a purity of at least 99.5%, and meet precise weight requirements for smaller bars.

- Gold coins must be 99.5% pure (the only exception is the American Gold Eagle coin). Coins should remain in their original mint packaging, stay in pristine condition, and include a certificate of authenticity.

These IRS guidelines guarantee that the gold is of superior quality, making it a reliable choice for long-term retirement investments.

You can purchase IRA-approved gold through reputable gold investment companies and online dealers.

What Gold Products are IRA-Eligible?

If you’re thinking about adding gold to your retirement portfolio, here’s what you need to understand about IRA eligibility.

IRA-Eligible Gold Coins

IRA-eligible coins are gold coins that satisfy the IRS’s strict criteria for inclusion in a self-directed Individual Retirement Account (IRA).

These coins must meet high standards for purity, originate from recognized government mints, and remain in pristine condition to be suitable for retirement accounts.

The IRS enforces these rules to ensure only top-quality, investment-grade coins are permitted.

| Requirement | Details |

|---|---|

| Minimum Purity | At least 99.5% pure |

| Approved Mints | Produced by government mints, such as the U.S. Mint, Royal Canadian Mint, or Perth Mint |

| Form | Specific coins like American Gold Eagle, Canadian Gold Maple Leaf, or Australian Gold Kangaroo |

| Condition | Must be uncirculated and in mint condition |

| Storage | Required to be held in an IRS-approved storage facility |

Examples of IRA-eligible coins include: American Gold Eagles, Canadian Gold Maple Leafs, Austrian Gold Philharmonics, Australian Gold Kangaroos.

These coins are favored by IRA investors for their trusted value, exceptional purity, and support from respected government authorities. However, some coins, despite meeting purity standards, are not allowed in IRAs because they are classified as collectibles.

Examples include coins like the United Kingdom Sovereign, French 20 Franc gold coins, and U.S. Liberty coins, which are excluded due to their collectible status.

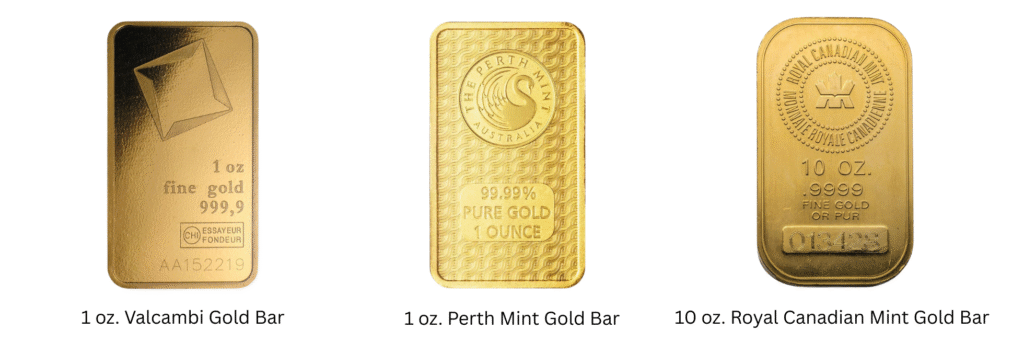

IRA-Eligible Gold Bars

IRA-eligible gold bars are those that comply with IRS regulations for use in a self-directed Individual Retirement Account (IRA).

Unlike coins, these gold bars are crafted by certified refiners, assayers, or manufacturers, not government mints. However, they must still meet strict purity standards. They need to be in excellent delivery condition and stored in a facility approved by the IRS.

| Requirement | Details |

|---|---|

| Minimum Purity | At least 99.5% pure |

| Approved Producers | Made by accredited refiners, assayers, or manufacturers (e.g., Valcambi, Perth Mint) |

| Form | Standard gold bars |

| Condition | Must be in excellent delivery condition |

| Storage | Required to be kept in an IRS-approved storage facility |

Examples of IRA-eligible gold bars: 1 oz. Valcambi Gold Bars, 1 oz. Perth Mint Gold Bars, 10 oz. Royal Canadian Mint Gold Bars, 1 kg. Argor-Heraeus Gold Bars.

These bars are valued for their exceptional purity, reliable production quality, and strong reputation in the gold industry. This makes them dependable choices for gold IRA investments.

How to Buy IRA Approved Gold?

Purchasing IRA-approved gold differs from buying non-IRA-approved gold, especially when the goal is to include it in an Individual Retirement Account (IRA). If you’re investing in an IRA, the process involves specific steps:

- Find a gold IRA company and set up a self-directed IRA.

- Fund the IRA and choose gold products that meet IRA eligibility standards.

- Arrange for the gold to be stored in an IRS-approved depository.

TOP-RATED GOLD IRA COMPANY

- Offers high-quality IRA-approved gold products at reasonable prices

- Named “Best Gold IRA Company” by Forbes and Money magazine

- Trusted by thousands of customers (A+ BBB, AAA BCA, 1,000+ 5-star reviews)

Reputable companies like Augusta Precious Metals can guide you through opening a gold IRA and organizing secure storage for your gold. The IRS prohibits IRA holders from storing gold themselves, as this could risk losing the tax advantages of a gold IRA.

Here’s a comparison of buying IRA-approved versus non-IRA-approved gold:

| Aspect | IRA-Approved Gold | Non-IRA-Approved Gold |

|---|---|---|

| Purchases | Often requires a minimum investment to open an account | No minimum investment required |

| Storage | Must be kept in an IRS-approved depository | Can be stored in a home safe, bank vault, or any secure location |

| Shipping | Typically included in account fees | Buyer pays for postage and insurance |

| Costs | IRA setup fee, annual maintenance fee, storage fees | No mandatory ongoing fees |

You can still buy IRA-approved gold for personal use outside of an IRA and store it at home or another location. In such cases, the purchase process mirrors that of non-IRA-approved gold, with no additional IRA-related requirements.

What is a Better Investment: Gold Bars or Gold Coins?

Gold bars and gold coins are both popular options for investors looking to add precious metals to their gold IRA portfolios. However, they serve different purposes based on individual goals, budgets, and preferences.

Gold bars are universally recognized and easily traded, with their value tied closely to gold’s spot price. Popular coins, such as the American Gold Eagle or Canadian Gold Maple Leaf, also enjoy strong liquidity due to their global recognition and demand.

Below is a detailed comparison to help you decide which type of gold is right for you.

Gold Bars

Gold bars (also called ingots) are rectangular pieces of refined gold, typically ranging from 1 gram to 1 kilogram or larger. Produced by trusted refiners and mints worldwide, these bars boast a high purity level, usually 99.99%, making them nearly pure gold.

Benefits of Gold Bars:

- High Purity: Gold bars offer near-perfect purity, ensuring they hold consistent value, ideal for investors focused on wealth preservation.

- Cost-Effectiveness: Bars generally carry lower premiums over the spot price of gold compared to coins. This makes them economical for large-scale investments.

- Efficient Storage: Their uniform, stackable shape simplifies storage, especially for those with significant gold holdings.

If your aim is to secure wealth with a straightforward, high-value asset, gold bars are often preferable due to their purity and lower cost per ounce. If you’re drawn to the potential for collectible appreciation or enjoy the artistry of coins, gold coins may be a better fit.

Gold Coins

Gold coins are minted by government or private mints and are prized for their craftsmanship and historical significance. Available in sizes from 1/20 ounce to 1 ounce, they combine investment value with aesthetic appeal.

Benefits of Gold Coins:

- Collectible Value: Many coins gain additional worth due to their rarity or historical context, appealing to collectors and potentially increasing in value over time.

- Flexible Divisibility: Coins are easier to sell or trade in smaller units, offering flexibility for investors who may need to liquidate portions of their holdings.

- Visual Appeal: With intricate designs and cultural significance, coins attract those who value artistry or wish to gift gold.

Coins are often easier to sell in smaller quantities, making them ideal if you foresee needing to liquidate portions of your investment. Gold bars, while highly liquid in larger markets, may require professional assistance to divide or sell.

Purchasing IRA-Eligible Gold: Things to Keep in Mind

Investing in IRA-eligible gold can be a smart way to diversify your retirement portfolio, offering potential tax advantages.

While you don’t need an IRA to buy gold bars and coins, gold IRAs provide unique benefits, such as tax-deductible contributions for traditional IRAs (up to annual limits) or tax-free growth and withdrawals for Roth IRAs during retirement.

However, a gold IRA isn’t ideal for everyone. Below are important factors to evaluate before investing in IRA-approved gold.

IRA-Approved Gold

As you already know, not all gold qualifies for an IRA. The IRS requires gold to meet specific standards:

- Purity: Minimum of 99.5% (with exceptions like the American Gold Eagle).

- Manufacturer: Must come from approved mints or refiners (e.g., U.S. Mint, PAMP Suisse).

- Condition: Coins must be uncirculated, and bars must be in good delivery condition.

Popular options include American Gold Eagle coins, Canadian Gold Maple Leaf coins, and 1 oz. Valcambi gold bars. Research products to ensure they meet IRS criteria and align with your investment preferences.

Investment Goals and Risk Tolerance

A gold IRA can hedge against inflation and economic uncertainty, but it may not suit every investor. Gold doesn’t generate income like stocks or bonds, and its value can fluctuate. Consider:

- Portfolio Diversification: Does gold align with your overall retirement strategy?

- Time Horizon: Are you comfortable locking funds in an IRA until retirement?

- Risk Profile: Are you seeking stability, or do you prefer assets with higher growth potential?

If your goal is short-term gains or liquidity, non-IRA gold might be more suitable. For long-term wealth preservation, a gold IRA could be a strong fit.

Tax Benefits and Contribution Limits

A gold IRA can offer significant tax perks. Contributions to a traditional IRA may be tax-deductible, while Roth IRA funds grow tax-free and can be withdrawn without taxes in retirement. However, the IRS sets annual contribution limits:

- For 2025, the limit is $7,000 for individuals under 50 and $8,000 for those 50 and older.

- If you want to invest more in gold annually, you’ll need to purchase it outside an IRA, as these limits apply to all IRA contributions, not just gold.

Consider whether these caps align with your investment goals, especially if you plan to allocate a larger sum to precious metals.

Storage and Custodian Requirements

Unlike physical gold purchased outside an IRA that which you can store at home, IRA-eligible gold must be held in an IRS-approved depository. You’ll also need an IRS-approved custodian like STRATA Trust or Equity Trust Company to manage the account and ensure compliance with regulations.

These requirements add complexity and cost, so factor them into your decision. Research custodians and depositories to confirm they’re reputable and offer secure, insured storage.

Costs and Fees

Gold IRAs come with additional expenses compared to traditional IRAs or direct gold purchases:

- Setup Fees: Opening a gold IRA often involves an initial fee to establish the account.

- Annual Maintenance Fees: These cover account administration and compliance with IRS rules.

- Storage Fees: Since IRA-eligible gold must be held in an IRS-approved depository, you’ll pay ongoing storage costs.

These fees can reduce your overall returns, so compare providers to find cost-effective options and ensure the fees fit your budget when choosing between a gold IRA vs physical gold.

Early Withdrawal Penalties

The IRS encourages long-term retirement savings by imposing a 10% penalty on withdrawals from an IRA before age 59½, in addition to applicable income taxes.

While there are exceptions (e.g., for certain medical expenses or first-time home purchases), this penalty could apply if you need to liquidate your gold early.

If you anticipate needing access to your funds before retirement, a non-IRA gold investment might offer more flexibility.

Minimum Investment Requirements

Some gold IRA companies require a substantial initial investment requirement, often $10,000, $25,000 or more. This can be a barrier if you’re starting fresh without an existing IRA or an old 401(k) to roll over into a gold IRA.

If you’re unable to meet these minimums, you might consider purchasing gold outside an IRA, or investing with companies that have lower investment requirements. Always ask about the minimum investment threshold when you’re looking for a gold IRA company.

Conclusion

Investing in IRA-eligible gold offers tax advantages and portfolio diversification but comes with unique costs, restrictions, and considerations. Evaluate your financial goals, budget, and liquidity needs to determine if a gold IRA is right for you.

If the contribution limits, fees, or early withdrawal penalties don’t suit your plans, buying gold outside an IRA may be a simpler alternative.

Work with a trusted gold dealer and financial advisor to navigate the process, select IRS-compliant products, and choose a reliable custodian and depository. By carefully weighing these factors, you can make an informed decision that supports your long-term financial objectives.