Preserve Gold Review

This article provides a detailed, balanced review of Preserve Gold, a U.S. based precious metals dealer that helps retirement investors add gold into their retirement portfolios.

Written by Rick Erhart

Rick Erhart is an experienced precious metals professional with more than ten years in the field. He earned a degree in finance and is widely regarded as a specialist in self-directed IRAs.

Gold has long served as a reliable hedge against economic uncertainties, since it’s a tangible asset that historically retains value when fiat currencies falter. This timeless appeal draws investors looking for stability, making precious metals a cornerstone of diversified portfolios.

The growing demand for gold is driving the emergence of new gold investment companies, and one of the notable newcomers in this market is Preserve Gold.

Preserve Gold is a U.S.-based, BBB-accredited precious metals dealer and gold IRA company founded in 2022. The company has quickly gained attention as a prominent player in this industry thanks to high-caliber celebrity endorsements and paid national advertising campaigns.

A quick note before we continue with our Preserve Gold review!

Choosing a gold IRA company is a major financial decision, and we’re committed to providing you with trustworthy, detailed information on your options. After extensive research, we’ve compiled our top five gold IRA companies for this year.

Curious if Preserve Gold made the cut?

You can also request a free gold IRA kit from our top-recommended gold IRA company for 2025 below, or keep reading this review for the full scoop on Preserve Gold.

This Preserve Gold review covers services, products, fee structure, customer feedback, and overall company’s value proposition.

If you’re looking to open a gold IRA and diversify your retirement portfolio, this guide provides the detailed insights needed to make an informed decision.

Pros and Cons

| Preserve Gold Pros | Preserve Gold Cons |

|---|---|

| Zero-Fee Buyback and Price Protections: No-fee buyback for metals bought from the company at top market prices, boosting liquidity and exit options; includes price matching or beating competitors to safeguard against volatility. | Newer Company: Established in 2022, lacks long-term history compared to veteran firms, potentially concerning investors seeking proven stability. |

| Generous Promotions and Fee Waivers: Waives IRA storage and custodian fees for up to 5 years based on investment; offers up to $15,000 in free gold/silver, free shipping/insurance on large orders, and 24-hour cancellation guarantee, cutting costs significantly. | Phone-Only Purchases and Quotes: Requires representative calls for transactions and pricing; no full online buying, lengthening the process versus digital competitors. |

| Broad IRA-Eligible Inventory: Wide range of IRS-approved gold, silver, platinum, and palladium from trusted mints like U.S. Mint, Royal Canadian Mint, and Perth Mint, supporting diverse IRA and non-IRA portfolios with quality assurance. | Higher Investment Minimums: IRA minimum around $25,000 and $30,000 for bullion buyback programs, higher than competitors’ $10,000 entry points, limiting access for smaller investors. |

| Lifetime Support with Regular Reviews: Personalized lifetime account support, including portfolio reviews, market trend advice, and responsive expert help without high-pressure sales. | Limited Non-IRA Options Emphasis: Focuses mainly on IRAs; fewer streamlined options or promotions for non-retirement direct purchases. |

| Strong Educational Focus: Free resources like 2025 Precious Metals IRA Guide, quizzes, materials on inflation hedging and tax-free rollovers, plus personalized guidance, ideal for beginners. | No Live Chat or Instant Support: Relies on phone/email; no live chat for immediate help, potentially delaying queries outside business hours. |

| Transparent and Compliant Operations: Follows IRS rules for IRAs; partners with custodians like Horizon Trust and depositories like Delaware Depository for secure storage; Precious Metal Association founding member for ethics. |

Company Overview and Background

Preserve Gold is a family-owned business headquartered in Woodland Hills, California, established to address the growing demand for precious metals amid economic instability.

Preserve Gold’s mission is to empower investors by promoting informed decision-making, transparency, and trust. These core values set the company apart in a market often criticized for aggressive sales tactics.

Founder Daniel Boston and his team bring decades of industry experience, combining traditional expertise with modern, customer-focused service. Boston previously served as a Senior Account Executive at Lear Capital, a well-known gold IRA provider and prominent player in the market.

Daniel Boston has over a decade of experience in the precious metals industry. Though he tends to keep a low public profile, he occasionally shares his insights in interviews.

Most recently, Boston appeared in a 20-minute segment on Allen Jackson NOW, where he discussed the declining value of the dollar, rising inflation, and the benefits of investing in gold. You can watch the full interview below.

Despite its relative newness, Preserve Gold has earned accreditation from the Better Business Bureau (BBB) and maintains strong ties with IRS-approved partners. It operates as a full-service dealer, handling everything from IRA setups to home deliveries.

The company has received strong support from several well-known public figures. Preserve Gold has been endorsed by the late Charlie Kirk, Dr. Phil McGraw, Howie Mandel, Erick Stakelbeck, and other prominent conservative voices.

In 2025, the company expanded its educational resources, including an updated precious metals IRA guide tailored to current market trends such as stagflation concerns and increased gold buying by central banks.

Preserve Gold closely monitors market developments and regularly updates its educational materials to reflect changing conditions. The company keeps customers informed about emerging risks and shifts in the precious metals landscape.

Looking for the best gold IRA company? Download a free gold IRA comparison checklist to learn how to avoid common scams and find out whether the company of your choice passes the ethics test.

Products and Services Offered by Preserve Gold

Preserve Gold provides a comprehensive suite of products and services designed for both retirement-focused and direct-ownership investors. All metals meet IRS purity standards for IRA eligibility: .995+ for gold, .999+ for silver, and .9995+ for platinum and palladium.

Gold and Silver IRA Services

Preserve Gold provides expert guidance on gold IRA rollovers and self-directed precious metals IRAs. Their specialists are well-versed in IRS regulations and help customers with tax- and penalty-free rollovers from existing retirement accounts.

Eligible retirement accounts that can be rolled over into a gold IRA include:

- Traditional and Roth IRAs

- Traditional and Roth 401(k)s

- Thrift Savings Plans (TSP)

- 403(b)s

- 457(b)s

- Simplified Employee Pensions (SEPs)

- SIMPLE IRAs

- Tax-Sheltered Annuities (TSAs)

Preserve Gold is currently offering a special promotion: new clients can receive up to $20,000 in free gold and silver, depending on the amount they roll over into a gold IRA.

The bonus is typically 1% of your investment. For example, if you invest $100,000, you’ll receive $1,000 in free precious metals, a $1,000,000 investment earns you $10,000, and so on. Offer details may change, so be sure to confirm the latest terms with a Preserve Gold specialist.

The company partners with trusted custodians like Equity Trust, Goldstar, and Horizon Trust to ensure compliance. Customers can track performance via online dashboards with real-time charts, and Preserve Gold schedules portfolio reviews with a precious metals specialist every 90-180 days.

Physical Precious Metals Available

The catalog includes a wide array of IRA-eligible and collectible items from reputable mints. Products are sourced at wholesale and marked up for retail, with pricing available via phone quotes.

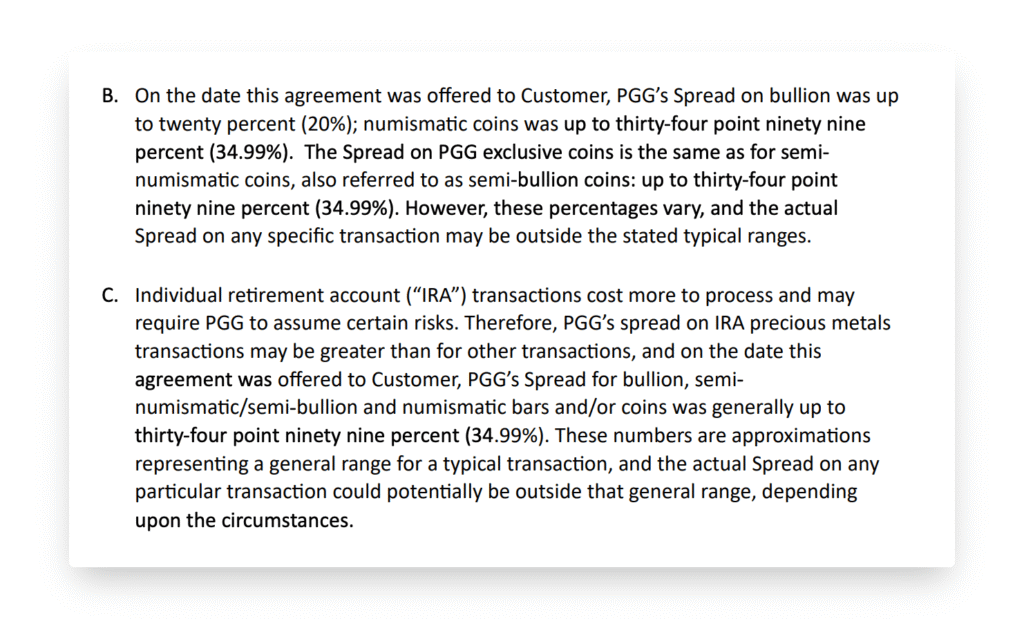

Preserve Gold charges a markup on the products they sell. General industry markups for gold IRA purchases often range from 3% to 5% over spot price, though this can vary widely by dealer and product.

According to Preserve Gold’s “Shipping and Transaction Agreement“, the upper limits for typical spreads are:

- Bullion: up to 20%.

- Numismatic coins: up to 34.99%.

- Semi-bullion/semi-numismatic coins: up to 34.99%.

The document notes that these are not fixed values, and that spreads may vary significantly and may be negotiable. It can differ across transactions (even for the same customer), and that the actual spread may be outside the stated typical ranges depending on circumstances.

The actual spread for a given purchase would be reflected in the specific invoice or order details, not this agreement.

The company offers a price match guarantee, committing to match or beat any competitor’s pricing. To take advantage of this, you’ll typically need to provide proof of a lower quote when speaking with a Preserve Gold representative, as pricing is handled over the phone rather than through fixed online listings. Always compare quotes from multiple dealers.

There’s also a 24-hour cancellation protection policy, allowing you to cancel without penalty within that time frame.

| Metal | Popular Products | Purity Standard | Use Cases |

|---|---|---|---|

| Gold | American Eagle Coins, Canadian Maple Leaf Coins, Australian Kangaroo Coins, Austrian Philharmonic Coins, Gold Bars and Rounds | .995+ | IRA diversification, long-term value preservation |

| Silver | American Eagle Coins, Canadian Maple Leaf Coins, Australian Kookaburra Coins, Austrian Philharmonic Coins, Silver Bars and Rounds | .999+ | Industrial hedge, affordable entry point |

| Platinum | American Eagle Coins, Canadian Maple Leaf Coins, Australian Koala Coins, Platinum Bars and Rounds | .9995+ | Automotive sector exposure, portfolio balance |

| Palladium | Canadian Maple Leaf Coins, Palladium Bars and Rounds | .9995+ | Catalytic converter demand, high-volatility growth |

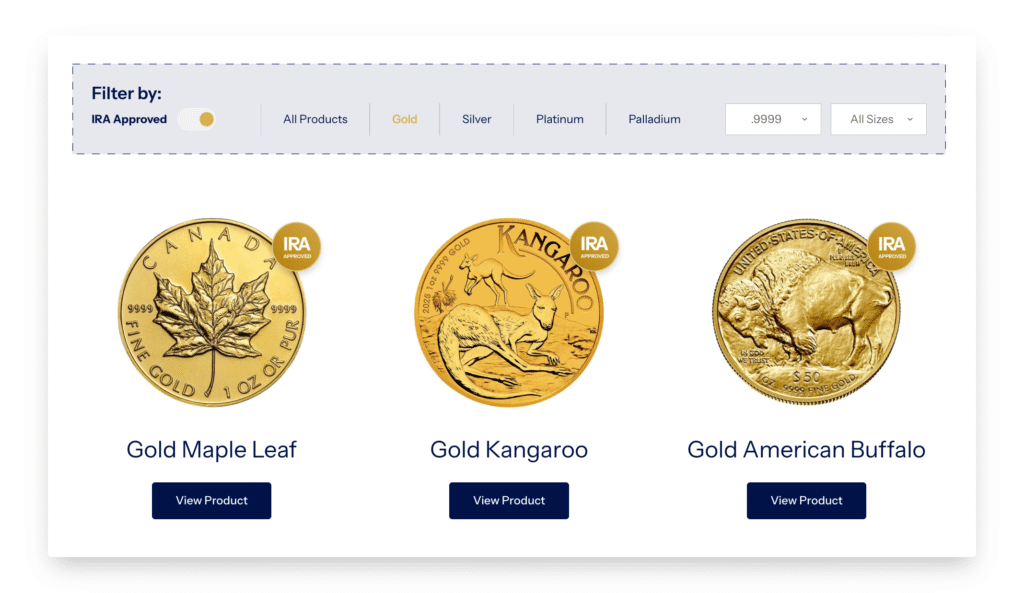

Availability varies with market conditions, so consulting a specialist is recommended. What I liked is that Preserve Gold has a convenient product filter that you can use to quickly navigate the available coins and bars.

You can filter the products by purity, IRA-eligibility, type of precious metal, and size. This feature is very helpful if you’re unsure what types of metals allowed by IRS for IRA inclusion, as it’s easy to get lost in the variety of available options.

Buyback Program

Preserve Gold offers a zero-fee buyback promise for precious metals. Customers can purchase gold, silver, platinum, or palladium for IRAs or direct holdings, and the company will later buy back those metals at fair market value (based on current spot prices.)

Preserve Gold charges no liquidation fees, commissions, or hidden costs unlike many gold dealers who take a 5-15% cut on resales. This policy, however, applies only to metals originally purchased through the company and is designed to build lasting relationships with clients. The company’s minimum buyback threshold is $30,000.

To initiate a buyback, customers can call the Preserve Gold team or fill out a form on the website. After providing details about their holdings, they’ll receive a quote based on live market pricing.

Preserve Gold’s Storage and Delivery Options

Precious metals in the IRA must be stored in segregated, IRS-approved depositories. Preserve Gold works with industry’s most reputable depositories in different parts of the country: Delaware Depository, International Depository Services (IDS), or Texas Precious Metals Depository.

Annual storage in these depositories starts at $100, with free shipping and insurance. Non-IRA purchases allow home delivery or personal storage, though depositories are advised for security against loss or damage.

Preserve Gold Fees and Costs

Preserve Gold emphasizes competitive, upfront pricing with zero hidden fees. However, some details require direct contact, a common industry practice.

Minimum Investment: $25,000 for new IRAs. By comparison, industry leaders like American Hartford Gold and Augusta Precious Metals set minimums between $10,000 and $50,000. American Hartford Gold requires just $10,000, while Augusta Precious Metals sets a $50,000 minimum. This places Preserve Gold in the mid-range, appealing to moderate-level investors.

- Setup Fees: None for new gold IRA accounts

- Storage Fees: $100+ annually, varying by value; up to 5 years free for qualifying investments.

- Custodial Fees: Typically range from $100 to $200 annually ($100 with Equity Trust, $175 with Goldstar, and $200 with Horizon). The first three years of fees may be waived depending on your rollover amount. Please see the table below for more details.

| Amount Rolled Over | Bonus Waiver |

|---|---|

| $20,000 | Setup fees waived |

| $50,000-$99,999 | Setup and 1 year annual fees waived |

| $100,000-$249,999 | Setup and 2 years of annual fees waived |

| $250,000+ | Setup and 3 years of annual fees waived |

Preserve Gold Reviews, Ratings and Complaints

Despite being a relatively new player in the market, Preserve Gold already has more than 464 reviews, the majority of which are positive. Here’s how those reviews break down by platform:

- Better Business Bureau (BBB): 4.97/5 based on 87 reviews, with A+ accreditation and only two complaints in the past three years;

- Google Reviews: 4.7/5 from 88 reviews;

- Trustpilot: 4.8/5 based on over 116 contributions;

- ConsumerAffairs: 5/5 from 173 reviews.

- TrustIndex: 4.9/5 from 360 reviews.

Company’s reputation has strengthened in 2025, with expanded review volumes reflecting growth. Positive Preserve Gold reviews often praise patient, non-pushy representatives, clear communication, and company’s professionalism.

If you’re looking for the best gold IRA company to invest with, download a free gold IRA comparison checklist. You’ll learn how to avoid common scams and see whether your chosen company passes the ethics test.

As of now, Preserve Gold has not been involved in any lawsuits, either as a plaintiff or a defendant. Complaints are rare, often resolved promptly, with no major issues on record. This aligns with the company’s customer-centric model.

Risks and Considerations

Amid economic uncertainties, central banks are stockpiling gold at unprecedented levels, propelling demand to soaring new heights. This timeless asset, revered as a steadfast store of value amid slumps and inflationary tempests, has earned its enduring nickname: “God’s money” for a reason.

Since 2008, $100 invested in gold has grown to $304 in purchasing power, outperforming cash ($68) and outperforming oil as well (~$50).

Silver adds industrial value in electronics and renewables; platinum and palladium support automotive catalysts. These metals diversify portfolios and lower volatility.

However, precious metals IRAs carry inherent risks: market volatility, no income generation, storage costs, and supply-demand-driven price swings with no yields (unlike stock dividends).

Precious metals IRAs enable tax-advantaged retirement holdings but require IRS-approved custodians and depositories for compliance, along with considerations like taxes related to a gold IRA, penalties for early withdrawals (before 59½) and RMDs at 72.

Preserve Gold mitigates some of these investment risks via customer education, but it’s worth consulting a financial advisor before making an investment. Gold has seen some impressive gains in recent years, but remember that past performance doesn’t guarantee future results.

How to Open an Account With Preserve Gold

Opening a new IRA and investing with Preserve Gold is a straightforward process that typically takes just a few days. It involves five simple steps. Here’s a detailed breakdown of how it works.

Step 1: Request a Free Gold IRA Kit

Begin by requesting Preserve Gold’s free gold IRA guide. The kit provides an in-depth overview of how Preserve Gold operates, including their role as a dealer in sourcing IRS-eligible metals and coordinating with custodians for transfer IRA to gold processes.

The guide helps you understand the fundamentals of precious metals investing. It covers benefits like portfolio diversification, protection against inflation and economic uncertainty, potential tax advantages (e.g., tax-deductible contributions in a Traditional IRA or tax-free growth in a Roth IRA), etc.

Step 2: Have a Consultation Call

Once you’ve requested the kit, a Preserve Gold precious metals specialist will reach out for a no-obligation consultation, typically lasting 15-30 minutes. This call focuses on your investment goals, risk profile, and retirement timeline.

Prepare questions in advance, and ask about gold IRA fees, product costs, rollover requirements, etc. This call is your chance to gauge the company’s responsiveness. Look for red flags like high-pressure sales tactics, which Preserve Gold advises against.

Step 3: Submit the Paperwork

If you decide to proceed, Preserve Gold will email you the necessary documents for electronic signature after the consultation. This includes account setup forms, requiring basic info like your driver’s license and details on any existing retirement accounts for rollovers.

The process is designed to be seamless, with Preserve Gold handling coordination with your chosen custodian.

For a Gold IRA, you’ll select the account type (Roth or Traditional) and confirm the custodian. Paperwork typically takes just a few minutes to complete online, and approval can happen within 1-3 business days.

If funding via rollover, provide your current account details. Preserve Gold ensures IRS compliance to avoid taxes or penalties.

Step 4: Fund the Account

Once paperwork is approved, transfer funds into your new account. This can take 3-7 business days, depending on the funding method.

Options to fund the account include cash contributions, a direct rollovers from IRAs, 401(k)s or other retirement plans, or indirect rollovers. Preserve Gold then uses these funds to purchase your selected precious metals on your behalf.

A direct rollover method is the safest option. This way, your old administrator simply sends funds straight to the new custodian without risks. Indirect rollovers (where you receive the check) must be redeposited within 60 days to dodge a 10% early withdrawal penalty (if under 59½).

Step 5: Send Precious Metals to Storage

After purchase, your metals are shipped to a secure storage facility. For gold IRAs, the IRS mandates storage in an approved depository (e.g., Delaware Depository or Brinks). Home storage is strictly prohibited and could trigger penalties.

Custodians manage storage, providing insurance and audits, and professional storage offers security against theft or loss. Choose a depository based on location and reputation. Preserve Gold can recommend options during consultation.

Managing Withdrawals and Ongoing Investments

Withdrawal options depend on the account type. In a gold IRA, you can request shipment of physical metals after age 59½ to avoid penalties. You can also sell metals through Preserve Gold’s buyback program, which offers competitive rates for liquidity.

Another option is to handle Required Minimum Distributions (RMDs) in-kind by receiving metals or in cash after selling them.

Roth IRAs have no RMDs, while Traditional ones do. Use Preserve Gold’s online RMD estimator tool to calculate estimates based on your age, account value, and IRS formulas.

| IRA Balance | Age 72 Estimated Annual RMD |

|---|---|

| $50,000 | $1,825 |

| $100,000 | $3,650 |

| $150,000 | $5,474 |

| $200,000 | $7,299 |

Withdrawals from Traditional IRAs are taxed as income, and Roths are tax-free if qualified. Early withdrawals (before 59½) incur a 10% penalty plus taxes.

Final Verdict

Preserve Gold is a pragmatic partner and a legitimate gold IRA company for anyone looking to strengthen their investment portfolios with tangible assets. The company bridges the gap between novice investors and complexity of IRS rules regarding self-directed gold IRAs, offering step-by-step guidance in the rollover process and beyond.

Company’s no-fee buyback, regular promotions, and high customer satisfaction make it ideal for IRA diversifiers. As the economy changes, precious metals are still a safe option, and Preserve Gold makes it easy to start investing in them.