Noble Gold Investments Review

This article offers a detailed review of Noble Gold Investments to help you determine if it’s the right choice for your investment goals. It covers the company’s history, services, strengths, and areas where it could improve.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

As economic conditions grow more unpredictable, investors often turn to precious metals for diversification and to safeguard their wealth. One of the notable companies in this space is Noble Gold Investments, a company that assists customers in setting up gold IRAs and incorporating physical precious metals into their holdings.

Competition in this industry is fierce, and many gold IRA companies onboard key opinion leaders to improve brand awareness and visibility. But unlike competitors, Noble Gold Investments avoids high-profile celebrity endorsements, focusing instead on solid customer service, straightforward pricing, and useful resources to support customer decisions.

Noble Gold Investments ranks #4 on our list of the best-rated gold IRA companies for 2025, thanks to its robust educational resources, competitive pricing, and strong security measures.

The company is endorsed by American actor Kevin Sorbo and has been featured in Yahoo Finance, Business Insider, Forbes, and Fortune, among others.

This Noble Gold Investments review pulls from user feedback, reported issues, details on products and Noble Gold’s operations, as well as company updates. It covers the background, service options, available items, costs, security measures, comparisons to competitors, and related aspects.

Overall, we hope that by the end of this review, you’ll be able to understand whether Noble Gold aligns with your personal investment goals.

Pros and Cons

| Noble Gold Investments Pros | Noble Gold Investments Cons |

|---|---|

| Competitive Pricing: Set fees and regular incentives like free silver coins for qualifying accounts | Absence of Real-Time Pricing: Lacks detailed fee listings or real-time pricing on their website. |

| Distinctive Storage Solutions: Includes unique facilities in Texas and international locations for storing precious metals. | Shipping and Assistance Limited to North America: Primarily geared toward customers in the U.S. |

| Robust Security: Vaults feature segregated spaces with full coverage and enhanced security measures. | Involves Personal Conversations for IRA Setup: Setting up an IRA requires a personal consultation, rather than a fully online process. |

| Straightforward Buyback Program: Allows customers to sell back their precious metals to Noble at fair market values. | Limited Rare Coin Options: Focuses more on standard products, with fewer rare coin options compared to competitors. |

| Plentiful Educational Resources: Offers a range of guides, personalized consultations, and insights for investors. | Aggressive Marketing in Some Reviews: A few customer reviews point to the use of aggressive marketing and scare tactics. |

| Ongoing Market Updates: Frequent updates on market developments through their website and newsletter. |

Download Noble Gold’s free gold IRA guide to discover how to protect and grow your wealth with gold and silver.

Learn everything you need to know about IRAs, diversification, and the timeless value of precious metals.

Company Overview and History

Collin Plume and Charles Thorngren, both with backgrounds in the industry, founded the company in 2016. By prioritizing customer needs, Noble Gold has built a following among those planning for retirement, as well as affluent individuals seeking to invest in physical precious metals for personal ownership and storage.

They both carried over expertise from their time as brokers at Regal Assets, which had been an innovator in gold IRAs before it wound down operations.

Today, Noble Gold Investments is headquartered in Encino, California. The business continues to expand, receiving positive feedback in reviews for its wide range of high-quality products, guidance, and commitment to satisfaction.

Plume’s early career focused on real estate sales. He then spent almost six years offering guidance on precious metals, which sparked his deep interest in the sector. For him, holding physical assets such as gold and silver plays a key role in fostering financial stability through diversified holdings, and this view underpins the firm’s operations.

As a recognized expert in precious metals, Plume is a member of Forbes Business Council and maintains an active profile on LinkedIn, where he posts about gold market developments to an audience of more than 19,500 followers.

Under Collin Plume’s leadership, Noble Gold Investments earned accreditation from the Better Business Bureau on January 23, 2017, and has maintained an A+ rating ever since. To achieve this rating, businesses must effectively resolve customer complaints and adhere to the BBB’s Standards for Trust, including honest advertising, transparency, and keeping promises.

Thorngren contributed over two decades of investment knowledge when he co-founded Noble Gold. He stepped away in November 2020 to launch what became Legacy Precious Metals.

However, it doesn’t seem like the company achieved success. As of 2025, Legacy Precious Metals holds an F rating on Better Business Bureau due to unresolved customer complaints.

With Thorngen involved in Legacy Precious Metals, Plume now oversees Noble Gold Investments as its only owner and central decision-maker. Today, Noble operates as both a dealer in precious metals and a provider of gold IRAs, aiding with rollovers and assisting those saving for retirement in establishing and overseeing self-directed IRAs supported by gold.

Beyond gold, Noble can also help you purchase and incorporate silver, platinum, and palladium into your retirement portfolio. Plus direct purchases of precious metals beyond retirement accounts are also available.

The company collaborates with established custodians and storage facilities, like Equity Trust Company for managing IRAs and International Depository Services for secure keeping, ensuring full adherence to IRS guidelines.

Products and Services

As mentioned earlier, Noble Gold’s main services involve self-directed IRAs that focus on holding physical assets like gold, silver, platinum, and palladium, all within accounts that offer tax advantages.

The company guides you through IRS rules, helps you open a gold IRA, and streamlines the process of transferring funds from existing retirement accounts, such as 401(k)s, Thrift Savings Plans, or traditional IRAs. Expert precious metals specialists assist you every step of the way to ensure a smooth transition without incurring tax penalties.

For those who are not interested in IRAs but want to gain exposure to precious metals, the company allows direct purchases of bullion coins and bars to help diversify holdings outside of retirement accounts.

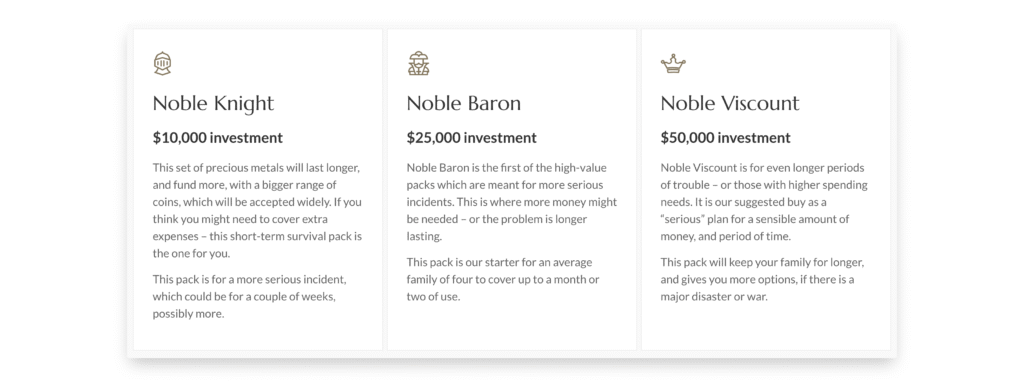

A unique feature is their “Royal Survival Packs”, which are pre-packaged sets of precious metals designed for unforeseen events and challenging times, including economic downturns or geopolitical conflicts, when gold remains a reliable store of value.

These packs start with the entry-level Knight option at $10,000 and go up to the high-end Ambassador version exceeding $500,000. They include gold bars and easy-to-trade coins, like gold and silver Eagles.

The Ambassador pack caters specifically to customers abroad, with payments accepted in U.S. dollars or Bitcoin, and holdings kept in safe facilities throughout North America.

When it comes to receiving your metals, there are two options for you to choose from.

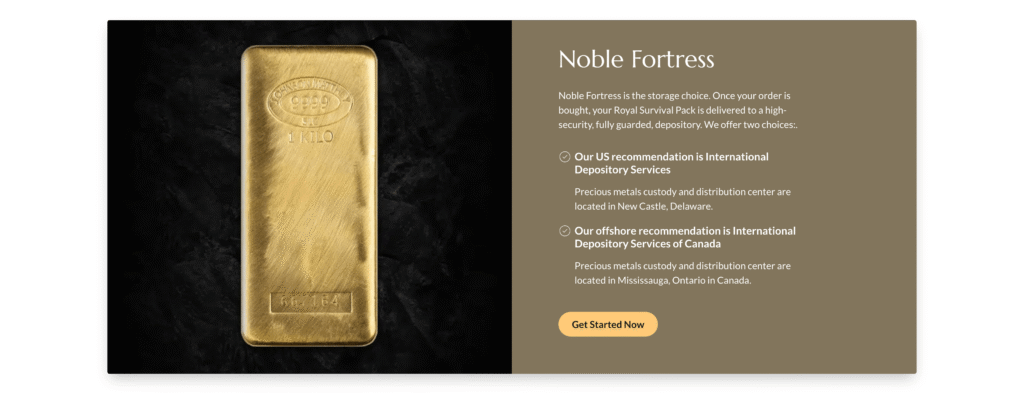

- Noble Express handles insured, discreet shipments right to your door within 5 days of purchase.

- Noble Fortress arranges secure storage in a high-security vault through International Depository Services facility in New Castle, Delaware in the U.S., or Mississauga, Ontario in Canada.

Noble Gold also has a straightforward and dependable buyback program. The company agrees to buy back metals at current market rates without additional fees, making it simple to liquidate your gold and silver when necessary.

Education forms a key part of their services, with free materials available on topics like gold IRAs, basics of precious metals, investment fundamentals, and regular updates on market conditions.

Their website features a complimentary guide on investing in gold and silver. It covers details on IRA rollovers, the benefits of asset diversification, and how gold can help mitigate inflation risks. Customers can schedule immediate sessions with experts for tailored advice on market shifts, retirement planning, and protecting against financial volatility.

The company also produces content on timely political and economic topics, such as reviews of congressional stock trades or examinations of job market reports.

Noble Gold Investments Reviews and Complaints

Noble Gold has earned an A+ rating on BBB an strong ratings across the web, reflecting its focus on providing customer support in a low-pressure manner. In 2025, the company received an impressive composite score of 4.87 out of 5 stars, based on over 2,440 reviews from various platforms.

- 4.97/5 based on 216 reviews with the Better Business Bureau (BBB), as well as A+ accreditation, only 4 complaints in the last three years;

- 4.9/5 from 619 reviews in Google Reviews;

- 4.9/5 on Trustpilot, based on over 656 contributions;

- 4.9/5 on ConsumerAffairs from 825 reviews;

- 5/5 on TrustLink according to 124 reviews.

The company actively responds to customer issues on social channels and review websites. Overall feedback leans positive, though occasional notes mention small matters like packaging issues or aggressive marketing. However, issues appear infrequent and get resolved promptly.

Download Noble Gold’s free gold IRA guide to discover how to protect and grow your wealth with gold and silver.

Learn everything you need to know about IRAs, diversification, and the timeless value of precious metals.

Customers often praise the smooth gold IRA setup, expert staff, timely deliveries, and reasonable costs. Support from figures such as Charlie Kirk, along with favorable mentions in expert reviews underscore the company’s reliability and commitment to customer satisfaction.

Noble Gold IRA Fees

Noble Gold Investments maintains transparent pricing with fixed gold IRA fees that vary by account size. In numerous instances, they waive the initial setup charge, particularly for those that hit specific thresholds. The primary costs break down as follows:

| Type of Fee | Cost | Details |

|---|---|---|

| Account setup fee | $80 (once) | Waived for larger accounts |

| Custodian admin fee | $125 per year | Charged by Equity Trust |

| Storage fee | $150 per year | Stored separately and insured |

The total annual expense comes to $275, covering oversight and secure storage of your metals. This structure remains competitive compared to similar providers.

Noble Gold frequently offers promotions and incentives to attract new customers. For example, in September 2025, they ran a special promotion giving new account holders a free 3 oz. Silver American Virtue coin, making it an appealing option for beginners.

What we don’t like about Noble Gold Investments is that the website lacks live pricing, so you’ll have to contact them for quotes. Delivery fees also depend on individual order details.

Setting Up an IRA With Noble Gold Investments

Investing in a Noble Gold IRA is straightforward, but it requires personalized guidance to comply with IRS regulations and tailor the process to your specific financial goals.

The process begins when you request a free gold IRA kit from their website, which contains all the necessary information about rolling over funds and adhering to IRS guidelines.

Once you have your kit, a dedicated precious metals specialist will assist you every step of the way, ensuring the process goes smoothly:

- Initial call: Your specialist will discuss your financial goals and verify your eligibility to invest in a gold IRA. This is also when you’ll review your available retirement funds and understand the best options for diversifying with precious metals.

- Account creation: With your eligibility confirmed, you’ll work with Equity Trust, a trusted custodian for IRA administration, to open your new gold IRA account. This step ensures that your investments comply with IRS rules.

- Depositing funds: You have several options to fund your IRA, including tax-advantaged transfers from existing retirement accounts like 401(k)s or IRAs, rollovers, or yearly contributions (capped at $7,000 for individuals under 50, or $8,000 for those 50 and older). Noble Gold handles the heavy lifting, assisting with each step of the transfer to ensure everything is done correctly and efficiently.

- Selecting precious metals: Your specialist will help you choose IRS-approved gold, silver, platinum, and palladium products that align with your investment goals and the specific requirements for your IRA. This includes high-quality coins and bars that meet weight, purity, and other IRA guidelines.

- Secure storage: Once your precious metals are purchased, they are shipped to one of Noble Gold’s highly secure, insured depositories. This ensures that your assets are stored safely, in compliance with IRS regulations for precious metal IRAs.

- Ongoing assistance: You’ll have 24/7 access to your account online to track your investments and stay informed. Regular follow-ups and updates from your specialist will keep you updated on the market and ensure your IRA is performing according to plan.

Noble Gold’s IRA minimum is $20,000, suiting newcomers or those investors who are not looking to allocate overly substantial funds to precious metals. For alternatives beyond IRAs, survival packs start from $5,000, and direct acquisitions of gold and silver require a $10,000 threshold.

Funding options encompass IRA transfers, 401(k) rollovers, or cash contributions, with metals coming directly from Noble Gold. Many clients appreciate the uncomplicated approach, absent of high-pressure selling practices.

Precious Metals Offered by Noble Gold Investments

Noble Gold selects its product inventory thoughtfully to ensure high quality and compliance with IRA rules. The site features detailed descriptions, clear images, and background on each item’s history. This approach provides more than just price tags; it helps users understand the value behind their selections.

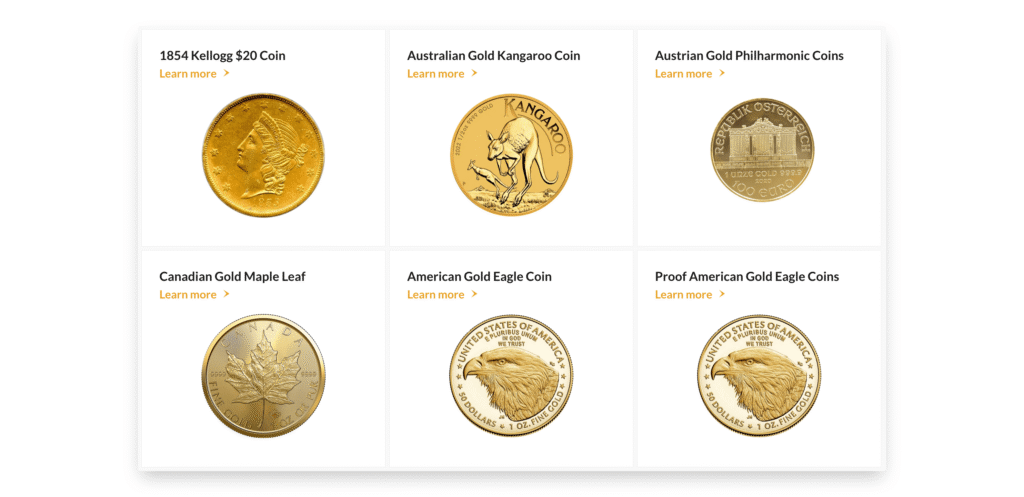

Gold Products

The company carries an assortment of gold coins and bars eligible for IRAs. These stand out for their high purity and ease of liquidation. Among the coins:

- The American Gold Eagle comes in regular, proof, or a four-piece proof set. Made from 22-karat gold, it displays Lady Liberty on one side and an eagle on the other. Face values span from $5 to $50. Proof versions appeal to collectors but hold the same amount of gold as the standard ones.

- The Canadian Gold Maple Leaf achieves 99.99% purity from the Royal Canadian Mint.

- The Austrian Gold Philharmonic honors the Vienna Philharmonic Orchestra.

- The Australian Gold Kangaroo highlights Australia’s iconic animals.

For bars, choices include the PAMP or Credit Suisse Gold Bar, PAMP Suisse 100g Gold Bar, Perth Mint 1oz Gold Bar, and Johnson Matthey 1kg Gold Bar. This selection allows investors to choose bigger quantities or smaller portions.

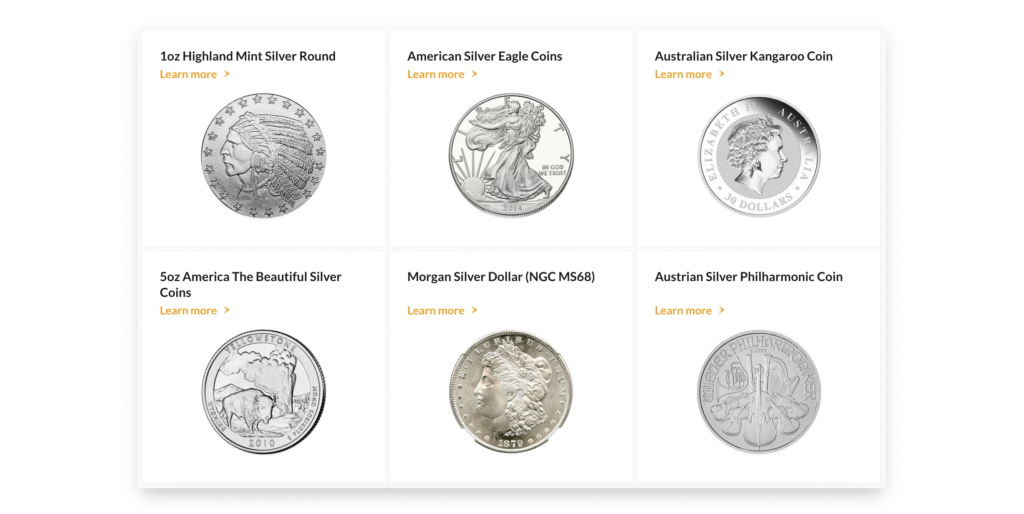

Silver Products

Noble focuses on silver options that meet IRA standards with superior purity. The available coins include:

- 1oz American Silver Eagle

- 1oz Canadian Silver Maple Leaf (featuring 99.99% purity and advanced security elements like micro-engravings)

- 1oz Australian Silver Kangaroo

- 1oz Austrian Silver Philharmonic

- 5oz America the Beautiful Series

Silver bars available via Noble Gold Investments include:

- 5oz Highland Mint Silver Bar

- 1kg Australian Silver Bar

- 1oz Highland Mint Silver Round

The Canadian Silver Maple Leaf is particularly popular due to its stunning design, which features the obverse image of Queen Elizabeth II and the reverse maple leaf motif. Its $5 CAD denomination corresponds to one ounce of fine silver, making it a trusted choice for investors.

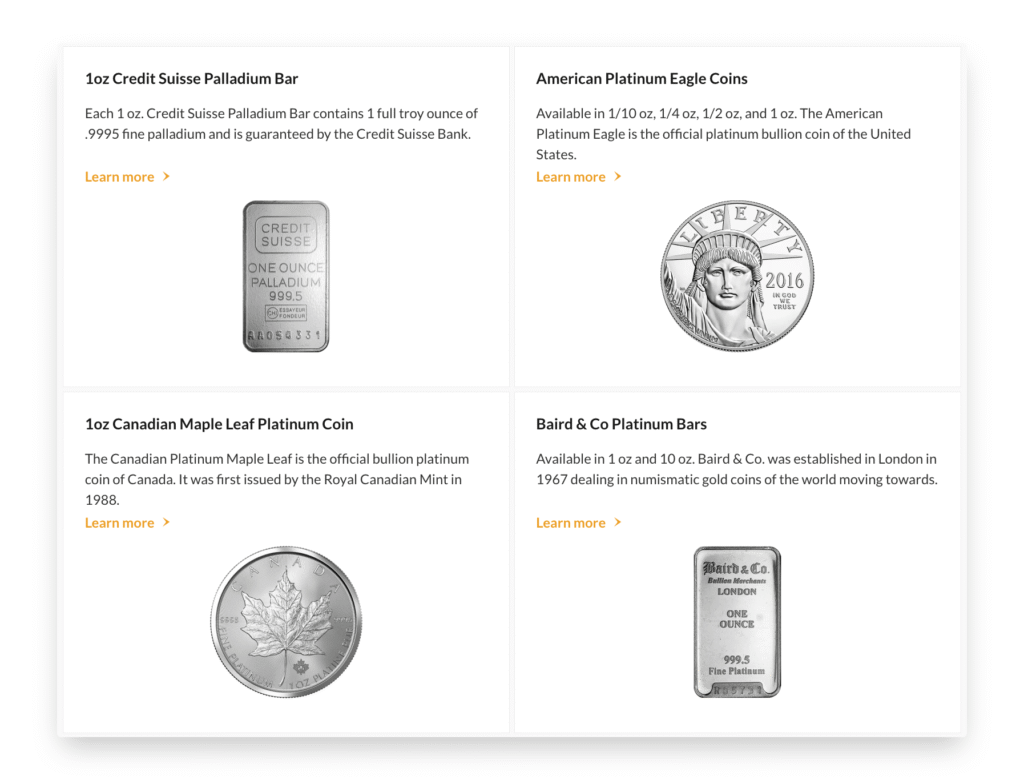

Platinum and Palladium Products

For diversification, platinum options encompass the American Platinum Eagle, 1oz Canadian Platinum Maple Leaf, or Baird & Co bars in 1oz and 10oz weights. Palladium selections cover the Canadian Palladium Maple Leaf and 1oz Credit Suisse Palladium Bar.

Noble Gold outlines differences between standard bullion, such as Eagles or Maple Leafs valued mainly for their metal content and low premiums, and higher-end or semi-numismatic coins. The latter fetch steeper prices because of scarcity, despite equivalent purity.

For gold IRA setups, the recommendation points to basic bullion, which provides better liquidity and costs nearer to spot prices. Outside of IRAs, rarer pieces like Morgan Silver Dollars add a collectible appeal, though the overall variety remains more limited than at some competitors.

Storage Facilities

All assets are stored in segregated vaults, ensuring customers receive the exact metals they deposit. This means your metals are kept in individual compartments, never commingled with other clients’ assets. This ensures maximum protection and storage clarity.

Each storage facility complies with IRS regulations and holds approvals from prestigious organizations such as COMEX, CME, LBMA, and ICE. Additionally, all stored assets are covered by comprehensive insurance from Lloyd’s of London, protecting against risks like theft, damage, or loss.

When you open a gold IRA or purchase precious metals through Noble Gold, you can choose from the following storage options:

- Texas Depository (Dallas): Exclusively reserved for Noble Gold clients, offering convenient access and regional protections.

- Delaware Depository (New Castle): A popular choice with COMEX certification.

- Canadian Storage Facility (Mississauga, Ontario): Ideal for cross-border diversification.

For “Survival Packs” outside of IRAs, IRS rules permit home storage, giving you flexibility for your non-IRA assets.

Alternatives to Noble Gold Investments

Noble Gold Investments is a reliable, low-barrier option for modest portfolios. However, some alternatives excel in reputation, service depth, and cost efficiency for most investors.

Augusta Precious Metals provides tailored guidance to clients, including ongoing account management throughout the life of the investment. This approach avoids aggressive sales tactics and appeals to those who value detailed learning resources and premium service, over Noble Gold’s more basic guidance.

The company requires a starting investment of $50,000, which is much steeper than Noble Gold’s $20,000 threshold. This setup draws in committed and serious investors looking to invest substantial money into precious metals. Augusta also includes no fees in the initial year and a week-long price lock guarantee.

Those who qualify gain access to ongoing IRS compliance and tax information assistance, Harvard-trained economic webinars on market trends, and flawless 5/5 Trustpilot ratings based on 1,000+ reviews, contrasting Noble’s solid but lower-volume 4.8/5 feedback.

Goldco provides award-winning customer care with no investment requirement, unlike Noble’s $20,000 minimum. The company stands out with a broader selection of platinum and palladium products alongside gold/silver. Plus, all customers are eligible for the highest-price buyback program.

Goldco mirrors Noble in fees, but excels with over 6,200 five-star reviews and Money.com’s 2025 Best Customer Service award, far surpassing Noble’s 2,300+ ratings.

Both companies focus on beginner accessibility and educational resources like free kits, but Goldco highlights its Inc. 5000 recognition for fast growth and reliable customer support.

Birch Gold Group brings decades of expertise and has earned endorsements from influential figures like Ron Paul and Ben Shapiro.

With a $10,000 minimum investment (half of Noble Gold’s $20,000 requirement) Birch attracts customers through extensive free resources, including webinars, podcasts, and a newsletter that delves into economic trends.

Birch Gold Group processes rollovers in under 10 days and offers strong buyback rates, as well as an A+ BBB rating with 4.87/5-star reviews.

Compared to Noble Gold, Birch Gold stands out with clearer pricing, more reliable shipping, and higher storage fees balanced by premium educational support.

Conclusion

Noble Gold Investments is a legit, trustworthy, and investor-centric gold investment company. It is a good fit for those investors who seek customer education, top-notch security, and affordability. Its lean model delivers value through low fees, innovative products like “Royal Survival Packs”, and high customer satisfaction, as seen in recent BBB reviews and rankings.

While we think that Noble Gold Investments lacks product variety, the quality of available products matches high-quality standards for inclusion in IRA. We also think that Noble Gold lacks transparency when it comes to prices of the precious metals they sell.

Ready to invest with Noble Gold? Start by requesting a free gold IRA guide from them to connect with customer support and learn more about their gold IRA.

However, Noble is still one of the most reputable gold IRA companies on the market. It is well positioned to service novice investors, those in retirement, or individuals prioritizing emergency savings.